Region:Middle East

Author(s):Rebecca

Product Code:KRAC4011

Pages:97

Published On:October 2025

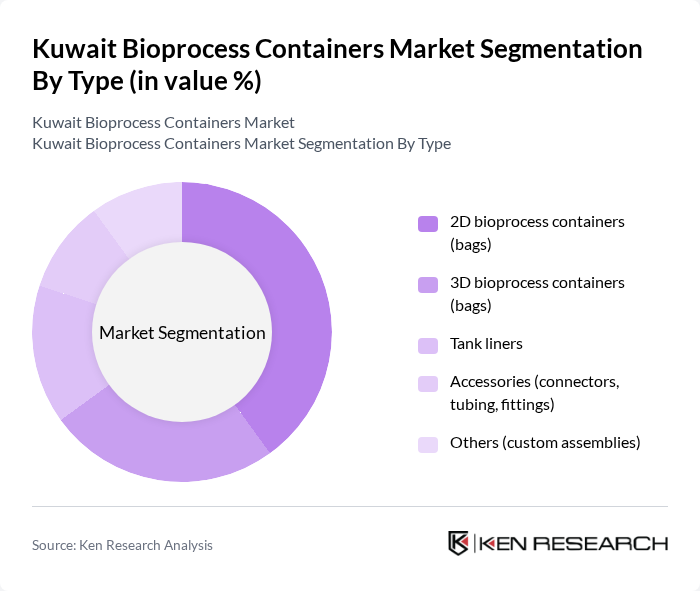

By Type:The market is segmented into 2D bioprocess containers (bags), 3D bioprocess containers (bags), tank liners, accessories (connectors, tubing, fittings), and others (custom assemblies). 2D bioprocess containers lead the market due to their extensive use in cell culture and fermentation, driven by cost-effectiveness, ease of handling, and suitability for small- to medium-scale bioprocessing. Demand for 3D bioprocess containers is rising, especially in applications requiring higher volumes and more complex mixing or storage processes .

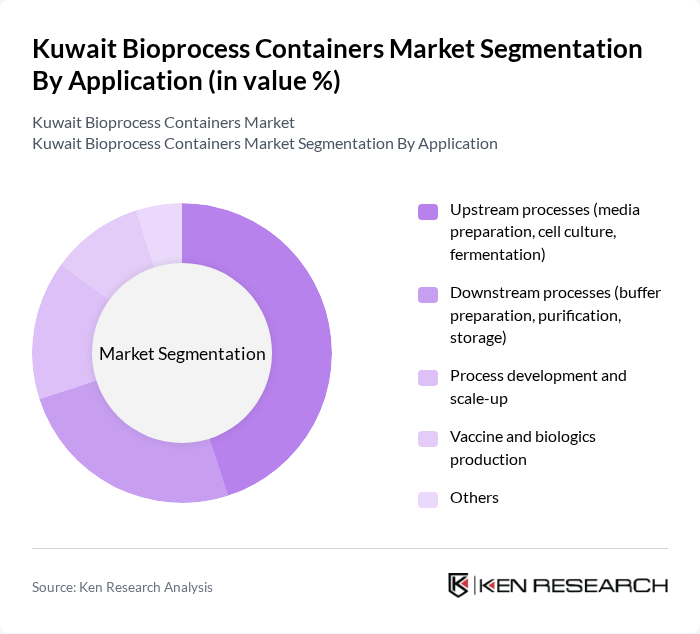

By Application:The applications of bioprocess containers include upstream processes (media preparation, cell culture, fermentation), downstream processes (buffer preparation, purification, storage), process development and scale-up, vaccine and biologics production, and others. The upstream processes segment is the most significant, reflecting the increasing emphasis on biopharmaceutical production and the need for efficient, contamination-free media preparation and cell culture. Downstream applications are also expanding as manufacturers seek flexible, scalable solutions for purification and storage .

The Kuwait Bioprocess Containers Market is characterized by a dynamic mix of regional and international players. Leading participants such as Thermo Fisher Scientific Inc., Sartorius AG, Merck KGaA, Cytiva (formerly GE Healthcare Life Sciences), Eppendorf AG, Corning Incorporated, Pall Corporation, Bio-Rad Laboratories, Inc., 3M Company, Sartorius Stedim Biotech S.A., Saint-Gobain Life Sciences, Meissner Filtration Products, Inc., Single Use Support GmbH, Entegris, Inc., CellBios Technology Pvt. Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the bioprocess containers market in Kuwait appears promising, driven by technological advancements and a growing emphasis on sustainability. As the biopharmaceutical sector expands, the demand for efficient and eco-friendly bioprocessing solutions will likely increase. Furthermore, collaborations between local manufacturers and international research institutions are expected to foster innovation, enhancing the overall market landscape. The focus on personalized medicine will also create new avenues for growth, positioning Kuwait as a competitive player in the biopharmaceutical industry.

| Segment | Sub-Segments |

|---|---|

| By Type | D bioprocess containers (bags) D bioprocess containers (bags) Tank liners Accessories (connectors, tubing, fittings) Others (custom assemblies) |

| By Application | Upstream processes (media preparation, cell culture, fermentation) Downstream processes (buffer preparation, purification, storage) Process development and scale-up Vaccine and biologics production Others |

| By End-User | Biopharmaceutical manufacturers Contract manufacturing organizations (CMOs) Academic and research institutes Diagnostic laboratories Others |

| By Material Type | Polyethylene (PE) Polypropylene (PP) Ethylene-vinyl acetate (EVA) Polyvinyl chloride (PVC) Others (multi-layer films) |

| By Distribution Channel | Direct sales Distributors Online sales Others |

| By Region | Central Kuwait Northern Kuwait Southern Kuwait Others |

| By Price Range | Low Medium High Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Biopharmaceutical Manufacturing | 60 | Production Managers, Quality Assurance Leads |

| Research & Development Labs | 50 | Lab Directors, Bioprocess Scientists |

| Healthcare Institutions | 40 | Pharmacy Managers, Clinical Research Coordinators |

| Regulatory Bodies | 45 | Regulatory Affairs Specialists, Compliance Officers |

| Supply Chain & Logistics | 55 | Logistics Managers, Procurement Officers |

The Kuwait Bioprocess Containers Market is valued at approximately USD 0.8 million, driven by the increasing demand for biopharmaceuticals and the rapid adoption of single-use technologies in the healthcare sector.