Region:Middle East

Author(s):Dev

Product Code:KRAC2994

Pages:89

Published On:January 2026

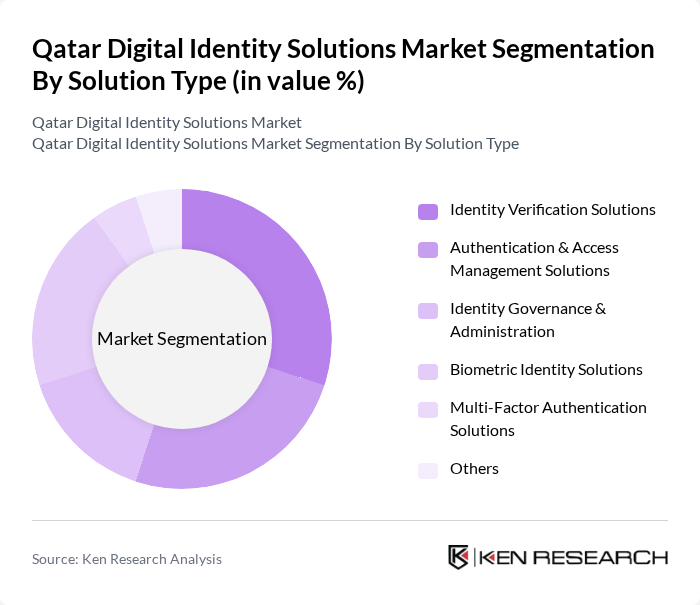

By Solution Type:

The Identity Verification Solutions segment is currently leading the market, in line with global and GCC trends where integrated verification and authentication platforms form the core of digital identity investments. This segment is driven by the increasing need for secure online transactions, stringent KYC and AML requirements in BFSI, and compliance with national data protection and cybersecurity frameworks. Businesses across various sectors, including banking, healthcare, telecom, and e?commerce, are adopting these solutions to enhance security, reduce fraud, and build customer trust through seamless digital onboarding. The growing trend of remote service delivery, mobile-first customer journeys, and AI?powered risk?based authentication further fuels the demand for identity verification technologies, making this segment a critical component of the digital identity landscape.

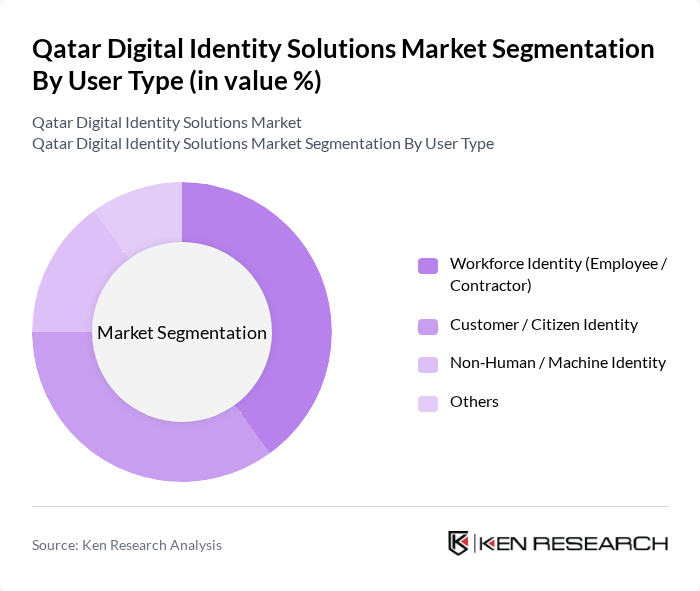

By User Type:

The Workforce Identity segment is the largest in the market, consistent with global patterns where large enterprises prioritize securing employee access to complex IT environments through identity and access management, single sign?on, and privileged access controls. The rise of hybrid and remote work models in Qatar’s public and private sectors, together with growing cloud adoption and digital workplace initiatives, has increased demand for robust workforce identity solutions. Additionally, the Customer / Citizen Identity segment is also significant, reflecting Qatar’s digital government strategy and the rapid expansion of online banking, telecom self?service, and e?commerce, all of which depend on strong citizen and customer identity, KYC, and consent management capabilities.

The Qatar Digital Identity Solutions Market is characterized by a dynamic mix of regional and international players. Leading participants such as Ministry of Communications and Information Technology (MCIT), Qatar, Ministry of Interior, Qatar, Qatar Central Bank, Qatar National Bank (QNB), Qatar Islamic Bank (QIB), Ooredoo Qatar, Vodafone Qatar, Gulf Business Machines (GBM Qatar), Microsoft Corporation, IBM Corporation, Oracle Corporation, Cisco Systems, Thales Group, HID Global, Other Emerging Local and Regional Digital Identity Providers contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Qatar digital identity solutions market appears promising, driven by technological advancements and increasing government support. As the nation continues to embrace digital transformation, the integration of AI and blockchain technologies is expected to enhance identity verification processes. Furthermore, the growing emphasis on user-centric identity management will likely lead to more personalized and secure solutions, fostering greater consumer trust and engagement. This evolving landscape presents significant opportunities for innovation and collaboration among stakeholders in the digital identity ecosystem.

| Segment | Sub-Segments |

|---|---|

| By Solution Type | Identity Verification Solutions Authentication & Access Management Solutions Identity Governance & Administration Biometric Identity Solutions Multi-Factor Authentication Solutions Others |

| By User Type | Workforce Identity (Employee / Contractor) Customer / Citizen Identity Non?Human / Machine Identity Others |

| By Deployment Model | Public Cloud Private Cloud Hybrid Cloud On-Premises |

| By Application | eGovernment & National ID Services eKYC & Remote Onboarding Access Control & Single Sign-On Fraud Prevention & Risk-Based Authentication Regulatory Compliance & Audit Others |

| By Industry Vertical | Banking, Financial Services & Insurance (BFSI) Government & Public Sector Healthcare Retail & eCommerce Telecommunications & IT Energy & Utilities Education Others |

| By Organization Size | Large Enterprises Small & Medium Enterprises (SMEs) |

| By Region (Within Qatar) | Doha Al Rayyan Al Wakrah Umm Salal & Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Government Digital Identity Initiatives | 100 | Policy Makers, IT Directors |

| Healthcare Sector Digital Identity Solutions | 80 | Healthcare Administrators, IT Managers |

| Financial Services Digital Identity Implementation | 90 | Compliance Officers, Risk Managers |

| Private Sector Adoption of Digital Identity | 70 | Business Development Managers, CTOs |

| Public Awareness and User Experience | 60 | End-users, Customer Experience Managers |

The Qatar Digital Identity Solutions Market is valued at approximately USD 1.1 billion, contributing to the broader GCC digital identity solutions market, which is valued at around USD 2.76 billion. This growth is driven by increasing demand for secure digital transactions and government initiatives.