Region:Middle East

Author(s):Geetanshi

Product Code:KRAC4401

Pages:85

Published On:October 2025

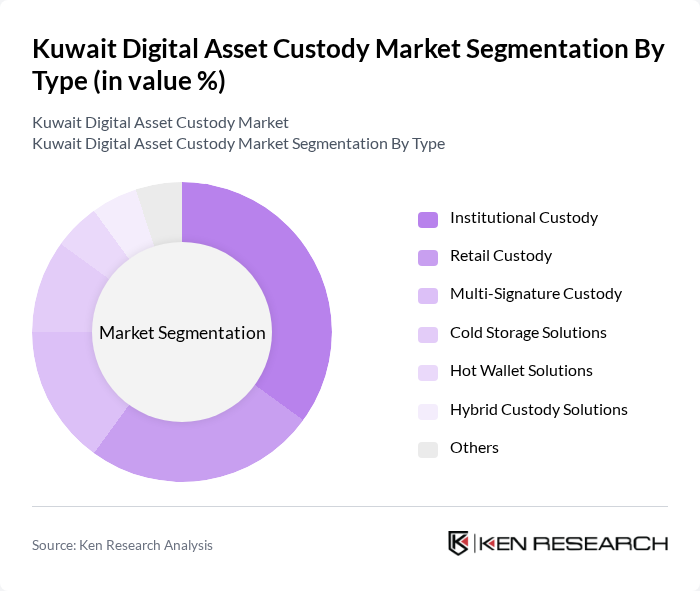

By Type:The market is segmented into various types of custody solutions, including Institutional Custody, Retail Custody, Multi-Signature Custody, Cold Storage Solutions, Hot Wallet Solutions, Hybrid Custody Solutions, and Others. Institutional Custody is gaining traction due to the increasing number of institutional investors entering the digital asset space, seeking secure and compliant storage solutions. Retail Custody is also growing as individual investors become more interested in cryptocurrencies. Multi-signature and cold storage solutions are increasingly adopted for enhanced security, while hybrid models integrate both cold and hot wallet features to balance accessibility and safety .

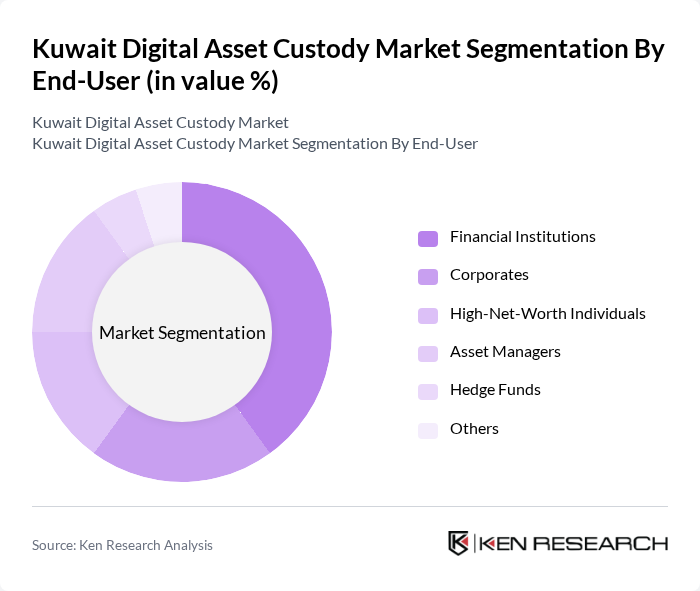

By End-User:The end-user segmentation includes Financial Institutions, Corporates, High-Net-Worth Individuals, Asset Managers, Hedge Funds, and Others. Financial Institutions are the leading end-users, driven by their need for secure and compliant custody solutions for managing digital assets. Corporates are increasingly adopting digital assets for treasury management and investment purposes. Asset managers and hedge funds require advanced custody solutions to support portfolio diversification and risk management .

The Kuwait Digital Asset Custody Market is characterized by a dynamic mix of regional and international players. Leading participants such as Kuwait Finance House, National Bank of Kuwait, Boubyan Bank, BitGo, Coinbase Custody, Fidelity Digital Assets, Anchorage Digital, Gemini Custody, Ledger Vault, Fireblocks, Trustology, Zodia Custody, Copper, Cobo, Hex Trust, Komainu, Securosys, Digital Asset Custody Company contribute to innovation, geographic expansion, and service delivery in this space .

The future of the Kuwait digital asset custody market appears promising, driven by increasing institutional interest and regulatory advancements. As the government continues to refine its regulatory framework, more financial institutions are likely to enter the market, enhancing competition and service offerings. Additionally, the integration of advanced technologies such as artificial intelligence and blockchain will further streamline custody solutions, making them more accessible and secure for a broader range of investors, thus fostering market growth.

| Segment | Sub-Segments |

|---|---|

| By Type | Institutional Custody Retail Custody Multi-Signature Custody Cold Storage Solutions Hot Wallet Solutions Hybrid Custody Solutions Others |

| By End-User | Financial Institutions Corporates High-Net-Worth Individuals Asset Managers Hedge Funds Others |

| By Asset Class | Cryptocurrencies Tokenized Assets Stablecoins Non-Fungible Tokens (NFTs) Central Bank Digital Currencies (CBDCs) Others |

| By Service Model | Full-Service Custody Self-Custody Solutions Managed Custody Services Wallet-as-a-Service Reporting & Compliance Services Risk & Security Management Others |

| By Distribution Channel | Direct Sales Online Platforms Partnerships with Financial Advisors Others |

| By Compliance Level | Fully Compliant Solutions Partially Compliant Solutions Non-Compliant Solutions Others |

| By Geographic Focus | Domestic Market Regional Market International Market Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Banking Sector Digital Custody Services | 100 | Compliance Officers, Digital Asset Managers |

| Investment Firms and Asset Managers | 60 | Portfolio Managers, Risk Analysts |

| Regulatory Bodies and Government Agencies | 40 | Policy Makers, Financial Regulators |

| Technology Providers for Custody Solutions | 50 | Product Development Managers, Technical Leads |

| End-users of Digital Custody Services | 80 | Individual Investors, Institutional Clients |

The Kuwait Digital Asset Custody Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by institutional adoption and the demand for secure storage solutions for digital assets.