Region:Middle East

Author(s):Geetanshi

Product Code:KRAD7197

Pages:90

Published On:December 2025

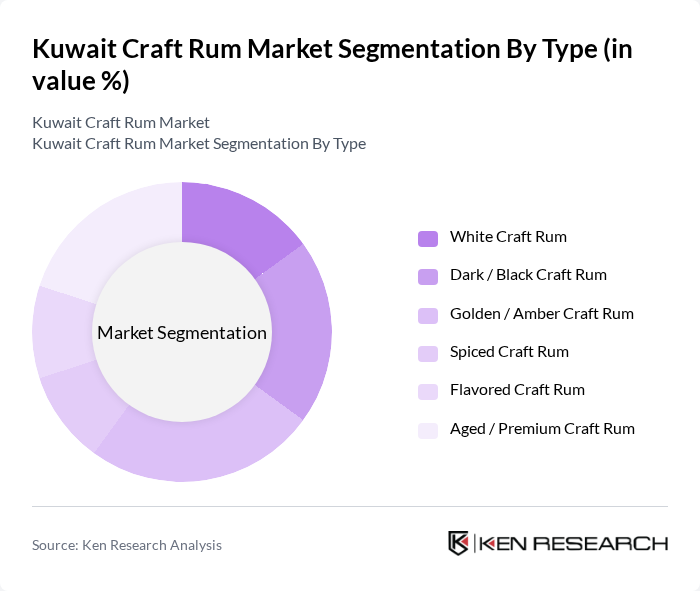

By Type:The craft rum market can be segmented into various types, each catering to different consumer preferences across global and regional channels accessed by Kuwait residents. The primary subsegments include White Craft Rum, Dark / Black Craft Rum, Golden / Amber Craft Rum, Spiced Craft Rum, Flavored Craft Rum, and Aged / Premium Craft Rum, which are consistent with international craft rum classifications. Among these, Aged / Premium Craft Rum has gained significant traction worldwide due to its perceived quality, provenance, and exclusivity, appealing to discerning consumers who are willing to pay a premium for small-batch, cask?finished, and longer?aged offerings. This global preference pattern influences the product mix selected by Kuwait?based consumers in regional duty-free, travel?retail, and licensed hospitality venues.

By End-User / Application:The craft rum market is also segmented by end-user applications, which, for Kuwait?linked demand, include On-trade (Bars, Lounges, Clubs) in foreign licensed markets frequented by Kuwait residents, Hotels & Resorts (Licensed Venues Outside Kuwait Serving Kuwait Residents/Tourists), Off-trade (Specialty Spirits Retailers & Duty-Free in regional hubs and airports), Online & Cross-border E-commerce Platforms shipping to neighboring licensed jurisdictions, and Private Events & Catering (Licensed Venues Abroad). The On-trade segment in nearby GCC and international tourism destinations is particularly influential for Kuwait-origin consumers, driven by the growth of premium cocktail programs, craft bars, and resort-based mixology concepts that showcase small-batch and premium rum expressions.

The Kuwait Craft Rum Market is characterized by a dynamic mix of regional and international players serving Kuwait?linked demand primarily through duty-free, regional importers, and licensed hospitality venues outside the country. Leading participants such as Bacardi Limited (Facundo Bacardi Rum Co.), Diageo plc (Captain Morgan, Ron Zacapa), Pernod Ricard S.A. (Havana Club International), Rémy Cointreau Group (Mount Gay Distilleries Ltd.), Beam Suntory Inc. (House of Rum Portfolio), Distill Ventures / Diageo?backed Craft Rum Brands, Campari Group (Appleton Estate, Wray & Nephew), Plantation Rum (Maison Ferrand), Foursquare Rum Distillery (R.L. Seale & Co. Ltd.), Brugal & Co. S.A. (The Edrington Group), Don Q (Serrallés Distillery Inc.), Diplomático Rum (Destilerías Unidas S.A.), Abu Dhabi Distillers LLC (Regional Craft Spirits Supplier), Dubai Duty Free Liquor & Fine Wine (Travel Retail Operator), Al Boom Marine / Beverage Distribution Division (Regional Importer Serving Kuwait) contribute to innovation in premium and craft rum styles, expanded presence in GCC travel-retail and hotel chains, and diversified packaging and limited-edition releases targeted at regional premium spirits consumers.

The future of the craft rum market in Kuwait appears promising, driven by increasing consumer interest in unique, locally produced beverages. As disposable incomes rise and tourism continues to grow, local distilleries are likely to see enhanced demand for their products. Additionally, innovative marketing strategies and collaborations with local establishments can further boost visibility and sales. The focus on sustainability and organic ingredients will also play a crucial role in attracting environmentally conscious consumers, shaping the market's trajectory.

| Segment | Sub-Segments |

|---|---|

| By Type | White Craft Rum Dark / Black Craft Rum Golden / Amber Craft Rum Spiced Craft Rum Flavored Craft Rum Aged / Premium Craft Rum |

| By End-User / Application | On-trade (Bars, Lounges, Clubs) Hotels & Resorts (Licensed Venues Outside Kuwait Serving Kuwait Residents/Tourists) Off-trade (Specialty Spirits Retailers & Duty-Free) Online & Cross?border E?commerce Platforms Private Events & Catering (Licensed Venues Abroad) |

| By Packaging Type | Glass Bottles (Standard & Premium) Travel Retail / Duty?Free Formats (Gift Packs, Minis) Cans & Ready?to?Drink (RTD) Craft Rum Cocktails Kegs and Bulk Packaging (On?trade) |

| By Distribution Channel | Duty?Free & Travel Retail Specialty Spirits Retailers in GCC and Nearby Hubs On?trade Importers & Distributors (HoReCa) Online Cross?border Platforms & Marketplaces Direct?to?Consumer via Brand Websites / Clubs |

| By Price Range | Economy Craft Rum Standard / Mid?Range Craft Rum Premium Craft Rum Super?Premium & Limited Editions |

| By Flavor Profile | Classic (Light, Clean) Rich & Caramelized (Dark, Molasses?forward) Spiced (Cinnamon, Vanilla, Clove, etc.) Tropical & Fruit?forward (Coconut, Pineapple, Mango, etc.) Experimental & Barrel?finished (Wine, Sherry, etc.) |

| By Consumption Occasion / Use Case | Home Consumption (Imported / Duty?Free Purchases) Gifting & Souvenirs (Travel Retail) Social Gatherings & Parties (Abroad / Private) Mixology & Craft Cocktails Collectors & Enthusiast Purchases |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Preferences for Craft Rum | 120 | Rum Enthusiasts, Casual Drinkers |

| Retail Insights on Craft Spirits | 100 | Store Managers, Beverage Buyers |

| Distribution Channel Effectiveness | 80 | Distributors, Wholesalers |

| Trends in Cocktail Mixology | 70 | Bartenders, Mixologists |

| Impact of Tourism on Craft Rum Sales | 60 | Tourism Operators, Hospitality Managers |

The Kuwait Craft Rum Market is valued at approximately USD 2 thousand, reflecting a five-year historical analysis of rum consumption and import value in the country. This niche market is influenced by growing consumer interest in premium and artisanal spirits.