Region:Middle East

Author(s):Rebecca

Product Code:KRAC4010

Pages:99

Published On:October 2025

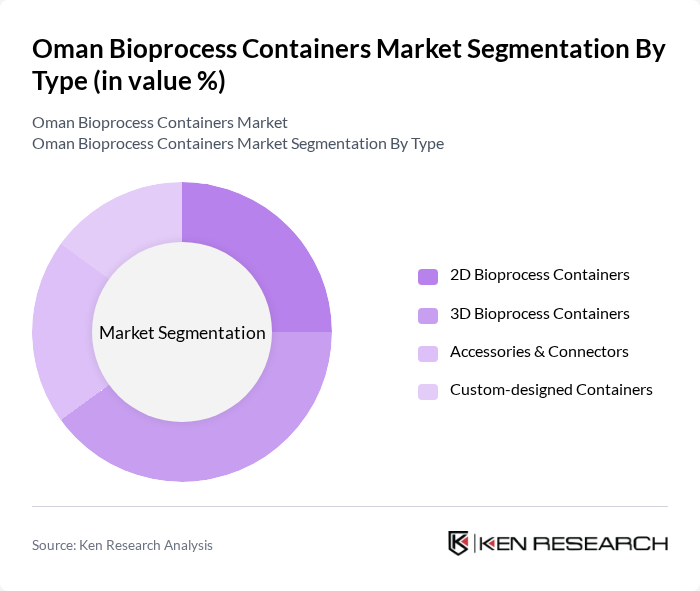

By Type:The market is segmented into various types of bioprocess containers, including 2D Bioprocess Containers, 3D Bioprocess Containers, Accessories & Connectors, and Custom-designed Containers. Among these, 3D Bioprocess Containers are gaining significant traction due to their ability to provide efficient, scalable solutions for cell culture and fermentation processes, especially in single-use bioprocessing setups. The demand for custom-designed containers is also increasing as companies seek tailored solutions to optimize production workflows and meet specific regulatory requirements .

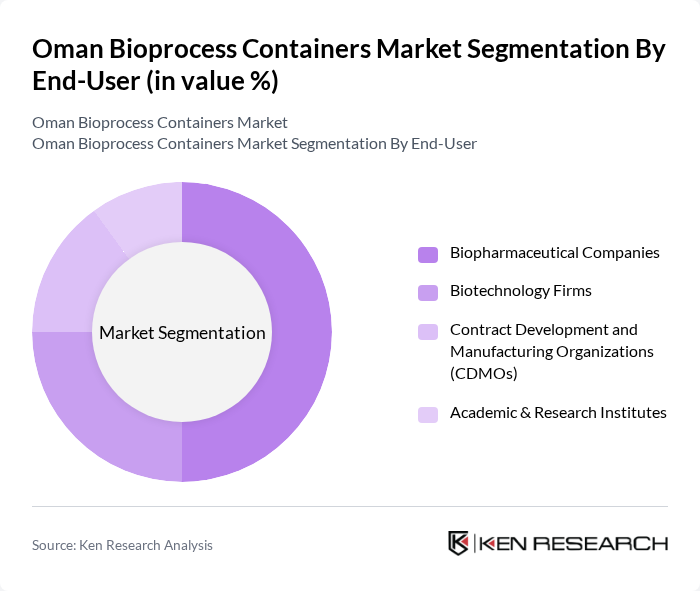

By End-User:The end-user segmentation includes Biopharmaceutical Companies, Biotechnology Firms, Contract Development and Manufacturing Organizations (CDMOs), and Academic & Research Institutes. Biopharmaceutical Companies are the leading end-users, driven by the surge in biologics production and the need for efficient, contamination-free manufacturing methods. CDMOs are also expanding their use of bioprocess containers in response to the growing trend of outsourcing in the biopharmaceutical sector and the demand for flexible, single-use systems .

The Oman Bioprocess Containers Market is characterized by a dynamic mix of regional and international players. Leading participants such as Thermo Fisher Scientific, Sartorius AG, Merck KGaA, Cytiva (Danaher Corporation), Eppendorf AG, Corning Incorporated, 3M Company, Pall Corporation, Bio-Rad Laboratories, Becton, Dickinson and Company, Agilent Technologies, Fujifilm Diosynth Biotechnologies, Lonza Group, Saint-Gobain Life Sciences, Meissner Filtration Products, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the bioprocess containers market in Oman appears promising, driven by technological advancements and a strong focus on sustainability. As the biopharmaceutical sector continues to expand, the demand for innovative and efficient bioprocess solutions is expected to rise. Additionally, the integration of automation and IoT technologies will likely enhance operational efficiencies, while regulatory frameworks are anticipated to evolve, facilitating smoother market entry for new products and technologies, thus fostering a more competitive landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | D Bioprocess Containers D Bioprocess Containers Accessories & Connectors Custom-designed Containers |

| By End-User | Biopharmaceutical Companies Biotechnology Firms Contract Development and Manufacturing Organizations (CDMOs) Academic & Research Institutes |

| By Application | Cell Culture & Fermentation Media Preparation & Buffer Storage Vaccine Production Harvest, Collection & Transport |

| By Material | Polyethylene (PE) Polypropylene (PP) Ethylene Vinyl Acetate (EVA) Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Region | Muscat Salalah Sohar Others |

| By Price Range | Low Medium High Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pharmaceutical Manufacturing | 100 | Production Managers, Quality Assurance Leads |

| Biotechnology Research Institutions | 80 | Research Scientists, Lab Managers |

| Healthcare Providers | 70 | Clinical Operations Directors, Procurement Officers |

| Regulatory Bodies | 40 | Policy Makers, Compliance Officers |

| Supply Chain and Logistics | 50 | Logistics Coordinators, Supply Chain Analysts |

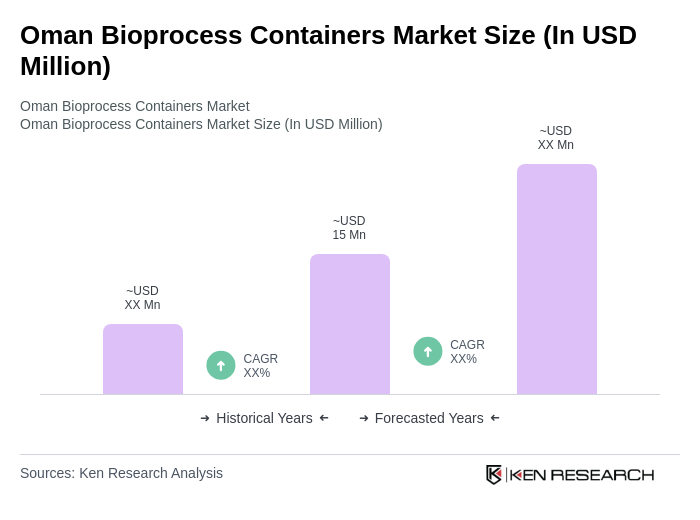

The Oman Bioprocess Containers Market is valued at approximately USD 15 million, reflecting a five-year historical analysis. This growth is driven by the increasing demand for biopharmaceuticals and the adoption of single-use technologies.