Region:Middle East

Author(s):Rebecca

Product Code:KRAD4371

Pages:87

Published On:December 2025

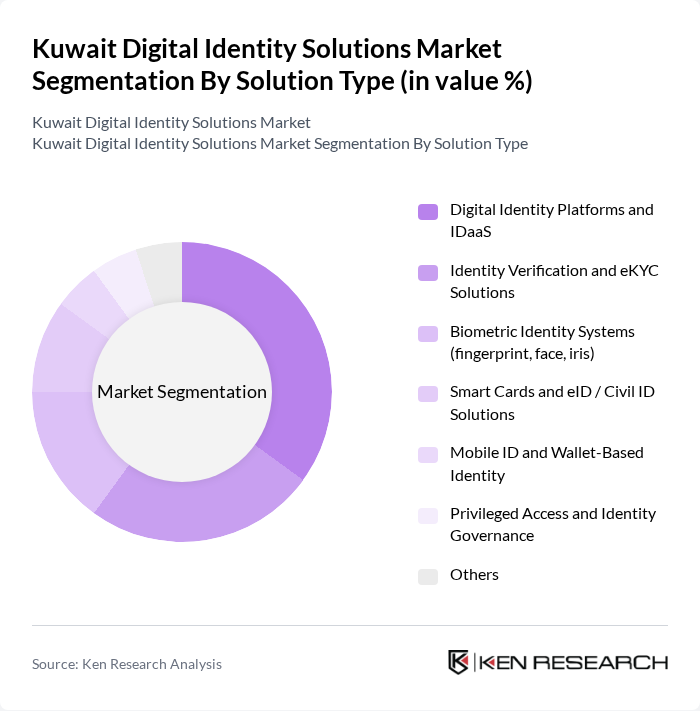

By Solution Type:The solution type segmentation includes various subsegments that cater to different aspects of digital identity management. The key subsegments are Digital Identity Platforms and IDaaS, Identity Verification and eKYC Solutions, Biometric Identity Systems, Smart Cards and eID/Civil ID Solutions, Mobile ID and Wallet-Based Identity, Privileged Access and Identity Governance, and Others. Public data for Kuwait does not provide precise percentage splits by solution type, so the following shares should be considered indicative estimates aligned with global and regional adoption patterns rather than statistically validated national figures. Digital Identity Platforms and IDaaS are widely recognized as a fast-growing segment globally due to scalability and flexibility, especially as organizations modernize identity and access management and move to the cloud, and in Kuwait this trend is reinforced by major government cloud and digital government partnerships under Vision 2035.

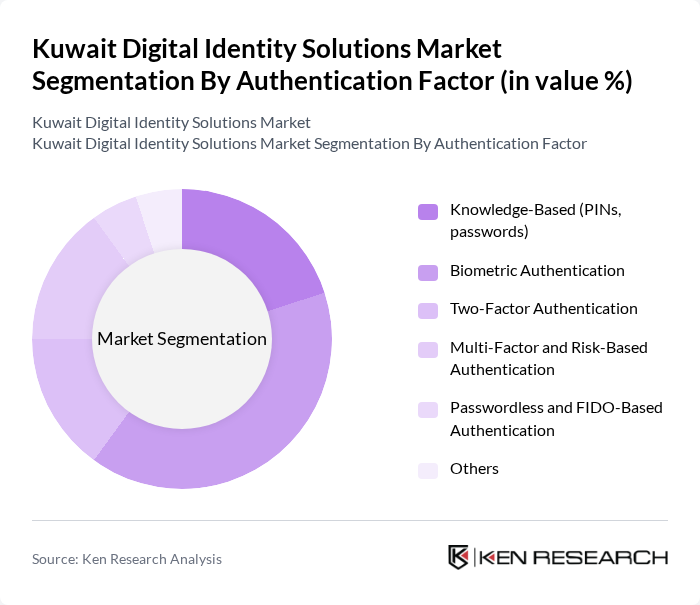

By Authentication Factor:This segmentation focuses on the various methods used to authenticate identities. The subsegments include Knowledge-Based (PINs, passwords), Biometric Authentication, Two-Factor Authentication, Multi-Factor and Risk-Based Authentication, Passwordless and FIDO-Based Authentication, and Others. Biometric Authentication is currently the leading subsegment, driven by advancements in technology and increasing consumer preference for secure and convenient authentication methods.

The Kuwait Digital Identity Solutions Market is characterized by a dynamic mix of regional and international players. Leading participants such as Public Authority for Civil Information (PACI) – Kuwait Mobile ID and Civil ID, Ministry of Interior, Kuwait – Biometric and Border Identity Systems, Ministry of Health, Kuwait – Digital Health Identity Initiatives, Zain Kuwait – Digital Identity and Biometric Authentication Services, Ooredoo Kuwait – Identity Management and Subscriber Verification, STC Kuwait – Digital Transformation and Identity Enablement, Kuwait Finance House – Digital Banking and eKYC Platforms, National Bank of Kuwait – Online Identity Verification and Customer Onboarding, Gulf Bank – Biometric and Remote Onboarding Solutions, Boubyan Bank – Mobile-First Digital Identity and eKYC, Kuwait Network Electronic Technology Company (KNET) – Digital Payments and Identity Enablement, Thales Group – eID Cards, Smart Cards, and Identity Management Solutions, HID Global – Government ID and Credential Management Solutions, Intercede – MyID Identity and Credential Management Platform, Local and Regional System Integrators (e.g., Kuwait-based ICT integrators supporting digital ID rollouts) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the digital identity solutions market in Kuwait appears promising, driven by technological advancements and increasing government support. As organizations prioritize cybersecurity and user privacy, the adoption of biometric authentication and decentralized identity solutions is expected to rise. Furthermore, the integration of artificial intelligence in identity verification processes will enhance security and efficiency, paving the way for innovative applications in various sectors, including finance and healthcare, thus fostering a more secure digital ecosystem.

| Segment | Sub-Segments |

|---|---|

| By Solution Type | Digital Identity Platforms and IDaaS Identity Verification and eKYC Solutions Biometric Identity Systems (fingerprint, face, iris) Smart Cards and eID / Civil ID Solutions Mobile ID and Wallet-Based Identity Privileged Access and Identity Governance Others |

| By Authentication Factor | Knowledge-Based (PINs, passwords) Biometric Authentication Two-Factor Authentication Multi-Factor and Risk-Based Authentication Passwordless and FIDO-Based Authentication Others |

| By Application | e-Government and National ID Services Banking, Payments, and eKYC Telecom Subscriber Onboarding and SIM Registration Healthcare Access and Patient Identity Online Commerce and Remote Onboarding Enterprise Workforce and Customer IAM Others |

| By Deployment Mode | Cloud-Based On-Premises Hybrid Others |

| By Organization Size | Large Enterprises Small and Medium Enterprises (SMEs) Government Ministries and Authorities Others |

| By End-User Sector | Government and Public Sector Banking, Financial Services, and Insurance (BFSI) Telecommunications Healthcare Retail and E-commerce Oil & Gas and Critical Infrastructure Others |

| By Security Assurance Level | Low Assurance Substantial / Medium Assurance High Assurance Qualified / Regulated Use Cases |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Government Digital Identity Initiatives | 60 | Government Officials, Policy Makers |

| Banking Sector Digital Solutions | 50 | IT Managers, Compliance Officers |

| Healthcare Digital Identity Systems | 40 | Healthcare Administrators, IT Directors |

| Private Sector Adoption of Digital Identity | 50 | Business Owners, IT Consultants |

| End-User Experience with Digital Identity | 40 | General Public, Technology Users |

The Kuwait Digital Identity Solutions Market is valued at approximately USD 120 million, driven by the increasing demand for secure digital transactions and the national digital transformation agenda under Kuwait Vision 2035.