Region:Middle East

Author(s):Rebecca

Product Code:KRAC1089

Pages:93

Published On:October 2025

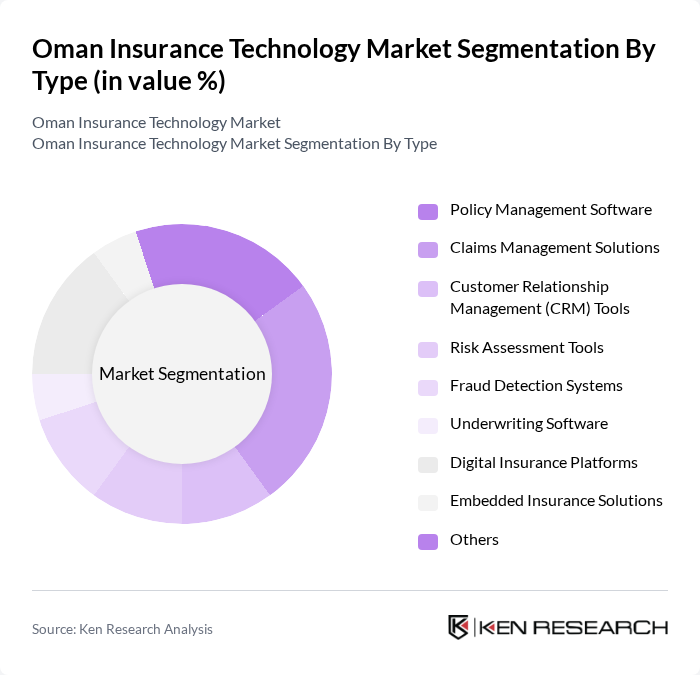

By Type:The market is segmented into a range of technology solutions tailored for the insurance sector. Key subsegments include Policy Management Software, Claims Management Solutions, Customer Relationship Management (CRM) Tools, Risk Assessment Tools, Fraud Detection Systems, Underwriting Software, Digital Insurance Platforms, Embedded Insurance Solutions, and Others. Among these,Claims Management Solutionsare currently leading the market, reflecting the sector’s focus on automating claims processes, reducing turnaround times, and enhancing customer satisfaction through digital channels.

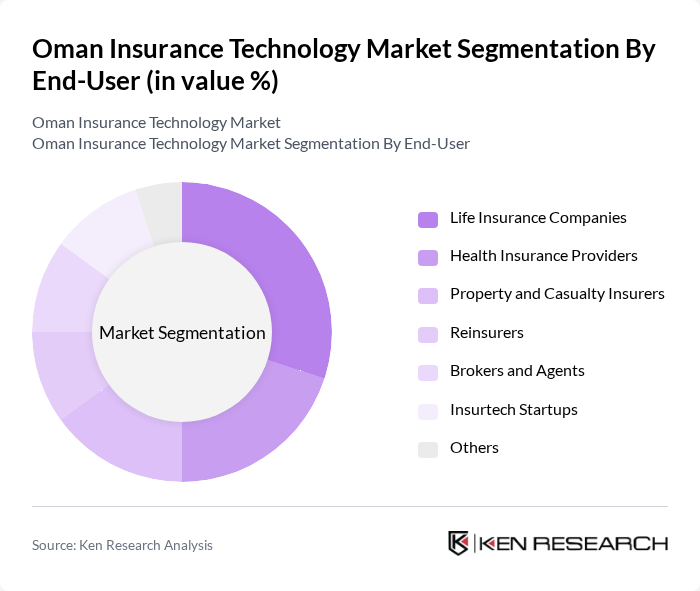

By End-User:The end-user segmentation includes Life Insurance Companies, Health Insurance Providers, Property and Casualty Insurers, Reinsurers, Brokers and Agents, Insurtech Startups, and Others.Life Insurance Companiesare the dominant segment, driven by rising demand for life insurance products, increased awareness of financial security, and the need for efficient management of policyholder data and claims.

The Oman Insurance Technology Market is characterized by a dynamic mix of regional and international players. Leading participants such as National Life & General Insurance Company SAOG, Oman United Insurance Company SAOG, Dhofar Insurance Company SAOG, Al Madina Insurance Company SAOG, Al Ahlia Insurance Company SAOC, Takaful Oman Insurance SAOG, Vision Insurance SAOC, Arabia Falcon Insurance Company SAOC, Oman Reinsurance Company SAOC (Oman Re), Muscat Insurance Company SAOG, Al Ittihad Al Watani General Insurance Company SAOC, Bima Oman (Insurtech Platform), Beema Insurance Services LLC, Nextcare Oman (TPA/Insurtech), Smartt Insurtech Solutions LLC contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Oman insurance technology market appears promising, driven by ongoing digital transformation and increasing consumer demand for innovative solutions. As the government continues to support technology adoption, the market is likely to see enhanced collaboration between traditional insurers and tech startups. Additionally, the integration of advanced technologies such as AI and blockchain will further streamline operations and improve customer experiences, positioning Oman as a regional leader in insurtech innovation.

| Segment | Sub-Segments |

|---|---|

| By Type | Policy Management Software Claims Management Solutions Customer Relationship Management (CRM) Tools Risk Assessment Tools Fraud Detection Systems Underwriting Software Digital Insurance Platforms Embedded Insurance Solutions Others |

| By End-User | Life Insurance Companies Health Insurance Providers Property and Casualty Insurers Reinsurers Brokers and Agents Insurtech Startups Others |

| By Application | Customer Onboarding Policy Issuance Claims Processing Risk Management Compliance Management Digital Payments Integration Fraud Prevention Others |

| By Distribution Channel | Direct Sales Online Platforms Insurance Brokers Agents Bancassurance Others |

| By Technology | Cloud Computing Artificial Intelligence Blockchain Big Data Analytics Internet of Things (IoT) Robotic Process Automation (RPA) Others |

| By Company Size | Large Enterprises Medium Enterprises Small Enterprises |

| By Policy Support | Subsidies for Technology Adoption Tax Incentives for Insurtech Startups Grants for Research and Development Regulatory Sandboxes Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Insurance Technology Adoption | 120 | IT Managers, CTOs of Insurance Firms |

| Digital Transformation Strategies | 90 | Business Development Managers, Strategy Heads |

| Customer Experience Innovations | 70 | Customer Service Managers, UX Designers |

| Regulatory Compliance Technologies | 60 | Compliance Officers, Risk Management Executives |

| InsurTech Startups Insights | 50 | Founders, Product Managers of Startups |

The Oman Insurance Technology Market is valued at approximately USD 1.4 billion, reflecting significant growth driven by digital insurance platform adoption, regulatory requirements, and increased consumer awareness in the sector.