Region:Middle East

Author(s):Geetanshi

Product Code:KRAD5847

Pages:91

Published On:December 2025

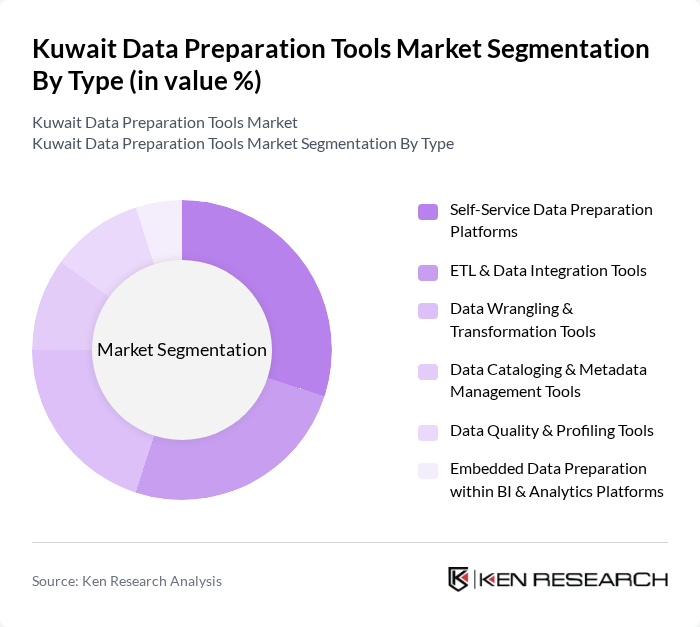

By Type:The market is segmented into various types of data preparation tools, including Self-Service Data Preparation Platforms, ETL & Data Integration Tools, Data Wrangling & Transformation Tools, Data Cataloging & Metadata Management Tools, Data Quality & Profiling Tools, and Embedded Data Preparation within BI & Analytics Platforms. This typology aligns with global data preparation tools market structures, where self-service, ETL/data integration, data quality, and cataloging are recognized as core functional categories. Among these, Self-Service Data Preparation Platforms are gaining traction due to their user-friendly interfaces, ability to empower business users to profile and transform data without deep IT intervention, and close integration with BI and analytics tools deployed across enterprises in Kuwait.

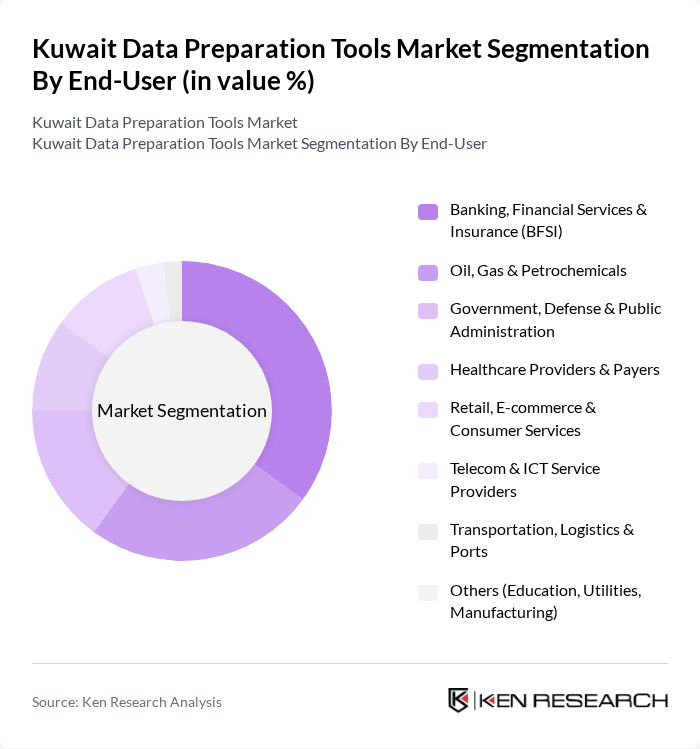

By End-User:The end-user segmentation includes Banking, Financial Services & Insurance (BFSI), Oil, Gas & Petrochemicals, Government, Defense & Public Administration, Healthcare Providers & Payers, Retail, E-commerce & Consumer Services, Telecom & ICT Service Providers, Transportation, Logistics & Ports, and Others (Education, Utilities, Manufacturing). This structure is consistent with Kuwait’s broader ICT and BI software market segmentation, where BFSI, oil and gas, government, and healthcare are among the largest consumers of analytics and data management solutions. The BFSI sector is the leading end-user, driven by the need for robust data management and preparation solutions to comply with regulatory and reporting requirements, strengthen risk and fraud analytics, and enhance omni-channel customer experience.

The Kuwait Data Preparation Tools Market is characterized by a dynamic mix of regional and international players. Leading participants such as Microsoft Corporation (Power Query, Power BI, Azure Data Factory), IBM Corporation (IBM DataStage, IBM Cloud Pak for Data), Oracle Corporation (Oracle Data Integrator, Oracle Cloud Data Integration), SAP SE (SAP Data Intelligence, SAP Data Services), Informatica Inc. (Informatica Intelligent Data Management Cloud), Alteryx, Inc., SAS Institute Inc. (SAS Data Management & Data Preparation), Talend (Qlik Talend Data Fabric), QlikTech International AB (Qlik Sense, Qlik Data Integration), Tableau Software, LLC (Tableau Prep Builder), TIBCO Software Inc., Google LLC (Google Cloud DataPrep & Dataflow), Amazon Web Services, Inc. (AWS Glue, AWS DataBrew), Snowflake Inc. (Snowflake Data Cloud & Native Data Preparation Ecosystem), Databricks, Inc. (Databricks Lakehouse Platform & Data Engineering) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the data preparation tools market in Kuwait appears promising, driven by technological advancements and increasing digitalization across sectors. As organizations prioritize data-driven strategies, the demand for innovative solutions will likely rise. Furthermore, the integration of artificial intelligence and machine learning into data preparation processes is expected to enhance efficiency and accuracy, positioning Kuwait as a regional leader in data management solutions in future.

| Segment | Sub-Segments |

|---|---|

| By Type | Self-Service Data Preparation Platforms ETL & Data Integration Tools Data Wrangling & Transformation Tools Data Cataloging & Metadata Management Tools Data Quality & Profiling Tools Embedded Data Preparation within BI & Analytics Platforms |

| By End-User | Banking, Financial Services & Insurance (BFSI) Oil, Gas & Petrochemicals Government, Defense & Public Administration Healthcare Providers & Payers Retail, E-commerce & Consumer Services Telecom & ICT Service Providers Transportation, Logistics & Ports Others (Education, Utilities, Manufacturing) |

| By Deployment Model | On-Premises Public Cloud Private Cloud Hybrid |

| By Industry Vertical | Oil & Gas Banking & Financial Services Government & Smart City Programs Healthcare & Life Sciences Retail & Wholesale Telecom & Media Transportation & Logistics Others (Education, Utilities, Manufacturing) |

| By Functionality | Data Ingestion & Connectivity Data Cleaning, Profiling & Quality Management Data Transformation, Enrichment & Wrangling Data Governance, Lineage & Compliance Automation & Orchestration of Data Pipelines |

| By Size of Organization | Small Enterprises Medium Enterprises Large Enterprises |

| By Geographic Presence | Kuwait City & Metropolitan Area Other Urban & Industrial Zones Free Zones & Special Economic Areas |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Enterprise Data Management | 100 | IT Managers, Data Architects |

| SME Data Preparation Tools | 80 | Business Owners, Operations Managers |

| Healthcare Data Solutions | 70 | Healthcare IT Specialists, Data Analysts |

| Financial Services Data Tools | 90 | Financial Analysts, Compliance Officers |

| Retail Data Analytics | 60 | Marketing Managers, Data Scientists |

The Kuwait Data Preparation Tools Market is valued at approximately USD 140 million, reflecting a significant investment in business intelligence, analytics, and data management platforms across various sectors, including banking, healthcare, and retail.