Region:Middle East

Author(s):Geetanshi

Product Code:KRAC9545

Pages:93

Published On:November 2025

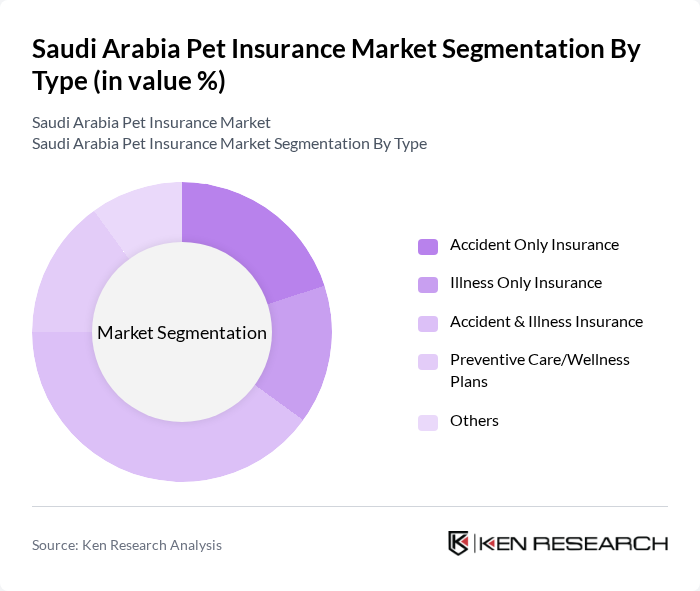

By Type:The market is segmented into Accident Only Insurance, Illness Only Insurance, Accident & Illness Insurance, Preventive Care/Wellness Plans, and Others. Among these, Accident & Illness Insurance is the most popular, as it provides comprehensive coverage for both unexpected accidents and a wide range of health issues. This reflects the growing demand for holistic pet care solutions and the willingness of pet owners to invest in broader protection for their animals .

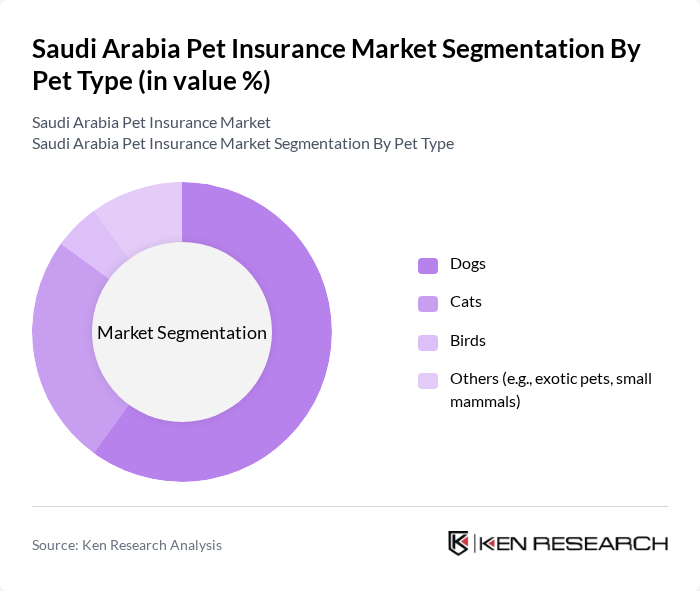

By Pet Type:Segmentation by pet type includes Dogs, Cats, Birds, and Others (such as exotic pets and small mammals). Dogs represent the dominant segment, driven by their high ownership rates and the greater frequency of veterinary care required compared to other animals. The willingness of dog owners to invest in comprehensive insurance coverage is a key factor supporting this segment’s market leadership .

The Saudi Arabia Pet Insurance Market is characterized by a dynamic mix of regional and international players. Leading participants such as Tawuniya (The Company for Cooperative Insurance), Bupa Arabia for Cooperative Insurance, Gulf Insurance Group (GIG Saudi), Allianz Saudi Fransi Cooperative Insurance Company, Al Rajhi Takaful, MEDGULF (The Mediterranean and Gulf Cooperative Insurance and Reinsurance Company), Alinma Tokio Marine, United Cooperative Assurance Company (UCA), Al-Ahlia Insurance Company for Cooperative Insurance, Al-Etihad Cooperative Insurance Co., Aljazira Takaful Taawuni Company, Al Sagr Cooperative Insurance Co., Malath Cooperative Insurance Co., Walaa Cooperative Insurance Co., and Arabian Shield Cooperative Insurance Co. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the pet insurance market in Saudi Arabia appears promising, driven by increasing pet ownership and a growing emphasis on pet health. As awareness of the benefits of pet insurance rises, more pet owners are likely to seek coverage. Additionally, advancements in technology and digital platforms will facilitate easier access to insurance products, enhancing customer experience. The market is expected to evolve with innovative offerings tailored to meet the diverse needs of pet owners, fostering a more robust insurance landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Accident Only Insurance Illness Only Insurance Accident & Illness Insurance Preventive Care/Wellness Plans Others |

| By Pet Type | Dogs Cats Birds Others (e.g., exotic pets, small mammals) |

| By Coverage Type | Basic Coverage (Accident Only) Enhanced Coverage (Accident & Illness) Comprehensive/Lifetime Coverage Preventive Care Add-ons Others |

| By Distribution Channel | Online Direct Sales Insurance Brokers/Aggregators Veterinary Clinics/Partnerships Bancassurance Others (e.g., pet shops, NGOs) |

| By Policy Duration | Annual Policies Multi-Year Policies Lifetime Policies Short-Term/Trial Policies Others |

| By Customer Segment | Individual Pet Owners Pet Breeders Pet Shelters/Rescue Organizations Corporate/Institutional Clients Others |

| By Geographic Region | Central Region Eastern Region Western Region Southern Region Northern Region |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pet Owners | 120 | Dog and cat owners, ages 25-55 |

| Veterinarians | 60 | Practicing veterinarians and clinic managers |

| Insurance Brokers | 40 | Insurance agents specializing in pet insurance |

| Pet Retailers | 50 | Owners and managers of pet supply stores |

| Industry Experts | 40 | Market analysts and consultants in the pet insurance sector |

The Saudi Arabia Pet Insurance Market is valued at approximately USD 110 million, reflecting its significant share within the broader Middle East and Africa market, which exceeds USD 250 million. This growth is driven by increasing pet ownership and consumer spending on animal healthcare.