Region:Middle East

Author(s):Rebecca

Product Code:KRAA9342

Pages:81

Published On:November 2025

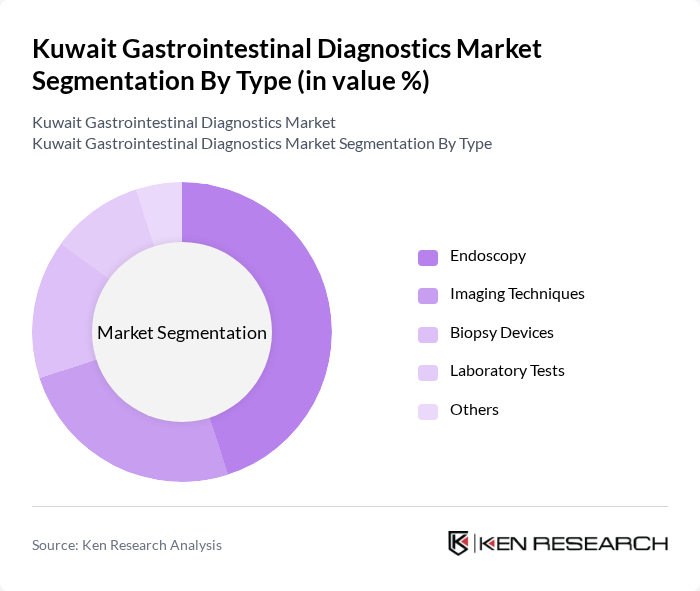

By Type:The market is segmented into various types, including Endoscopy, Imaging Techniques, Biopsy Devices, Laboratory Tests, and Others. Each of these sub-segments plays a crucial role in the overall diagnostics landscape, with specific applications and technologies catering to different diagnostic needs. Endoscopy is currently the leading sub-segment due to its effectiveness in visualizing the gastrointestinal tract and diagnosing conditions such as ulcers and cancers. The increasing demand for minimally invasive procedures is driving the growth of this segment.

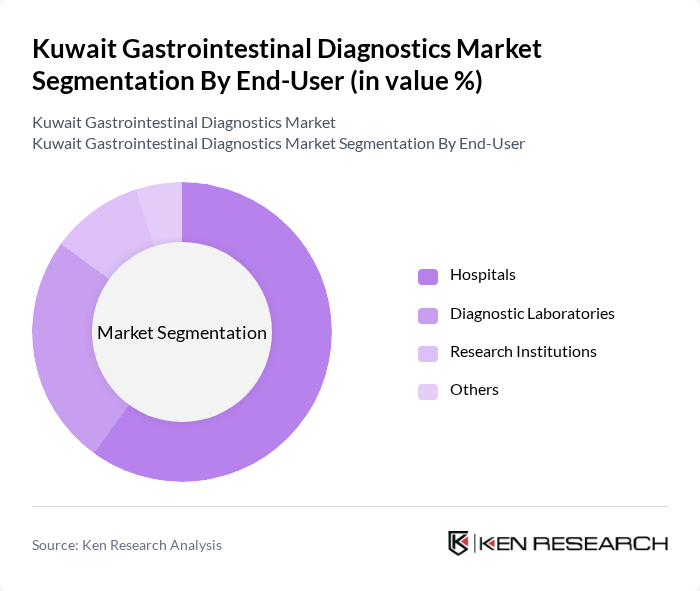

By End-User:The end-user segmentation includes Hospitals, Diagnostic Laboratories, Research Institutions, and Others. Hospitals are the primary end-users of gastrointestinal diagnostic tools, as they provide comprehensive healthcare services and have the necessary infrastructure to support advanced diagnostic procedures. The increasing number of hospitals and their focus on improving patient care are driving the demand for diagnostic services in this segment.

The Kuwait Gastrointestinal Diagnostics Market is characterized by a dynamic mix of regional and international players. Leading participants such as Al-Dar Medical Services, Kuwait Medical Center, Gulf Diagnostics, Al-Salam International Hospital, Kuwait Gastroenterology Center, MedLabs, Al-Mowasat Hospital, American Hospital Kuwait, Al-Bahar Medical Group, Kuwait University Health Center, Al-Razi Hospital, Dar Al Shifa Hospital, Al-Jahra Hospital, Ibn Sina Hospital, Kuwait Health Assurance Company, Abbott Laboratories, Siemens Healthineers, Roche Diagnostics, QIAGEN, Beckman Coulter, DiaSorin, Hologic, Meridian Bioscience, bioMérieux contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Kuwait gastrointestinal diagnostics market appears promising, driven by technological innovations and a growing emphasis on preventive healthcare. As telemedicine services expand, patients will have greater access to diagnostic consultations, particularly in underserved areas. Furthermore, the integration of artificial intelligence in diagnostic processes is expected to enhance accuracy and efficiency, leading to improved patient outcomes. These trends indicate a shift towards more accessible and effective gastrointestinal healthcare solutions in Kuwait.

| Segment | Sub-Segments |

|---|---|

| By Type | Endoscopy Imaging Techniques Biopsy Devices Laboratory Tests Others |

| By End-User | Hospitals Diagnostic Laboratories Research Institutions Others |

| By Region | Capital Governorate Hawalli Governorate Al Ahmadi Governorate Others |

| By Technology | Molecular Diagnostics Immunoassays PCR Technology Others |

| By Application | Cancer Screening Infectious Disease Diagnosis Chronic Disease Management Others |

| By Investment Source | Private Investments Government Funding International Aid Others |

| By Policy Support | Health Insurance Policies Subsidies for Diagnostic Equipment Tax Incentives for Healthcare Providers Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Gastroenterology Clinics | 60 | Gastroenterologists, Clinic Managers |

| Hospitals with GI Departments | 50 | Hospital Administrators, Department Heads |

| Diagnostic Laboratories | 40 | Lab Managers, Technicians |

| Patient Advocacy Groups | 40 | Patient Representatives, Health Educators |

| Healthcare Policy Makers | 40 | Health Policy Analysts, Government Officials |

The Kuwait Gastrointestinal Diagnostics Market is valued at approximately USD 32 million, reflecting a five-year historical analysis. This growth is attributed to the rising prevalence of gastrointestinal diseases and advancements in diagnostic technologies.