Region:Middle East

Author(s):Geetanshi

Product Code:KRAD4113

Pages:88

Published On:December 2025

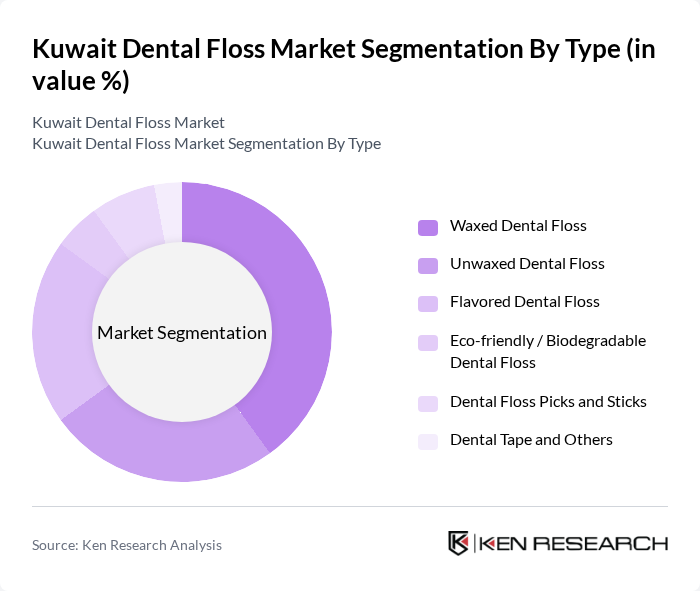

By Type:The market is segmented into various types of dental floss, including waxed dental floss, unwaxed dental floss, flavored dental floss, eco-friendly/biodegradable dental floss, dental floss picks and sticks, and dental tape and others. Among these, waxed dental floss is the most popular due to its ease of use and effectiveness in sliding between teeth. Flavored dental floss is also gaining traction, particularly among younger consumers who prefer products that enhance their oral care experience.

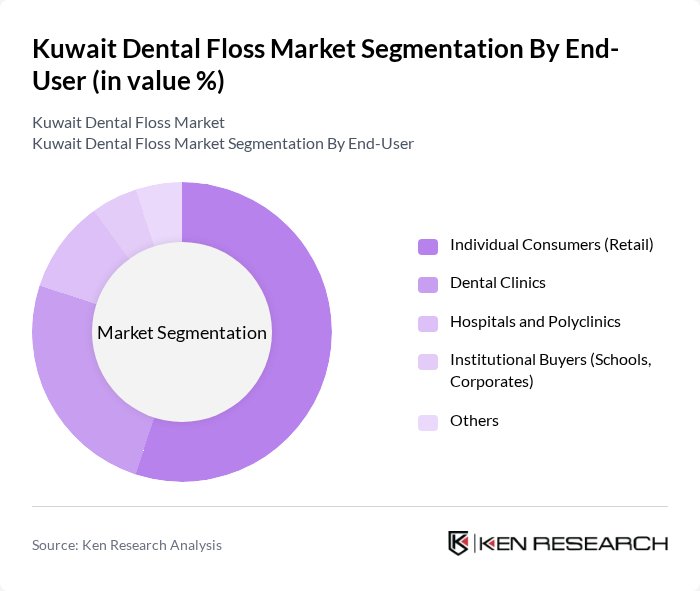

By End-User:The end-user segmentation includes individual consumers (retail), dental clinics, hospitals and polyclinics, institutional buyers (schools, corporates), and others. Individual consumers represent the largest segment, driven by the growing trend of self-care and preventive health measures. Dental clinics and hospitals also contribute significantly to the market as they recommend dental floss to patients as part of their oral hygiene routines.

The Kuwait Dental Floss Market is characterized by a dynamic mix of regional and international players. Leading participants such as Procter & Gamble (Oral-B), Colgate-Palmolive, Johnson & Johnson (Listerine), Unilever (Signal, Closeup), GSK plc (Sensodyne), Sunstar (GUM), Dr. Fresh LLC, DenTek Oral Care, Inc., Plackers, The Humble Co., Tom's of Maine, Eco-Dent, Radius Corporation, Local and Regional Private Labels (Kuwait & GCC Retailers), and Other Emerging Eco-friendly Dental Floss Brands contribute to innovation, geographic expansion, and service delivery in this space.

The future of the dental floss market in Kuwait appears promising, driven by ongoing health initiatives and increasing consumer awareness of oral hygiene. As the government continues to promote dental health through educational campaigns, the demand for dental floss is expected to rise. Additionally, the integration of innovative product features, such as eco-friendly materials and flavored options, will likely attract a younger demographic, further expanding the market's reach and potential.

| Segment | Sub-Segments |

|---|---|

| By Type | Waxed Dental Floss Unwaxed Dental Floss Flavored Dental Floss Eco-friendly / Biodegradable Dental Floss Dental Floss Picks and Sticks Dental Tape and Others |

| By End-User | Individual Consumers (Retail) Dental Clinics Hospitals and Polyclinics Institutional Buyers (Schools, Corporates) Others |

| By Distribution Channel | Supermarkets/Hypermarkets Online Retail and E-pharmacies Pharmacies and Drugstores Convenience Stores Dental Supply Channels and Others |

| By Packaging Type | Refillable Containers Single-use / Travel Packs Bulk / Professional Packaging Others |

| By Price Range | Economy Mid-range Premium Others |

| By Brand Loyalty | Brand-loyal Consumers Price-sensitive Consumers Occasional / Impulse Users Others |

| By Consumer Age Group | Children Teenagers Adults Seniors Others |

| By Cross Comparison of Key Players | Company Name Group Size (Global, Regional, or Local) Kuwait Dental Floss Revenue (USD, Latest Year) Revenue CAGR in Kuwait Dental Floss (3–5 Years) Market Share in Kuwait Dental Floss (%) Weighted Average Retail Price per Pack in Kuwait Number of SKUs in Kuwait Dental Floss Portfolio Share of Sales via Pharmacies vs Modern Trade (%) Share of Online / E-pharmacy Sales (%) Kuwait Distribution Reach (Number of Outlets Covered) Brand Awareness / Recommendation by Dentists in Kuwait Marketing & Promotion Spend in Kuwait (as % of Sales) |

| By Detailed Profile of Major Companies | Procter & Gamble (Oral-B) Colgate-Palmolive Johnson & Johnson (Listerine) Unilever (Signal, Closeup) GSK plc (Sensodyne) Sunstar (GUM) Dr. Fresh LLC DenTek Oral Care, Inc. Plackers The Humble Co. Tom's of Maine Eco-Dent Radius Corporation Local and Regional Private Labels (Kuwait & GCC Retailers) Other Emerging Eco-friendly Dental Floss Brands |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Dental Professionals Insights | 80 | Dentists, Dental Hygienists |

| Retail Market Feedback | 70 | Pharmacy Managers, Supermarket Buyers |

| Consumer Behavior Analysis | 120 | General Consumers, Health-Conscious Individuals |

| Market Trend Evaluation | 60 | Market Analysts, Health Researchers |

| Product Development Insights | 50 | Product Managers, Brand Strategists |

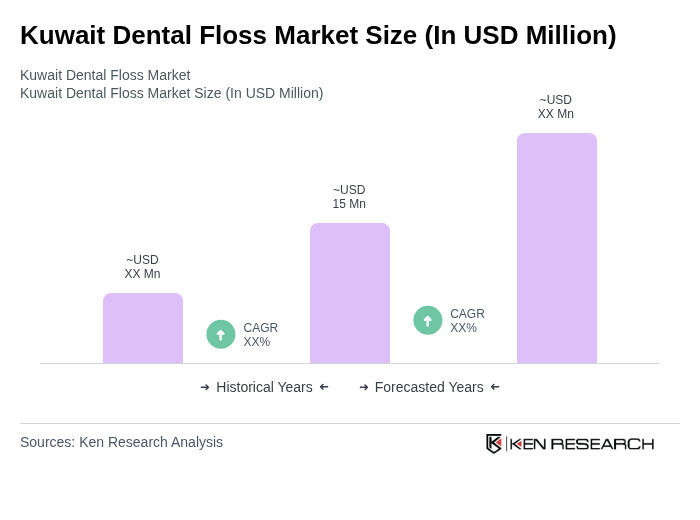

The Kuwait Dental Floss Market is valued at approximately USD 15 million, reflecting a growing awareness of oral hygiene and an increase in dental issues among the population, driving demand for preventive dental care solutions.