Region:Middle East

Author(s):Rebecca

Product Code:KRAD7451

Pages:81

Published On:December 2025

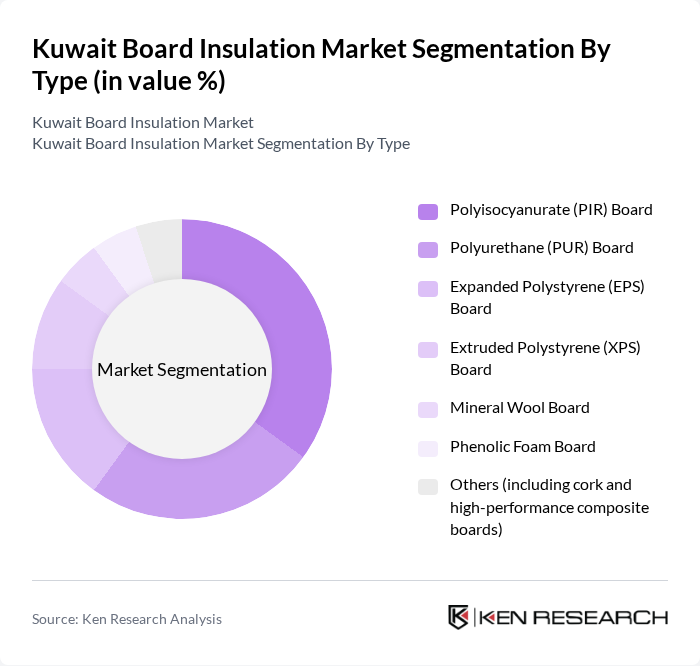

By Type:The market is segmented into various types of insulation boards, including Polyisocyanurate (PIR) Board, Polyurethane (PUR) Board, Expanded Polystyrene (EPS) Board, Extruded Polystyrene (XPS) Board, Mineral Wool Board, Phenolic Foam Board, and Others (including cork and high-performance composite boards). Among these, Polyisocyanurate (PIR) Board is the leading subsegment due to its superior thermal resistance and versatility in various applications. The increasing focus on energy efficiency in construction has driven demand for PIR boards, making them a preferred choice for both residential and commercial projects.

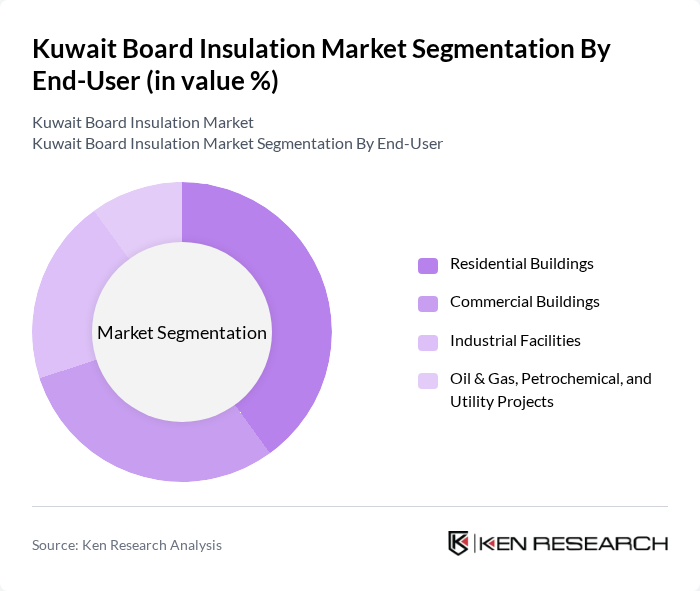

By End-User:The end-user segmentation includes Residential Buildings, Commercial Buildings, Industrial Facilities, and Oil & Gas, Petrochemical, and Utility Projects. The Residential Buildings segment is currently the largest end-user category, driven by the increasing construction of energy-efficient homes and government incentives for sustainable building practices. The growing awareness of energy conservation among homeowners has led to a surge in demand for insulation solutions in residential projects.

The Kuwait Board Insulation Market is characterized by a dynamic mix of regional and international players. Leading participants such as Kuwait Insulating Material Manufacturing Co. (KIMMCO?ISOVER), Gulf Insulation Group, Rockwool International A/S, ROCKWOOL Middle East, Kingspan Group, Saint?Gobain Construction Products (ISOVER, CertainTeed, etc.), Owens Corning, BASF SE, Knauf Insulation, Armacell International S.A., Huntsman Building Solutions, Dow Inc. (Styrofoam and related insulation solutions), Qatar Industrial Manufacturing Co. (QIMC) – Panel and Board Insulation Interests, Saudi Panel Manufacturing Co. (regional insulated panel & board supplier), Local Kuwait Distributors and Fabricators of EPS/XPS and PIR Boards contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Kuwait board insulation market appears promising, driven by increasing government support for sustainable construction and rising consumer awareness of energy efficiency. As the construction sector expands, particularly with the anticipated $7 billion investment in infrastructure, the demand for insulation products is expected to grow. Additionally, technological advancements in insulation materials will likely enhance product performance, making them more appealing to builders and homeowners alike, thus fostering market growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Polyisocyanurate (PIR) Board Polyurethane (PUR) Board Expanded Polystyrene (EPS) Board Extruded Polystyrene (XPS) Board Mineral Wool Board Phenolic Foam Board Others (including cork and high?performance composite boards) |

| By End-User | Residential Buildings Commercial Buildings Industrial Facilities Oil & Gas, Petrochemical, and Utility Projects |

| By Application | Roof and Terrace Insulation External Wall and Façade Insulation Internal Partition and Cavity Wall Insulation Floor and Podium Slab Insulation HVAC and Cold Storage Insulation Others |

| By Material | Polyisocyanurate (PIR) Polyurethane (PUR) Expanded Polystyrene (EPS) Extruded Polystyrene (XPS) Mineral Wool Others |

| By Installation Method | New Construction Retrofitting of Existing Buildings Prefabricated / Modular Systems |

| By Performance Characteristics | Thermal Resistance (R?value) Fire Resistance Moisture and Water Vapour Resistance Acoustic Performance Compressive Strength and Dimensional Stability Others |

| By Policy Support | Energy Efficiency and Green Building Programs Subsidies and Soft Loans for High?Efficiency Materials Tax Exemptions and Customs Rebates Government Procurement and Standards Mandates Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Insulation Projects | 60 | Homeowners, Residential Contractors |

| Commercial Building Insulation | 50 | Facility Managers, Commercial Developers |

| Industrial Insulation Applications | 40 | Plant Managers, Industrial Engineers |

| Energy Efficiency Initiatives | 40 | Energy Auditors, Sustainability Consultants |

| Insulation Material Suppliers | 50 | Sales Managers, Product Development Heads |

The Kuwait Board Insulation Market is valued at approximately USD 140 million, reflecting a significant growth trend driven by the demand for energy-efficient building materials and the expansion of the construction sector in the region.