Region:Asia

Author(s):Geetanshi

Product Code:KRAA4265

Pages:99

Published On:January 2026

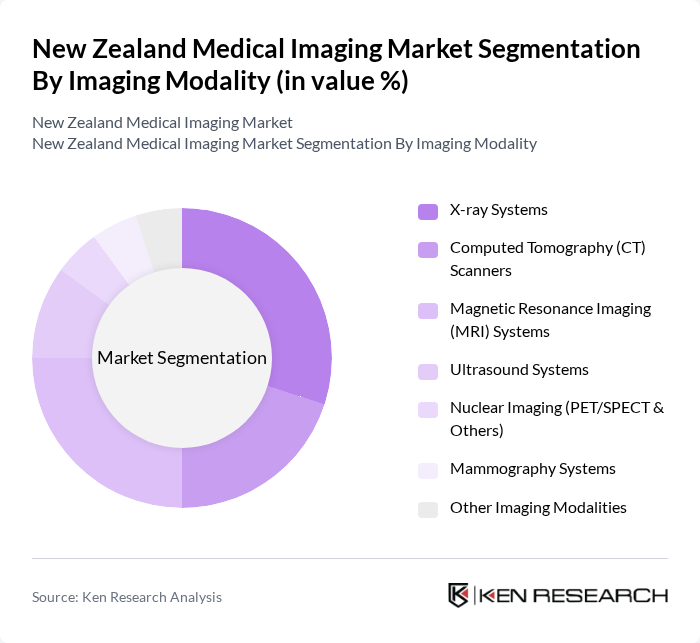

By Imaging Modality:The imaging modality segment includes various technologies used for diagnostic imaging. The subsegments are X-ray Systems, Computed Tomography (CT) Scanners, Magnetic Resonance Imaging (MRI) Systems, Ultrasound Systems, Nuclear Imaging (PET/SPECT & Others), Mammography Systems, and Other Imaging Modalities. Among these, X-ray Systems remain the most frequently utilized modality because of their cost?effectiveness, high examination volumes and use in emergency and primary care settings, while MRI Systems and CT Scanners are particularly prominent for advanced cross?sectional imaging in oncology, neurology, cardiology and musculoskeletal indications in hospitals and specialist clinics.

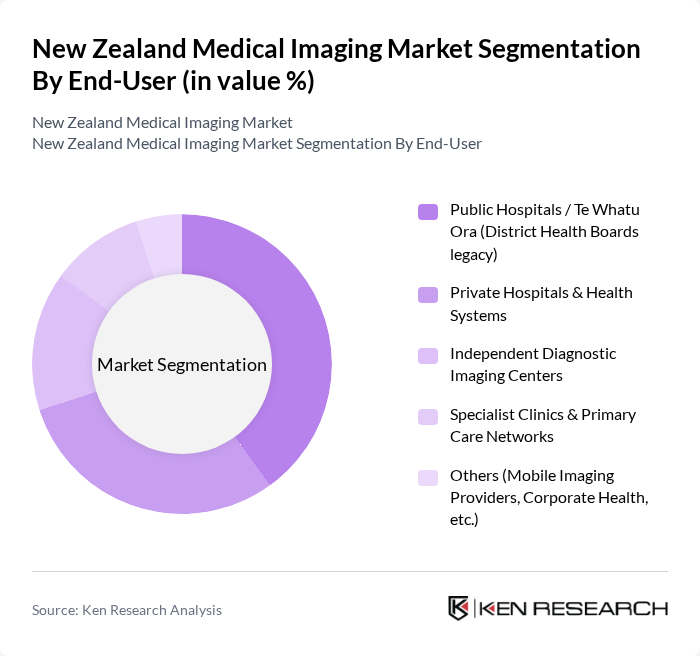

By End-User:The end-user segment encompasses various healthcare facilities that utilize medical imaging services. This includes Public Hospitals / Te Whatu Ora, Private Hospitals & Health Systems, Independent Diagnostic Imaging Centers, Specialist Clinics & Primary Care Networks, and Others (Mobile Imaging Providers, Corporate Health, etc.). Public Hospitals are the largest end-users due to their extensive patient base, role as tertiary and regional referral centres, and responsibility for providing comprehensive imaging services including emergency imaging, inpatient diagnostics, screening programmes and complex modalities such as interventional radiology and nuclear medicine.

The New Zealand Medical Imaging Market is characterized by a dynamic mix of regional and international players. Leading participants such as Fisher & Paykel Healthcare, GE HealthCare, Siemens Healthineers, Philips Healthcare, Canon Medical Systems, FUJIFILM Healthcare, Agfa HealthCare, Hitachi Medical Systems, Carestream Health, Mindray Medical International, Hologic, Inc., Bracco Imaging, EIZO Corporation, Pacific Radiology Group, Auckland Radiology Group contribute to innovation, geographic expansion, and service delivery in this space.

The future of the New Zealand medical imaging market appears promising, driven by ongoing technological advancements and increased government investment in healthcare infrastructure. As telemedicine continues to expand, the integration of remote diagnostics will enhance access to imaging services, particularly in rural areas. Furthermore, the growing emphasis on personalized medicine will likely lead to the development of tailored imaging solutions, improving patient outcomes and driving market growth in the future.

| Segment | Sub-Segments |

|---|---|

| By Imaging Modality | X-ray Systems Computed Tomography (CT) Scanners Magnetic Resonance Imaging (MRI) Systems Ultrasound Systems Nuclear Imaging (PET/SPECT & Others) Mammography Systems Other Imaging Modalities |

| By End-User | Public Hospitals / Te Whatu Ora (District Health Boards legacy) Private Hospitals & Health Systems Independent Diagnostic Imaging Centers Specialist Clinics & Primary Care Networks Others (Mobile Imaging Providers, Corporate Health, etc.) |

| By Region | North Island South Island Rural & Remote Communities |

| By Technology | Digital Imaging Systems Analog / Conventional Imaging Systems Hybrid Imaging Systems Portable & Point-of-Care Imaging Devices |

| By Clinical Application | Oncology Cardiology Neurology Musculoskeletal & Orthopedics Obstetrics & Gynecology Others |

| By Funding / Payer Type | Public Funding (Te Whatu Ora / ACC) Private Health Insurers Out-of-Pocket / Self-pay Others |

| By Service Delivery Model | In-hospital Imaging Services Independent Community Imaging Services Teleradiology & Remote Reporting Mobile Imaging Services |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hospital Imaging Departments | 120 | Radiologists, Imaging Directors |

| Private Imaging Clinics | 90 | Clinic Owners, Technologists |

| Medical Equipment Suppliers | 60 | Sales Managers, Product Specialists |

| Healthcare Policy Makers | 50 | Health Administrators, Policy Analysts |

| Research Institutions | 40 | Medical Researchers, Academic Professors |

The New Zealand Medical Imaging Market is valued at approximately USD 1.1 billion, driven by advancements in digital and AI-enabled imaging technologies, an increasing prevalence of chronic diseases, and a growing aging population requiring more diagnostic imaging services.