Region:Middle East

Author(s):Shubham

Product Code:KRAC2128

Pages:96

Published On:October 2025

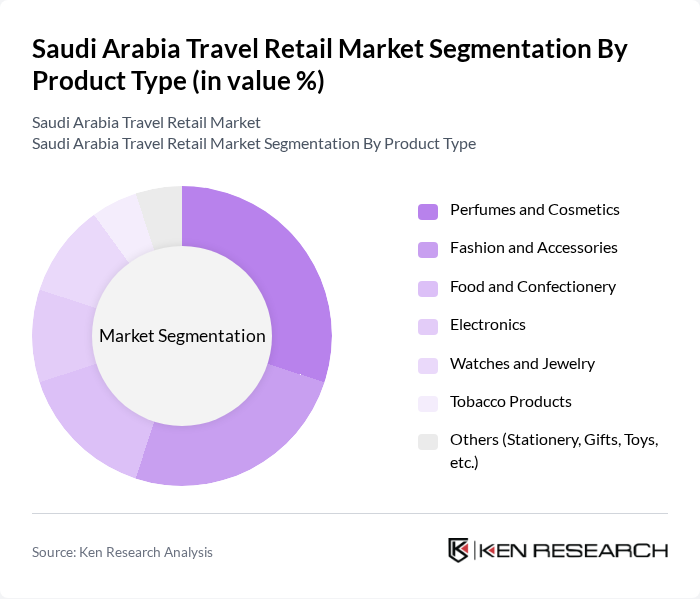

By Product Type:The product type segmentation includes various categories such as perfumes and cosmetics, fashion and accessories, food and confectionery, electronics, watches and jewelry, tobacco products, and others like stationery, gifts, and toys. Among these,perfumes and cosmeticshave emerged as the leading sub-segment due to the cultural significance of fragrance in the region and the high demand for luxury beauty products among travelers.

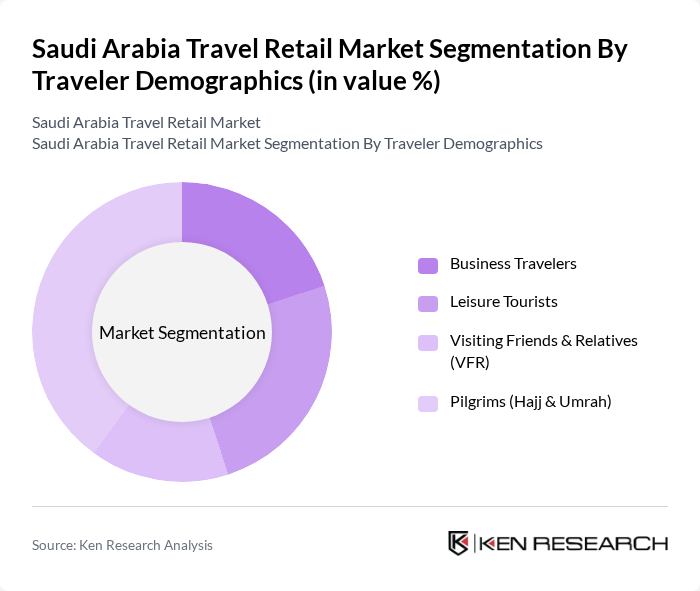

By Traveler Demographics:The traveler demographics segmentation includes business travelers, leisure tourists, visiting friends and relatives (VFR), and pilgrims (Hajj & Umrah).Pilgrimsrepresent a significant portion of the market due to the annual influx of visitors for religious purposes, particularly during Hajj and Umrah seasons, which drives demand for various retail products.

The Saudi Arabia Travel Retail Market is characterized by a dynamic mix of regional and international players. Leading participants such as Al Haramain Duty Free, Dufry AG, Lagardère Travel Retail, King Khalid International Airport Duty Free, King Fahd International Airport Duty Free, Aer Rianta International, Dubai Duty Free, Qatar Duty Free, Al Musbah Group, Al-Futtaim Group, Chalhoub Group, Alshaya Group, Alhokair Group, Al-Muhaidib Group, Al-Tamimi Group contribute to innovation, geographic expansion, and service delivery in this space.

The Saudi Arabia travel retail market is poised for significant transformation in the coming years, driven by increasing international tourism and enhanced retail environments. As the government continues to invest in infrastructure and promote tourism, retailers will need to adapt to evolving consumer preferences, particularly in luxury and sustainable products. The integration of technology and personalized shopping experiences will also play a crucial role in attracting and retaining customers, ensuring a competitive edge in the market.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Perfumes and Cosmetics Fashion and Accessories Food and Confectionery Electronics Watches and Jewelry Tobacco Products Others (Stationery, Gifts, Toys, etc.) |

| By Traveler Demographics | Business Travelers Leisure Tourists Visiting Friends & Relatives (VFR) Pilgrims (Hajj & Umrah) |

| By Distribution Channel | Airport Retail Cruise Liners Railway Stations Downtown/Duty-Paid Stores Online/E-commerce |

| By Price Range | Budget Mid-Range Premium/Luxury |

| By Brand Ownership | International Brands Local Brands |

| By Distribution Mode | Direct Sales Indirect Sales E-commerce |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Airport Duty-Free Shoppers | 120 | Frequent Travelers, Tourists |

| Luxury Goods Purchasers | 90 | High-Income Travelers, Expatriates |

| Electronics Buyers in Travel Retail | 60 | Tech-Savvy Travelers, Business Travelers |

| Cosmetics and Fragrance Shoppers | 50 | Female Travelers, Beauty Enthusiasts |

| Travel Retail Experience Feedback | 70 | General Travelers, First-Time Visitors |

The Saudi Arabia Travel Retail Market is valued at approximately USD 390 million, reflecting a significant growth driven by increasing international travelers, rising disposable incomes, and expanded retail offerings in airports and travel hubs.