Region:Middle East

Author(s):Dev

Product Code:KRAC3463

Pages:100

Published On:October 2025

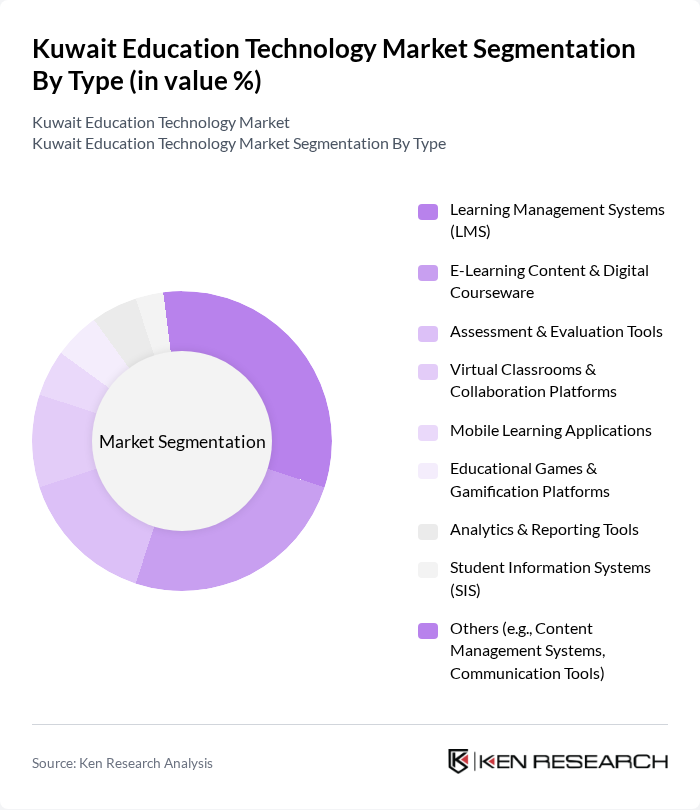

By Type:The Kuwait Education Technology Market can be segmented into various types, including Learning Management Systems (LMS), E-Learning Content & Digital Courseware, Assessment & Evaluation Tools, Virtual Classrooms & Collaboration Platforms, Mobile Learning Applications, Educational Games & Gamification Platforms, Analytics & Reporting Tools, Student Information Systems (SIS), and Others (e.g., Content Management Systems, Communication Tools). Each of these subsegments plays a crucial role in enhancing the educational experience and improving learning outcomes. LMS and digital courseware are the largest segments, reflecting the strong demand for centralized content delivery and interactive learning environments .

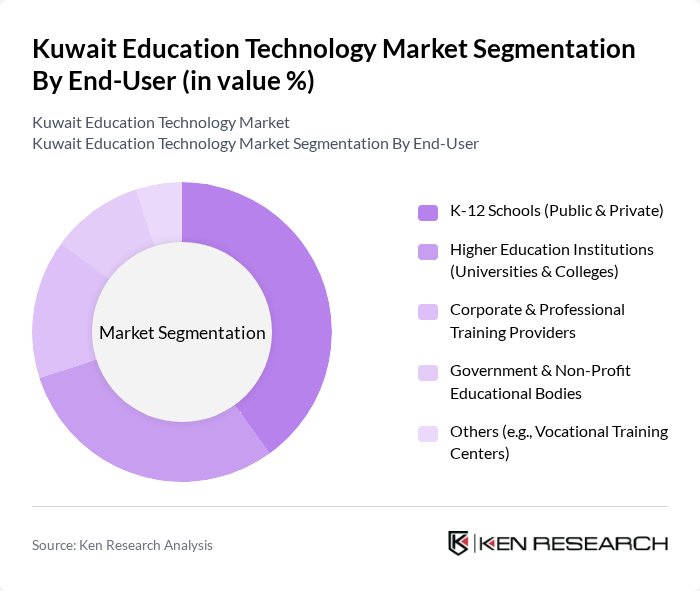

By End-User:The market can also be segmented by end-users, which include K-12 Schools (Public & Private), Higher Education Institutions (Universities & Colleges), Corporate & Professional Training Providers, Government & Non-Profit Educational Bodies, and Others (e.g., Vocational Training Centers). Each end-user category has unique needs and preferences, driving the demand for tailored educational technology solutions. K-12 and higher education institutions are the primary adopters, reflecting strong government investment and private sector participation in digital transformation .

The Kuwait Education Technology Market is characterized by a dynamic mix of regional and international players. Leading participants such as Nucamp, LearnQ8, EduTech Kuwait, Smart Learning Solutions, Gulf University for Science and Technology, Kuwait University, American University of Kuwait, American University of the Middle East, Kuwait Technical College, Arab Open University, Blackboard Inc., Instructure, Inc. (Canvas), Pearson Education, Microsoft Education, Google for Education contribute to innovation, geographic expansion, and service delivery in this space .

The future of the Kuwait education technology market appears promising, driven by ongoing government support and increasing digital literacy among students. As educational institutions continue to embrace innovative teaching methods, the integration of advanced technologies such as artificial intelligence and virtual reality is expected to enhance learning experiences. Additionally, the growing emphasis on STEM education will likely lead to the development of specialized programs and resources, further transforming the educational landscape in Kuwait.

| Segment | Sub-Segments |

|---|---|

| By Type | Learning Management Systems (LMS) E-Learning Content & Digital Courseware Assessment & Evaluation Tools Virtual Classrooms & Collaboration Platforms Mobile Learning Applications Educational Games & Gamification Platforms Analytics & Reporting Tools Student Information Systems (SIS) Others (e.g., Content Management Systems, Communication Tools) |

| By End-User | K-12 Schools (Public & Private) Higher Education Institutions (Universities & Colleges) Corporate & Professional Training Providers Government & Non-Profit Educational Bodies Others (e.g., Vocational Training Centers) |

| By Application | Classroom Learning Enhancement Remote & Distance Learning Blended & Hybrid Learning Teacher Professional Development Administrative Automation Others |

| By Distribution Channel | Direct Institutional Sales Online Marketplaces & Platforms Value-Added Resellers & System Integrators Educational Partnerships & Alliances Others |

| By Pricing Model | Subscription-Based (SaaS) One-Time License Purchase Freemium & Tiered Access Pay-Per-Use / Transactional Others |

| By Content Type | Text-Based Content Video & Multimedia Content Interactive & Adaptive Content Assessment & Test Prep Content Others |

| By User Demographics | Age Group (Children, Teenagers, Adults) Educational Background (Primary, Secondary, Tertiary) Learning Preferences (Visual, Auditory, Kinesthetic) Language of Instruction (Arabic, English, Bilingual) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| K-12 Education Technology Adoption | 100 | School Principals, IT Coordinators |

| Higher Education Digital Learning Tools | 80 | University Deans, Faculty Members |

| Vocational Training Technology Integration | 60 | Training Program Directors, Instructors |

| EdTech Startups and Innovations | 50 | Founders, Product Managers |

| Parental Perspectives on EdTech | 40 | Parents of K-12 Students, Education Advocates |

The Kuwait Education Technology Market is valued at approximately USD 150 million, reflecting the growth of digital learning and analytics solutions driven by government initiatives and the increasing adoption of cloud-based platforms and digital courseware.