Region:Middle East

Author(s):Rebecca

Product Code:KRAB7363

Pages:94

Published On:October 2025

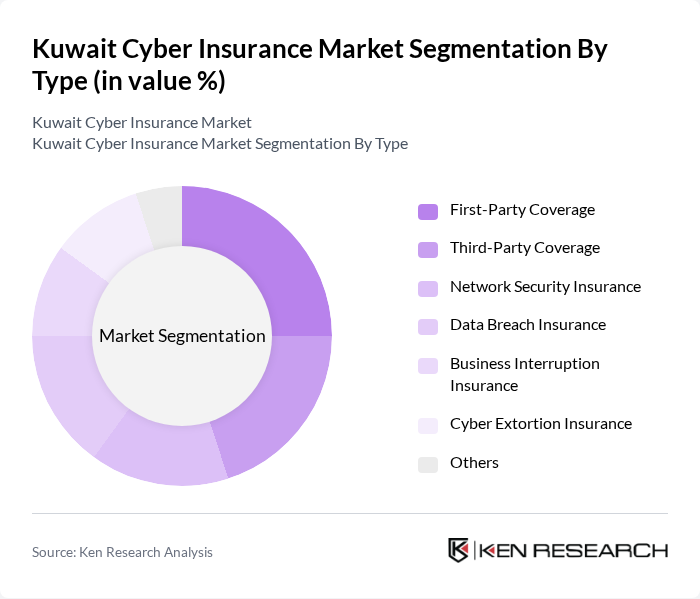

By Type:The market is segmented into various types of coverage, including First-Party Coverage, Third-Party Coverage, Network Security Insurance, Data Breach Insurance, Business Interruption Insurance, Cyber Extortion Insurance, and Others. Each of these sub-segments addresses specific risks associated with cyber incidents, catering to the diverse needs of businesses.

The First-Party Coverage segment is currently leading the market due to its focus on protecting organizations from direct losses incurred as a result of cyber incidents. This includes costs related to data recovery, business interruption, and reputational damage. As businesses increasingly face cyber threats, the demand for first-party coverage has surged, making it a preferred choice among organizations seeking to mitigate financial risks associated with cyberattacks.

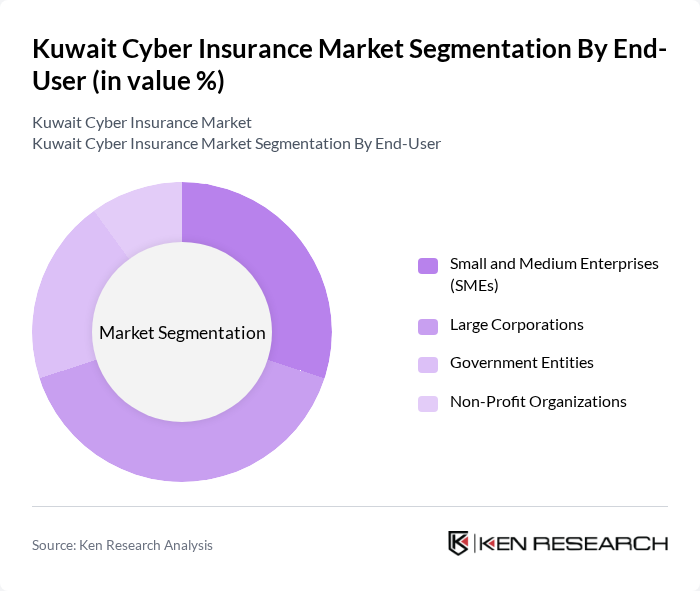

By End-User:The market is segmented by end-users, including Small and Medium Enterprises (SMEs), Large Corporations, Government Entities, and Non-Profit Organizations. Each segment has unique requirements and risk profiles, influencing their choice of cyber insurance products.

Large Corporations dominate the end-user segment due to their extensive digital operations and higher exposure to cyber risks. These organizations often handle vast amounts of sensitive data and are more likely to be targeted by cybercriminals. Consequently, they invest significantly in cyber insurance to safeguard their assets and ensure business continuity in the event of a cyber incident.

The Kuwait Cyber Insurance Market is characterized by a dynamic mix of regional and international players. Leading participants such as Kuwait Insurance Company, Gulf Insurance Group, Al Ahli Takaful Company, Warba Insurance Company, Kuwait Reinsurance Company, National Insurance Company, Al-Masraf Insurance Company, Takaful International Company, Al Sagr Cooperative Insurance Company, Al-Ahlia Insurance Company, Al-Jazeera Takaful Company, Al-Mawashi Insurance Company, Al-Bilad Insurance Company, Al-Fawaz Insurance Company, Al-Madina Insurance Company contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Kuwait cyber insurance market appears promising, driven by increasing digitalization and regulatory pressures. As businesses continue to embrace digital transformation, the demand for comprehensive cyber insurance solutions is expected to rise. Additionally, the growing recognition of cyber risks will likely lead to enhanced product offerings and innovative insurance models. The market is poised for growth as stakeholders adapt to evolving threats and regulatory landscapes, fostering a more resilient cybersecurity environment in Kuwait.

| Segment | Sub-Segments |

|---|---|

| By Type | First-Party Coverage Third-Party Coverage Network Security Insurance Data Breach Insurance Business Interruption Insurance Cyber Extortion Insurance Others |

| By End-User | Small and Medium Enterprises (SMEs) Large Corporations Government Entities Non-Profit Organizations |

| By Industry | Financial Services Healthcare Retail Telecommunications Manufacturing Education Others |

| By Coverage Type | Comprehensive Coverage Limited Coverage |

| By Distribution Channel | Direct Sales Brokers Online Platforms |

| By Policy Duration | Short-Term Policies Long-Term Policies |

| By Policy Support | Subsidies Tax Exemptions Risk Management Support |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Financial Services Cyber Insurance | 100 | Risk Managers, Compliance Officers |

| Healthcare Sector Cyber Risk | 80 | IT Security Managers, Hospital Administrators |

| Retail Industry Cyber Coverage | 70 | Operations Managers, IT Directors |

| Telecommunications Cyber Insurance | 60 | Network Security Analysts, Business Continuity Planners |

| SME Cyber Insurance Needs | 90 | Business Owners, IT Consultants |

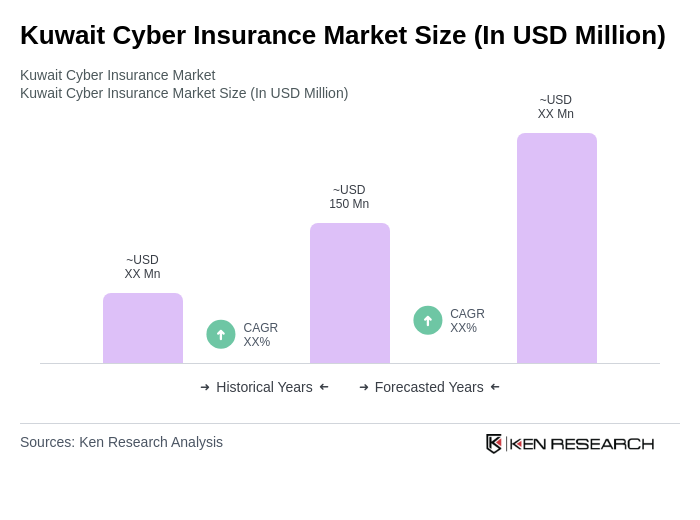

The Kuwait Cyber Insurance Market is valued at approximately USD 150 million, reflecting a significant increase driven by the rising frequency of cyberattacks and heightened awareness of cybersecurity risks among businesses in the region.