Region:Middle East

Author(s):Geetanshi

Product Code:KRAD4847

Pages:86

Published On:December 2025

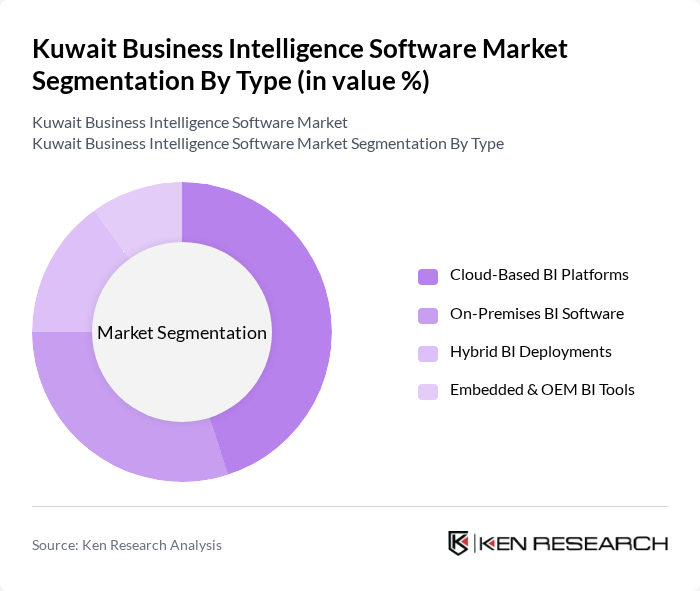

By Type:The market is segmented into various types of business intelligence software, including Cloud-Based BI Platforms, On-Premises BI Software, Hybrid BI Deployments, and Embedded & OEM BI Tools. This structure is consistent with global BI and analytics software categorization, where deployment model and integration depth are key differentiators. Each of these sub-segments caters to different business needs and preferences, with cloud-based solutions gaining significant traction in Kuwait and the wider Middle East & Africa region due to their scalability, subscription-based pricing, easier updates, and compatibility with modern data platforms and AI services.

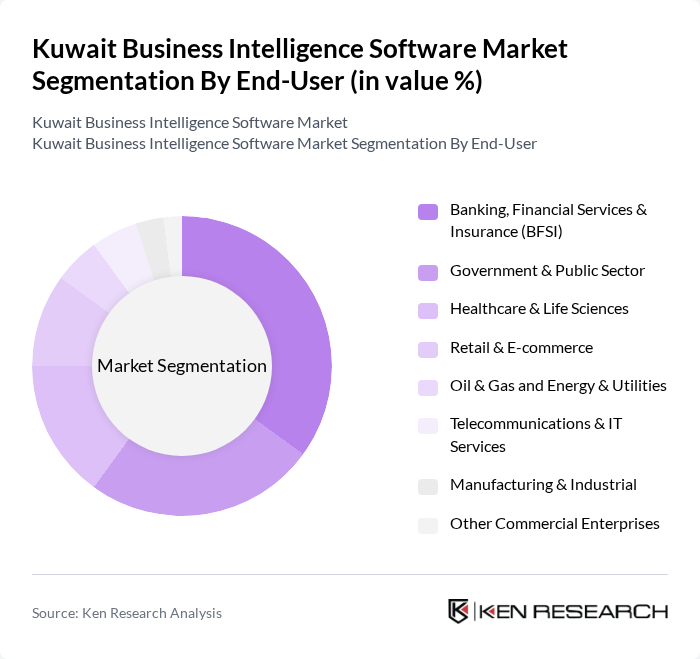

By End-User:The end-user segmentation includes various industries such as Banking, Financial Services & Insurance (BFSI), Government & Public Sector, Healthcare & Life Sciences, Retail & E-commerce, Oil & Gas and Energy & Utilities, Telecommunications & IT Services, Manufacturing & Industrial, and Other Commercial Enterprises. This vertical mix aligns with the main adopters of BI and analytics platforms globally and in the Middle East, where regulated sectors and data-intensive operations are leading spenders. The BFSI sector is particularly prominent in Kuwait, driven by the need for enhanced risk analytics, regulatory and financial reporting, customer segmentation, fraud detection, and performance dashboards, while government and public sector agencies increasingly use BI for e-government services, transparency initiatives, and operational optimization.

The Kuwait Business Intelligence Software Market is characterized by a dynamic mix of regional and international players. Leading participants such as Microsoft Corporation, SAP SE, Oracle Corporation, IBM Corporation, Tableau Software, LLC (Salesforce, Inc.), QlikTech International AB, Sisense Inc., MicroStrategy Incorporated, Domo, Inc., TIBCO Software Inc., Looker (Google Cloud), Zoho Corporation (Zoho Analytics), SAS Institute Inc., Yellowfin International Pty Ltd, Gulf Business Machines (GBM Kuwait) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Kuwait business intelligence software market appears promising, driven by technological advancements and increasing digitalization across various sectors. As organizations continue to embrace data analytics, the integration of artificial intelligence and machine learning will enhance predictive capabilities, allowing for more informed decision-making. Furthermore, the growing emphasis on data-driven strategies will likely lead to increased investments in business intelligence tools, fostering innovation and improving operational efficiencies across industries in Kuwait.

| Segment | Sub-Segments |

|---|---|

| By Type | Cloud-Based BI Platforms On-Premises BI Software Hybrid BI Deployments Embedded & OEM BI Tools |

| By End-User | Banking, Financial Services & Insurance (BFSI) Government & Public Sector Healthcare & Life Sciences Retail & E-commerce Oil & Gas and Energy & Utilities Telecommunications & IT Services Manufacturing & Industrial Other Commercial Enterprises (Hospitality, Logistics, Education, etc.) |

| By Deployment Model | Public Cloud Private Cloud Hybrid Cloud On-Premises |

| By Functionality | Reporting, Dashboards & Ad-hoc Query Data Visualization & Self-Service Analytics Advanced & Predictive Analytics Performance Management & KPI Monitoring Data Integration, ETL & Data Preparation |

| By Industry Vertical | Oil & Gas Banking & Financial Services Government, Defense & Public Administration Healthcare Providers & Payers Retail, Wholesale & Consumer Services Transportation, Logistics & Ports Education & Training Others |

| By Data Source | Enterprise Applications (ERP, CRM, HCM) Data Warehouses & Data Lakes Web, Social & Clickstream Data Machine, IoT & Sensor Data External & Third-Party Data |

| By Analytics Type | Descriptive Analytics Diagnostic Analytics Predictive Analytics Prescriptive Analytics |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Finance Sector Business Intelligence Usage | 120 | Chief Financial Officers, Data Analysts |

| Healthcare Analytics Adoption | 90 | Healthcare Administrators, IT Directors |

| Retail Data Management Practices | 80 | Retail Managers, Business Intelligence Specialists |

| Telecommunications Data Insights | 60 | Network Analysts, Business Development Managers |

| Government Sector Data Utilization | 100 | Policy Makers, IT Managers |

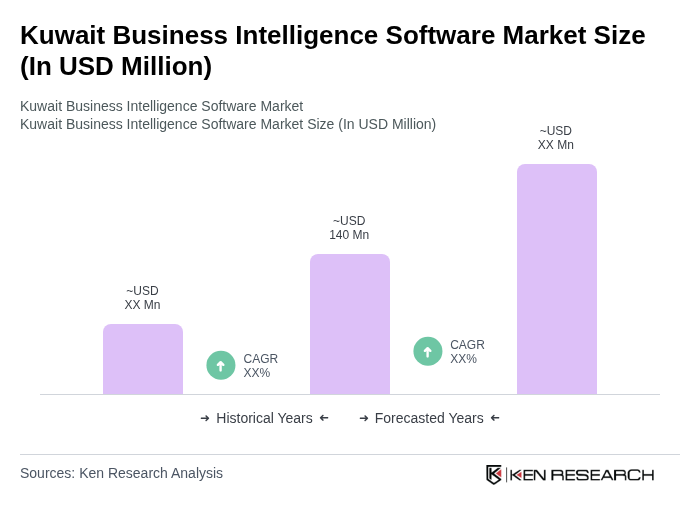

The Kuwait Business Intelligence Software Market is valued at approximately USD 140 million, reflecting a historical analysis of ICT and enterprise software spending in the region, driven by the demand for data-driven decision-making across various sectors.