Region:Middle East

Author(s):Shubham

Product Code:KRAD5460

Pages:91

Published On:December 2025

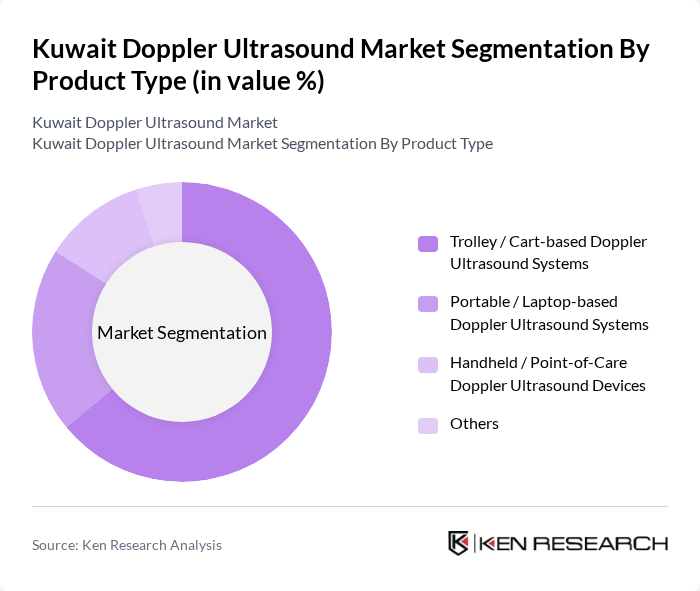

By Product Type:The product type segmentation includes Trolley / Cart-based Doppler Ultrasound Systems, Portable / Laptop-based Doppler Ultrasound Systems, Handheld / Point-of-Care Doppler Ultrasound Devices, and Others. Among these, Trolley / Cart-based systems dominate the market due to their advanced features and capabilities, making them suitable for hospitals and diagnostic centers. The increasing demand for portable and handheld devices is also notable, driven by the need for flexibility and ease of use in various clinical settings.

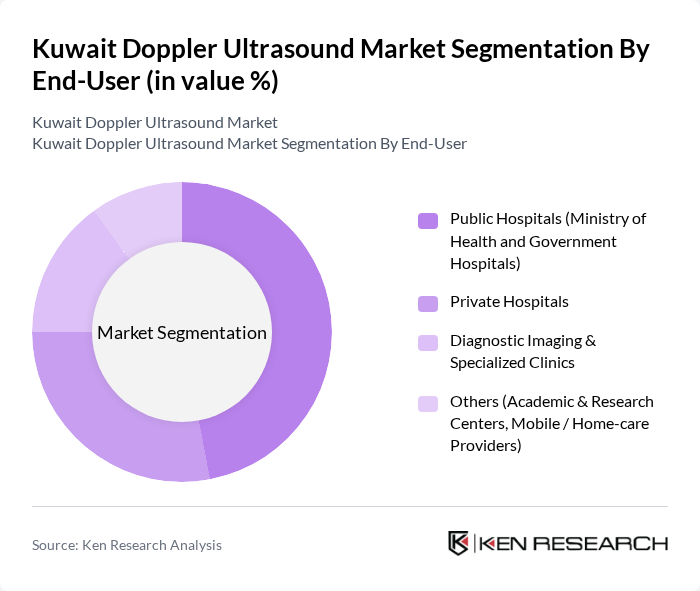

By End-User:The end-user segmentation includes Public Hospitals (Ministry of Health and Government Hospitals), Private Hospitals, Diagnostic Imaging & Specialized Clinics, and Others. Public hospitals are the leading segment, primarily due to government funding and initiatives to enhance healthcare services. Private hospitals also contribute significantly to the market, driven by the increasing number of patients seeking advanced diagnostic services. Specialized clinics are emerging as key players, focusing on specific medical fields that require Doppler ultrasound technology.

The Kuwait Doppler Ultrasound Market is characterized by a dynamic mix of regional and international players. Leading participants such as GE HealthCare, Philips Healthcare, Siemens Healthineers, Canon Medical Systems Corporation, Samsung Medison Co., Ltd., FUJIFILM Healthcare Corporation, Mindray Medical International Limited, Esaote S.p.A., Shenzhen SonoScape Medical Corp., Shenzhen Mindray Bio-Medical Electronics Co., Ltd., CHISON Medical Technologies Co., Ltd., Shenzhen SIUI (Shantou Institute of Ultrasonic Instruments Co., Ltd.), Clarius Mobile Health Corp., Al Essa Medical & Scientific Equipment Co. (Local Distributor, Kuwait), Bader Sultan & Brothers Co. W.L.L. (Medical Equipment Division, Kuwait) contribute to innovation, geographic expansion, and service delivery in this space.

The Kuwait Doppler ultrasound market is poised for significant growth, driven by increasing healthcare investments and technological advancements. By future, the government is expected to enhance healthcare infrastructure with an additional $600 million allocated for medical technology upgrades. This investment will likely facilitate the adoption of innovative ultrasound systems, improving diagnostic capabilities. Furthermore, the integration of telemedicine is anticipated to expand access to ultrasound services, particularly in underserved areas, fostering a more inclusive healthcare environment.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Trolley / Cart-based Doppler Ultrasound Systems Portable / Laptop-based Doppler Ultrasound Systems Handheld / Point-of-Care Doppler Ultrasound Devices Others |

| By End-User | Public Hospitals (Ministry of Health and Government Hospitals) Private Hospitals Diagnostic Imaging & Specialized Clinics Others (Academic & Research Centers, Mobile / Home-care Providers) |

| By Application | Cardiovascular & Vascular Imaging Obstetrics & Gynecology Radiology & General Abdominal Imaging Urology, Musculoskeletal & Other Applications |

| By Technology | D Doppler Ultrasound D / 4D Doppler Ultrasound Color & Power Doppler Ultrasound Others (Continuous-wave, Pulsed-wave, Duplex & Triplex Systems) |

| By Distribution Channel | Direct Sales by OEMs Local Authorized Distributors & Agents Tender-based Government Procurement Others (E-procurement Platforms, Regional Group Purchasing) |

| By Region | Capital Governorate (Kuwait City) Hawalli Governorate Al Ahmadi Governorate Farwaniya, Al Jahra & Mubarak Al-Kabeer Governorates |

| By Payer & Policy Support | Government-funded Facilities & Programs Private Insurance & Corporate-funded Healthcare Out-of-pocket & Self-pay Segment Grants, Donations & Public–Private Partnership (PPP) Initiatives |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Obstetric Doppler Ultrasound Usage | 100 | Obstetricians, Midwives |

| Cardiac Doppler Ultrasound Applications | 75 | Cardiologists, Cardiac Technologists |

| General Diagnostic Ultrasound Practices | 90 | Radiologists, General Practitioners |

| Healthcare Equipment Procurement | 70 | Procurement Officers, Hospital Administrators |

| Ultrasound Technology Adoption Trends | 85 | Healthcare IT Managers, Clinical Engineers |

The Kuwait Doppler Ultrasound Market is valued at approximately USD 7 million, reflecting a significant growth trend driven by the rising prevalence of cardiovascular diseases and advancements in ultrasound technology.