Region:Middle East

Author(s):Rebecca

Product Code:KRAD4974

Pages:90

Published On:December 2025

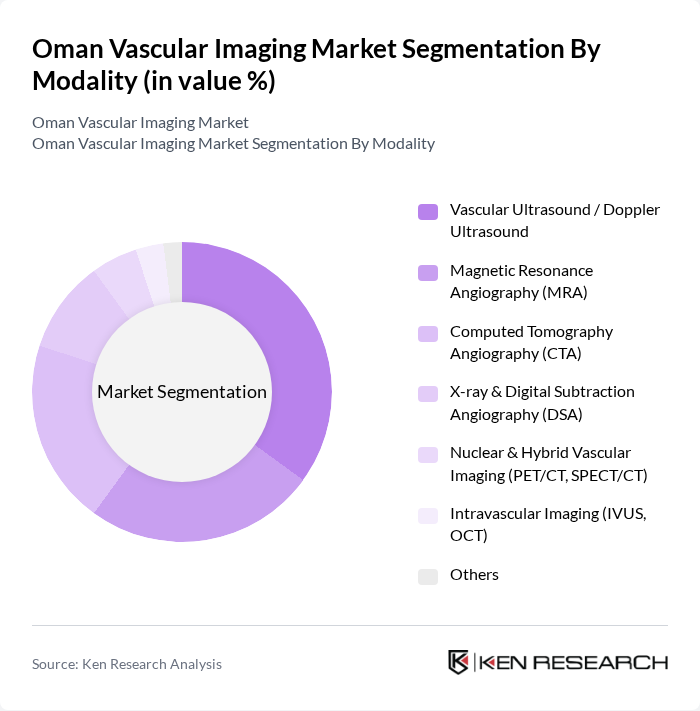

By Modality:The vascular imaging market can be segmented into various modalities, including Vascular Ultrasound / Doppler Ultrasound, Magnetic Resonance Angiography (MRA), Computed Tomography Angiography (CTA), X-ray & Digital Subtraction Angiography (DSA), Nuclear & Hybrid Vascular Imaging (PET/CT, SPECT/CT), Intravascular Imaging (IVUS, OCT), and Others. Vascular Ultrasound is the leading modality in Oman, supported by its non-invasive nature, lower cost, portability, absence of ionizing radiation, and widespread availability in Ministry of Health hospitals, university hospitals, and private clinics for peripheral arterial disease, venous thrombosis, and carotid assessments.

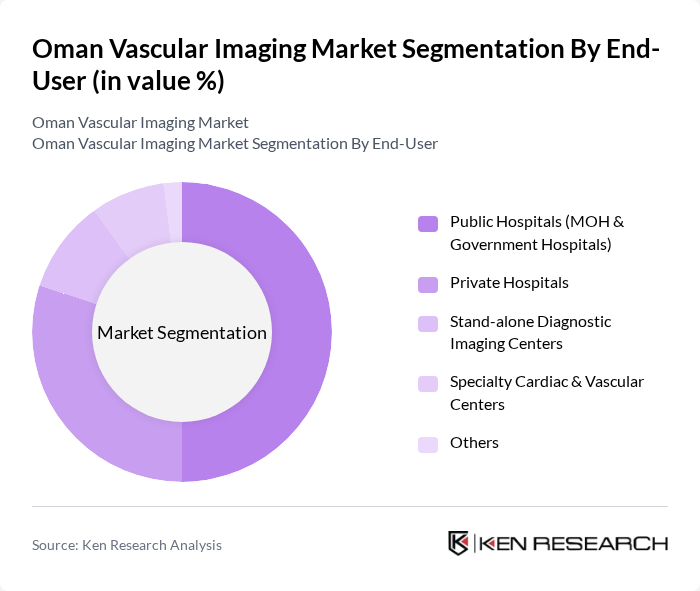

By End-User:The end-user segmentation includes Public Hospitals (MOH & Government Hospitals), Private Hospitals, Stand-alone Diagnostic Imaging Centers, Specialty Cardiac & Vascular Centers, and Others. Public hospitals dominate the market due to their extensive patient base, government-funded procurement of CT, MRI, angiography, and ultrasound systems, and their role as primary centers for cardiovascular and stroke care in Oman.

The Oman Vascular Imaging Market is characterized by a dynamic mix of regional and international players. Leading participants such as Siemens Healthineers, GE HealthCare Technologies Inc., Philips (Royal Philips, Philips Healthcare), Canon Medical Systems Corporation, Hitachi, Ltd. (Hitachi Healthcare / Fujifilm Healthcare after integration), Fujifilm Holdings Corporation, Mindray Medical International Limited, Samsung Medison Co., Ltd., Agfa?Gevaert Group, Carestream Health, Inc., Esaote S.p.A., Shimadzu Corporation, Hologic, Inc., Boston Scientific Corporation, Medtronic plc, Abbott Laboratories, Local & Regional Distributors in Oman (e.g., Al Farsi Medical Supplies, Muscat Pharmacy & Stores LLC) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Oman vascular imaging market appears promising, driven by technological advancements and increased healthcare investments. The integration of artificial intelligence in imaging analysis is expected to enhance diagnostic accuracy and efficiency. Additionally, the growing emphasis on preventive healthcare measures will likely lead to increased demand for non-invasive imaging techniques. As the government continues to prioritize healthcare infrastructure, the market is poised for significant growth, addressing both current challenges and emerging opportunities in the sector.

| Segment | Sub-Segments |

|---|---|

| By Modality | Vascular Ultrasound / Doppler Ultrasound Magnetic Resonance Angiography (MRA) Computed Tomography Angiography (CTA) X-ray & Digital Subtraction Angiography (DSA) Nuclear & Hybrid Vascular Imaging (PET/CT, SPECT/CT) Intravascular Imaging (IVUS, OCT) Others |

| By End-User | Public Hospitals (MOH & Government Hospitals) Private Hospitals Stand?alone Diagnostic Imaging Centers Specialty Cardiac & Vascular Centers Others |

| By Clinical Application | Peripheral Arterial Disease (PAD) & Venous Thromboembolism Coronary Artery & Structural Heart Disease Cerebrovascular Disease (Stroke, Carotid Artery Disease) Aortic & Other Aneurysmal Disorders Dialysis Access & Other Vascular Access Imaging Oncology?related Vascular Imaging Others |

| By Technology | D Imaging D / 4D Imaging Contrast?Enhanced Vascular Imaging AI?enhanced & Advanced Post?processing Others |

| By Patient Demographics | Pediatric Patients Adult Patients Geriatric Patients Others |

| By Distribution / Procurement Channel | Direct OEM Sales to Hospitals Sales via Local Distributors / Dealers Group Purchasing & Central Tenders (MOH, Public Sector) Other Indirect / Online Channels |

| By Region | Muscat Salalah Sohar Nizwa Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hospital Vascular Imaging Departments | 120 | Radiologists, Department Heads |

| Private Imaging Centers | 90 | Center Managers, Technologists |

| Healthcare Policy Makers | 60 | Health Ministry Officials, Policy Analysts |

| Medical Equipment Suppliers | 80 | Sales Managers, Product Specialists |

| Patient Advocacy Groups | 50 | Advocacy Leaders, Healthcare Educators |

The Oman Vascular Imaging Market is valued at approximately USD 20 million, reflecting a five-year historical analysis. This growth is attributed to the rising prevalence of cardiovascular diseases and advancements in imaging technologies.