Saudi Arabia Dental Floss Market Overview

- The Saudi Arabia Dental Floss Market is valued at USD 20 million, based on a five-year historical analysis and triangulation with the size of the global dental floss market and the share of Saudi Arabia within the regional oral care category. This growth is primarily driven by increasing awareness of oral hygiene, rising disposable incomes, and a growing population that prioritizes dental care in alignment with broader improvements in oral health services across the Middle East. The market has seen a surge in demand for dental floss and interdental cleaning products as consumers become more health-conscious, influenced by global oral care brands, dentist recommendations, and preventive dentistry campaigns.

- Key cities such as Riyadh, Jeddah, and Dammam dominate the market due to their high population density and advanced urban infrastructure, which mirrors the concentration of oral care spending in major metropolitan areas of the Kingdom. These cities have a well-established retail infrastructure, including supermarkets, hypermarkets, pharmacies, and beauty and personal care chains, which facilitate easy access to dental floss products, in line with global trends where supermarkets and pharmacies are leading distribution channels for dental floss. Additionally, the presence of dental clinics, hospitals, and specialized dental centers in these urban areas contributes to the increased consumption of dental hygiene products, as professional recommendations and routine dental visits promote the adoption of flossing as part of daily oral care.

- In 2023, the Saudi government implemented regulations mandating that all dental care products, including dental floss, must meet specific safety and quality standards set by the Saudi Food and Drug Authority (SFDA). This regulation aligns with the Medical Devices Interim Regulation and subsequent SFDA executive regulations and guidance, under which many oral-care items (including certain floss and interdental cleaning products) are classified as medical devices or consumer health products and must comply with SFDA registration, conformity assessment, labelling, and quality requirements issued by the Saudi Food and Drug Authority. This framework aims to ensure consumer safety, traceability, and consistent product quality, thereby supporting the wider adoption of high-quality dental hygiene products in the market.

Saudi Arabia Dental Floss Market Segmentation

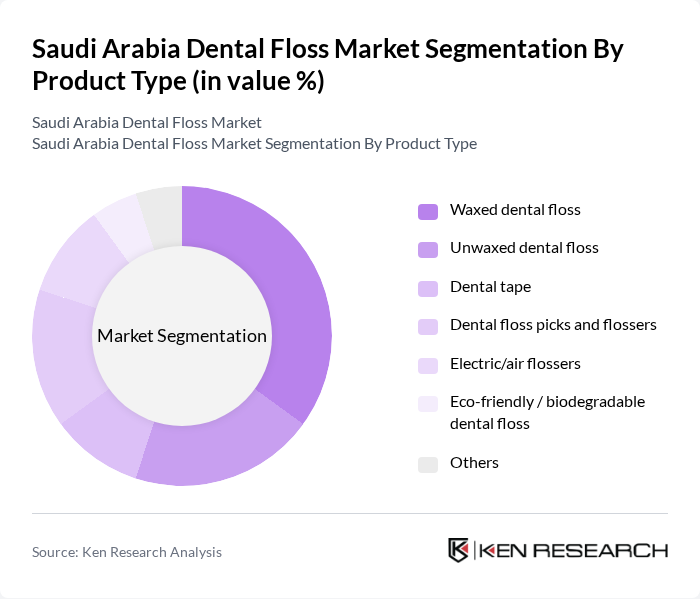

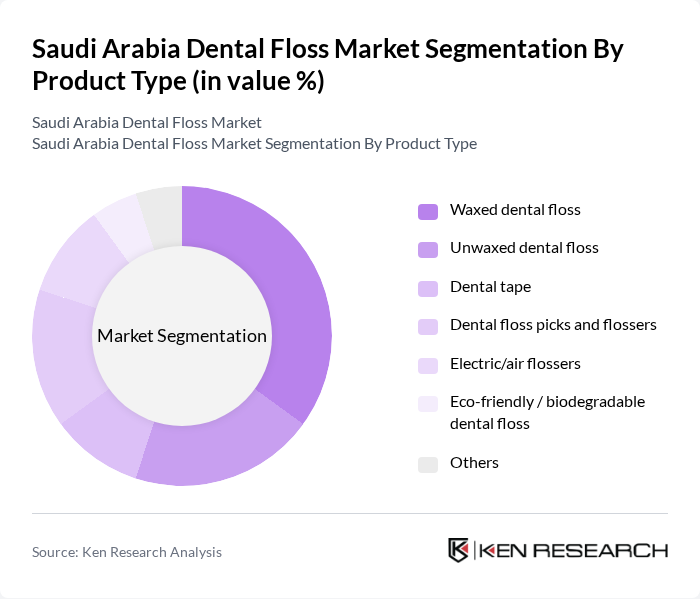

By Product Type:The product type segmentation includes various forms of dental floss, catering to different consumer preferences and needs. The subsegments are waxed dental floss, unwaxed dental floss, dental tape, dental floss picks and flossers, electric/air flossers, eco-friendly/biodegradable dental floss, and others. Among these, waxed dental floss is the most popular within traditional string floss due to its ease of use, reduced shredding, and effectiveness in cleaning between teeth, which is consistent with global trends where waxed floss holds a leading share of the segment.

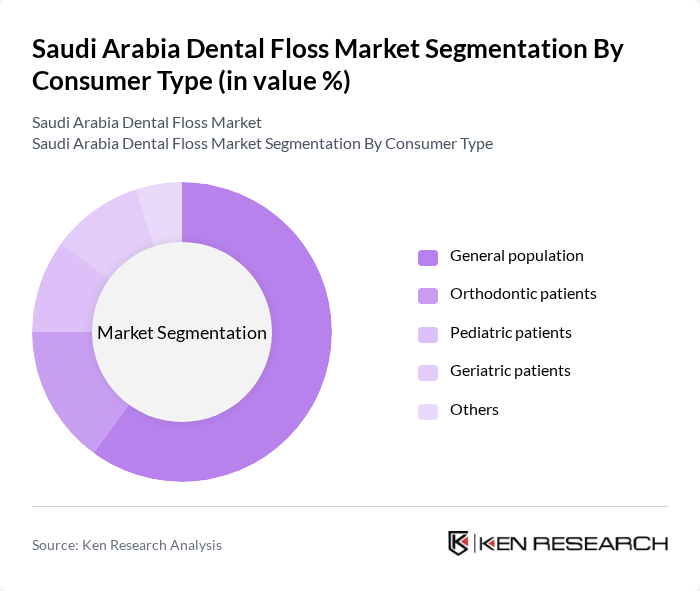

By Consumer Type:This segmentation focuses on the different consumer groups that utilize dental floss products. The subsegments include the general population, orthodontic patients, pediatric patients, geriatric patients, and others. The general population represents the largest consumer base, driven by increasing awareness of oral hygiene, manufacturer-led education, and preventive dental care initiatives, while orthodontic and pediatric patients are increasingly targeted with specialized floss, floss threaders, and floss picks designed for braces and age-specific needs.

Saudi Arabia Dental Floss Market Competitive Landscape

The Saudi Arabia Dental Floss Market is characterized by a dynamic mix of regional and international players. Leading participants such as Procter & Gamble Co. (Oral-B), Colgate-Palmolive Co., Johnson & Johnson Consumer Inc. (Listerine, Reach), Unilever PLC, Sunstar Suisse S.A. (GUM), Lion Corporation, GC Corporation, Dr. Fresh LLC, DenTek Oral Care, Inc., Plackers (Ranir LLC / Perrigo Company plc), Trisa AG, Sensodyne / GSK plc, Local & regional private-label brands (e.g., Nesto, Panda, Tamimi), Saudi and GCC regional distributors of dental floss products, Emerging eco-friendly floss brands available via e-commerce in KSA contribute to innovation, geographic expansion, and service delivery in this space, reflecting the broader global competitive environment in dental floss and oral care accessories.

Saudi Arabia Dental Floss Market Industry Analysis

Growth Drivers

- Increasing Awareness of Oral Hygiene:The Saudi Arabian population is becoming increasingly aware of the importance of oral hygiene, with dental care spending projected to reach SAR 14 billion in future. This growing awareness is driven by health campaigns and educational initiatives, leading to a rise in dental floss usage. The Ministry of Health's efforts to promote oral health have resulted in a 17% increase in dental check-ups, further encouraging the adoption of dental hygiene products, including floss.

- Rising Dental Care Expenditure:In future, the dental care expenditure in Saudi Arabia is expected to grow to SAR 14 billion, reflecting a significant increase in consumer spending on dental products. This rise is attributed to higher disposable incomes and a growing middle class, which is increasingly prioritizing oral health. As consumers invest more in dental care, the demand for dental floss is expected to rise, driven by the need for comprehensive oral hygiene solutions.

- Expansion of Retail Distribution Channels:The retail landscape in Saudi Arabia is evolving, with a notable increase in the number of pharmacies and supermarkets offering dental care products. In future, the number of retail outlets is projected to increase by 25%, enhancing accessibility to dental floss. This expansion is supported by the growth of e-commerce, which is expected to account for 20% of total retail sales, making dental floss more available to consumers across various demographics.

Market Challenges

- High Competition Among Brands:The Saudi dental floss market is characterized by intense competition, with over 35 brands vying for market share. This saturation leads to aggressive pricing strategies, which can erode profit margins. In future, the top five brands are expected to hold only 38% of the market share, indicating a fragmented landscape where new entrants struggle to establish a foothold amidst established players.

- Limited Consumer Education on Dental Floss:Despite the growing awareness of oral hygiene, many consumers in Saudi Arabia remain unaware of the benefits of dental floss. Approximately 62% of the population does not use dental floss regularly, primarily due to a lack of education on its importance. This gap presents a significant challenge for brands aiming to increase market penetration and consumer adoption of dental floss products.

Saudi Arabia Dental Floss Market Future Outlook

The future of the Saudi Arabia dental floss market appears promising, driven by increasing consumer awareness and a shift towards preventive dental care. As the population becomes more health-conscious, the demand for dental hygiene products, including floss, is expected to rise. Innovations in product offerings, such as eco-friendly and flavored options, will likely attract a broader consumer base. Additionally, the expansion of online retail channels will facilitate easier access to dental floss, further boosting market growth in the coming years.

Market Opportunities

- Introduction of Innovative Products:There is a significant opportunity for brands to introduce innovative dental floss products, such as biodegradable options and those infused with natural flavors. With the increasing consumer preference for sustainable products, these innovations can capture a growing segment of environmentally conscious buyers, potentially increasing market share and brand loyalty.

- Expansion into Untapped Rural Markets:Rural areas in Saudi Arabia present a largely untapped market for dental floss. With approximately 32% of the population residing in these regions, brands can focus on targeted marketing strategies to educate consumers about oral hygiene. Establishing distribution channels in these areas can significantly enhance market penetration and drive sales growth.