Region:Middle East

Author(s):Geetanshi

Product Code:KRAC1047

Pages:100

Published On:October 2025

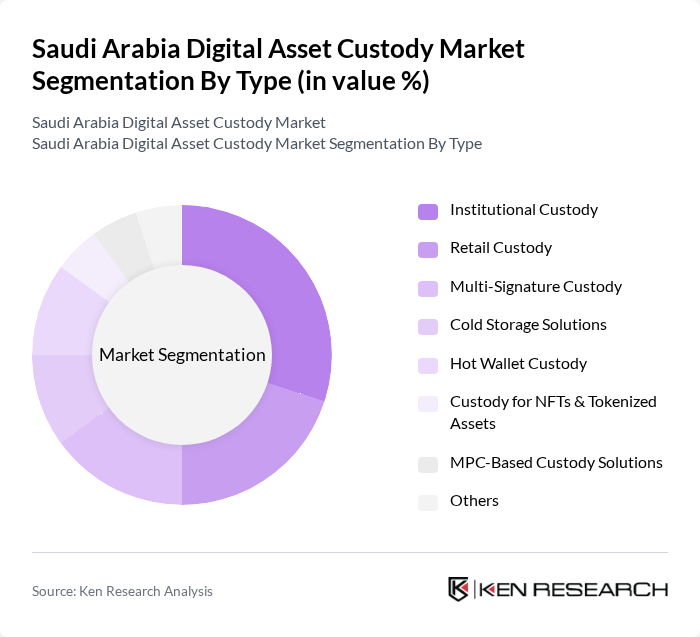

By Type:The market is segmented into various types of custody solutions, including Institutional Custody, Retail Custody, Multi-Signature Custody, Cold Storage Solutions, Hot Wallet Custody, Custody for NFTs & Tokenized Assets, MPC-Based Custody Solutions, and Others. Each of these sub-segments caters to different customer needs and preferences, with varying levels of security and accessibility. Institutional custody solutions are preferred by banks and asset managers for their compliance features and robust risk controls, while retail custody and hot wallet solutions offer greater accessibility for individual investors. Multi-signature and MPC-based custody solutions are increasingly adopted for enhanced security and operational flexibility, particularly for tokenized assets and NFTs.

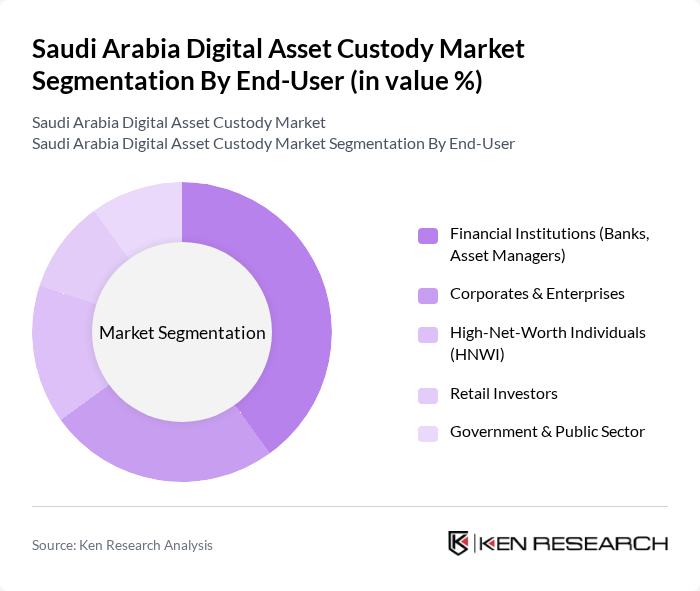

By End-User:The end-user segmentation includes Financial Institutions (Banks, Asset Managers), Corporates & Enterprises, High-Net-Worth Individuals (HNWI), Retail Investors, and Government & Public Sector. Each segment has unique requirements for digital asset custody, influencing the types of services offered. Financial institutions prioritize regulatory compliance and advanced security, corporates seek integrated solutions for treasury and investment management, HNWIs demand personalized custody and insurance, while retail investors and the public sector focus on accessibility and transparency.

The Saudi Arabia Digital Asset Custody Market is characterized by a dynamic mix of regional and international players. Leading participants such as Saudi Digital Asset Custody Company (SDACC), Alinma Investment, SEDCO Capital, Riyad Capital, SNB Capital (formerly NCB Capital), Al Rajhi Capital, Samba Capital, Arab National Bank, Albilad Investment, Aljazira Capital, Emirates NBD, Abu Dhabi Commercial Bank, Qatar National Bank, Gulf Bank, Bank Albilad, Fireblocks, BitGo, Komainu, Zodia Custody, Standard Chartered (Zodia Markets) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Saudi Arabia digital asset custody market appears promising, driven by technological advancements and increasing institutional interest. In future, the integration of artificial intelligence in custody services is expected to enhance operational efficiency and security. Additionally, the rise of decentralized finance (DeFi) is likely to create new avenues for custodians, as they adapt to the evolving landscape. As regulatory frameworks solidify, investor confidence will grow, further propelling market expansion.

| Segment | Sub-Segments |

|---|---|

| By Type | Institutional Custody Retail Custody Multi-Signature Custody Cold Storage Solutions Hot Wallet Custody Custody for NFTs & Tokenized Assets MPC-Based Custody Solutions Others |

| By End-User | Financial Institutions (Banks, Asset Managers) Corporates & Enterprises High-Net-Worth Individuals (HNWI) Retail Investors Government & Public Sector |

| By Asset Class | Cryptocurrencies (Bitcoin, Ethereum, etc.) Security Tokens Stablecoins Tokenized Real-World Assets Central Bank Digital Currencies (CBDCs) NFTs |

| By Service Model | Full-Service Custody Self-Custody Solutions Hybrid Custody Models Wallet-as-a-Service |

| By Compliance Level | Regulated Custodians Unregulated Custodians |

| By Geographic Presence | Domestic Custodians International Custodians |

| By Pricing Model | Subscription-Based Transaction Fee-Based Tiered Pricing Asset-Based Fees Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Banking Sector Custody Services | 100 | Custody Service Managers, Compliance Officers |

| Institutional Investors in Digital Assets | 80 | Portfolio Managers, Investment Analysts |

| Regulatory Bodies and Compliance Experts | 50 | Regulatory Affairs Specialists, Legal Advisors |

| Technology Providers for Digital Custody Solutions | 60 | Product Managers, Technology Officers |

| Market Analysts and Researchers | 40 | Market Research Analysts, Financial Consultants |

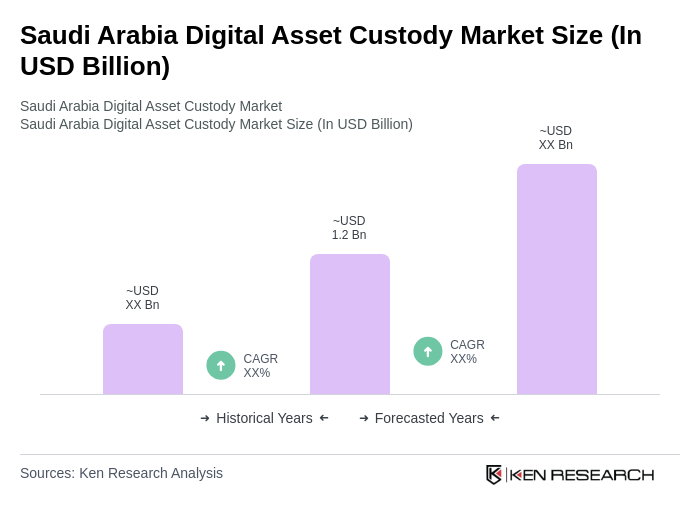

The Saudi Arabia Digital Asset Custody Market is valued at approximately USD 1.2 billion, driven by the increasing adoption of digital assets among institutional investors and the demand for secure storage solutions.