Region:Middle East

Author(s):Dev

Product Code:KRAD5236

Pages:97

Published On:December 2025

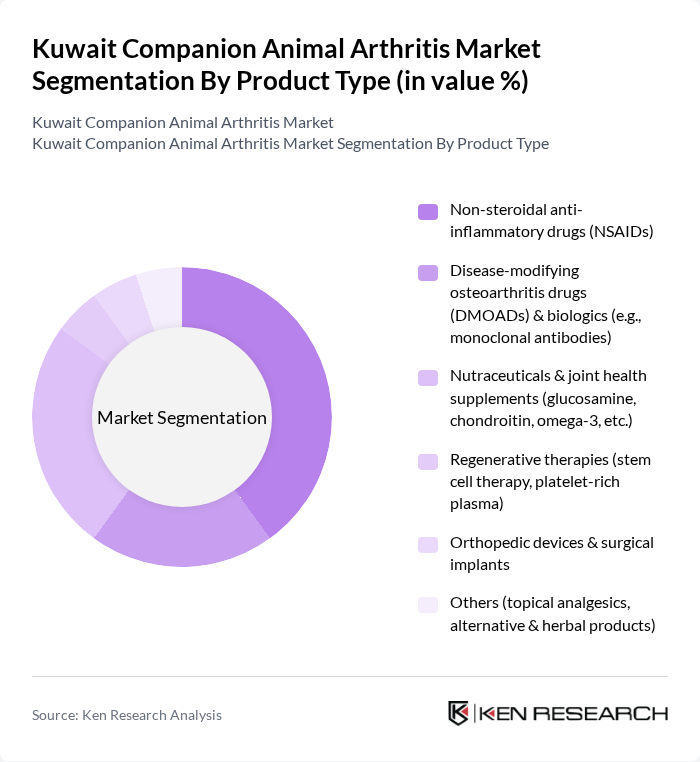

By Product Type:The product type segmentation includes various categories that cater to the treatment of arthritis in companion animals. The leading sub-segment is Non-steroidal anti-inflammatory drugs (NSAIDs), which are widely used due to their effectiveness in managing pain and inflammation. Nutraceuticals and joint health supplements are also gaining traction as pet owners increasingly seek preventive care options. The market is characterized by a growing trend towards holistic and alternative therapies, reflecting a shift in consumer preferences towards more natural treatment options.

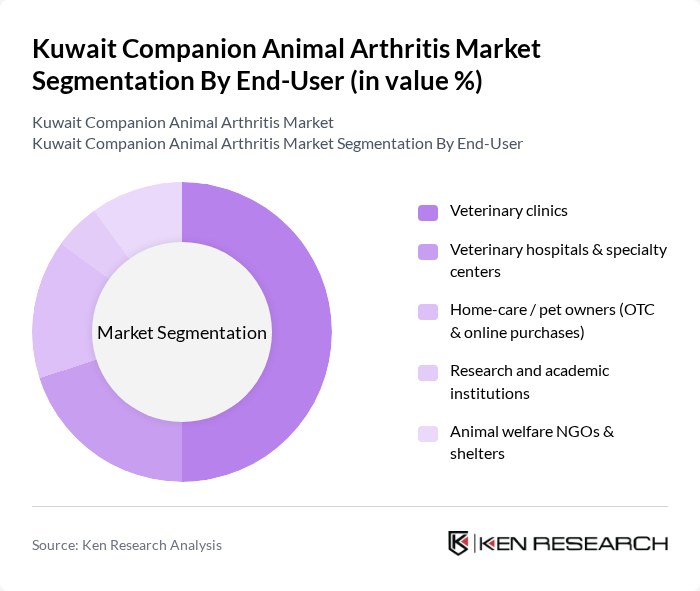

By End-User:The end-user segmentation highlights the various channels through which arthritis treatments are accessed. Veterinary clinics are the primary end-users, as they provide direct care and treatment for companion animals. Home-care and pet owners are increasingly purchasing over-the-counter (OTC) products and utilizing online platforms for convenience. The rise of animal welfare NGOs and shelters also plays a significant role in promoting arthritis awareness and treatment options for rescued animals.

The Kuwait Companion Animal Arthritis Market is characterized by a dynamic mix of regional and international players. Leading participants such as Zoetis Inc., Elanco Animal Health Incorporated, Merck Animal Health (MSD Animal Health), Boehringer Ingelheim Animal Health GmbH, Virbac S.A., Vetoquinol S.A., Ceva Santé Animale, Dechra Pharmaceuticals PLC, IDEXX Laboratories, Inc. (veterinary pain & mobility diagnostics), Nutramax Laboratories Veterinary Sciences, Inc., VetriScience Laboratories (FoodScience Corporation), Royal Canin (Mars, Incorporated), Hill's Pet Nutrition, Inc. (Colgate-Palmolive Company), Zoetis – Librela & Rimadyl franchise (regional performance in GCC), Local & regional veterinary distributors in Kuwait (e.g., Kuwait Saudi Pharmaceutical Industries Co. – KSPICO; local vet product importers) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Kuwait companion animal arthritis market appears promising, driven by increasing pet ownership and a growing emphasis on preventive healthcare. As pet owners become more informed about arthritis and its implications, demand for specialized treatments is expected to rise. Additionally, the integration of telemedicine in veterinary care will enhance accessibility, allowing pet owners to consult specialists remotely. This trend, coupled with advancements in treatment options, will likely foster a more robust market environment in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Non-steroidal anti-inflammatory drugs (NSAIDs) Disease-modifying osteoarthritis drugs (DMOADs) & biologics (e.g., monoclonal antibodies) Nutraceuticals & joint health supplements (glucosamine, chondroitin, omega-3, etc.) Regenerative therapies (stem cell therapy, platelet-rich plasma) Orthopedic devices & surgical implants Others (topical analgesics, alternative & herbal products) |

| By End-User | Veterinary clinics Veterinary hospitals & specialty centers Home-care / pet owners (OTC & online purchases) Research and academic institutions Animal welfare NGOs & shelters |

| By Animal Type | Dogs Cats Other companion animals (e.g., rabbits, small mammals) |

| By Treatment Modality | Pharmacological treatment (single-drug regimens) Multimodal therapy (drug + nutraceutical/physical therapy) Surgical intervention Palliative & supportive care Alternative & complementary therapies (physiotherapy, hydrotherapy, acupuncture, etc.) |

| By Distribution Channel | Veterinary clinics & hospitals Retail veterinary pharmacies Pet stores & pet pharmacy chains Online pharmacies & e-commerce platforms Others |

| By Region | Capital Governorate (Kuwait City) Hawalli Governorate Al Ahmadi Governorate Farwaniya & Al Jahra Governorates Mubarak Al-Kabeer Governorate |

| By Policy & Reimbursement Environment | Import regulations for veterinary pharmaceuticals & biologics Registration and pricing controls for veterinary medicines Emerging pet insurance coverage for chronic diseases (including arthritis) Government and municipal support for animal welfare initiatives Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Veterinary Clinics | 100 | Veterinarians, Clinic Managers |

| Pet Owners | 120 | Dog and Cat Owners, Pet Care Enthusiasts |

| Pet Supply Retailers | 80 | Store Managers, Product Buyers |

| Animal Welfare Organizations | 50 | Animal Welfare Officers, Outreach Coordinators |

| Pet Health Product Manufacturers | 70 | Product Development Managers, Marketing Executives |

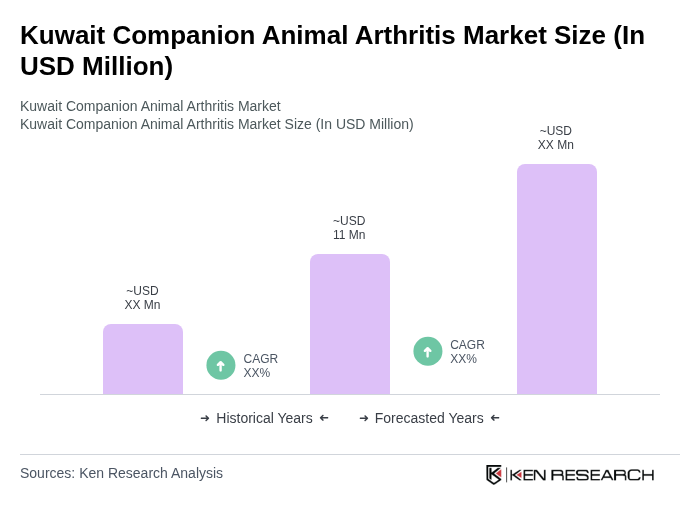

The Kuwait Companion Animal Arthritis Market is valued at approximately USD 11 million, reflecting a growing demand for veterinary care and arthritis treatments driven by increasing pet ownership and awareness about pet health.