Region:Middle East

Author(s):Shubham

Product Code:KRAB7583

Pages:99

Published On:October 2025

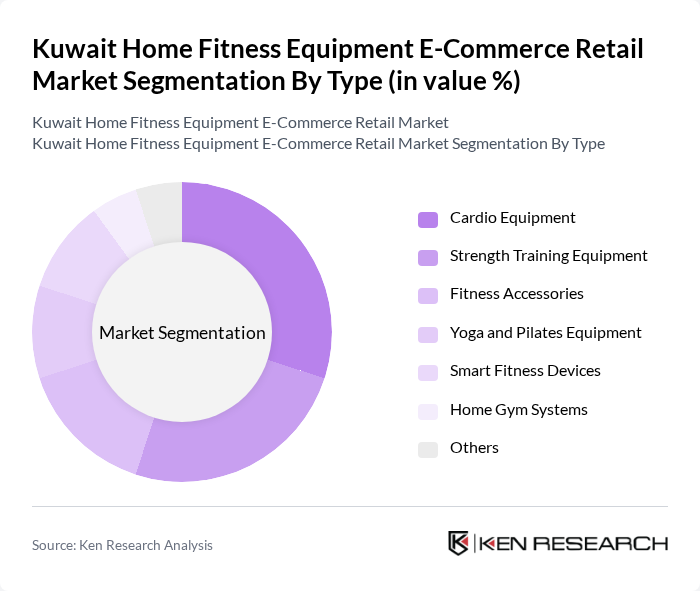

By Type:This segmentation includes various categories of fitness equipment that cater to different workout needs and preferences.

The Cardio Equipment segment is currently dominating the market, driven by a growing trend towards cardiovascular fitness and the popularity of home-based cardio workouts. Products such as treadmills, stationary bikes, and elliptical machines are highly sought after due to their effectiveness in promoting heart health and weight management. The increasing availability of these products through e-commerce platforms has further fueled their demand, making them a preferred choice for consumers looking to enhance their fitness routines at home.

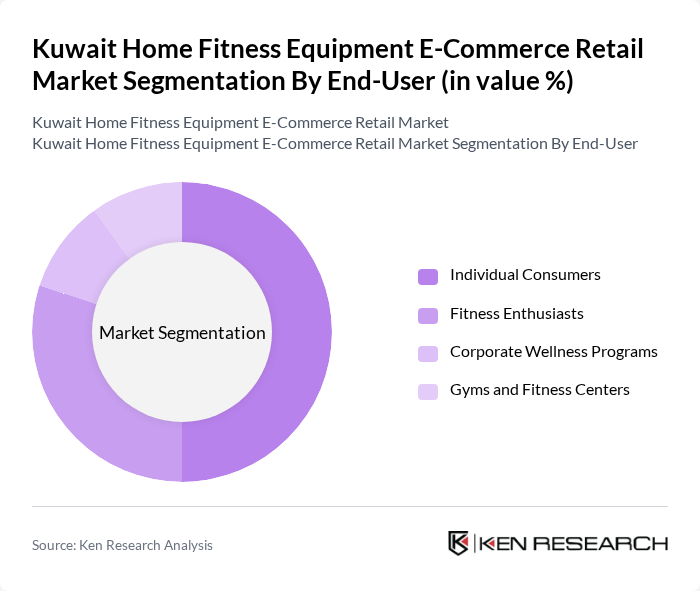

By End-User:This segmentation focuses on the different consumer groups that utilize home fitness equipment.

The Individual Consumers segment is the largest in the market, reflecting the growing trend of home workouts among the general population. With more people opting for convenience and flexibility in their fitness routines, individual consumers are increasingly investing in home fitness equipment. This shift is further supported by the rise of online shopping, which allows consumers to easily access a variety of fitness products tailored to their personal needs.

The Kuwait Home Fitness Equipment E-Commerce Retail Market is characterized by a dynamic mix of regional and international players. Leading participants such as Fitness First, Decathlon, Sports Direct, Life Fitness, Technogym, ProForm, NordicTrack, Bowflex, Reebok, Gold's Gym, Body-Solid, Horizon Fitness, Sole Fitness, Marcy, PowerBlock contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Kuwait home fitness equipment e-commerce market appears promising, driven by ongoing health trends and technological advancements. As consumers increasingly prioritize fitness, the demand for innovative and smart fitness solutions is expected to rise. Additionally, the integration of augmented reality in online shopping experiences may enhance consumer engagement, leading to higher conversion rates. Retailers that adapt to these trends will likely capture a larger share of the growing market.

| Segment | Sub-Segments |

|---|---|

| By Type | Cardio Equipment Strength Training Equipment Fitness Accessories Yoga and Pilates Equipment Smart Fitness Devices Home Gym Systems Others |

| By End-User | Individual Consumers Fitness Enthusiasts Corporate Wellness Programs Gyms and Fitness Centers |

| By Sales Channel | Online Retailers Brand Websites Third-Party E-Commerce Platforms Social Media Marketplaces |

| By Price Range | Budget Equipment Mid-Range Equipment Premium Equipment |

| By Brand Popularity | Established Brands Emerging Brands Private Labels |

| By Customer Demographics | Age Groups Gender Income Levels |

| By Product Features | Smart Technology Integration Portability Multi-functionality Warranty and Support |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Home Fitness Equipment Purchasers | 150 | Fitness Enthusiasts, Online Shoppers |

| Retailers of Fitness Equipment | 100 | Store Managers, E-commerce Directors |

| Fitness Equipment Manufacturers | 80 | Product Development Managers, Sales Executives |

| Health and Fitness Influencers | 60 | Social Media Influencers, Fitness Coaches |

| Logistics Providers for Fitness Equipment | 70 | Logistics Managers, Supply Chain Analysts |

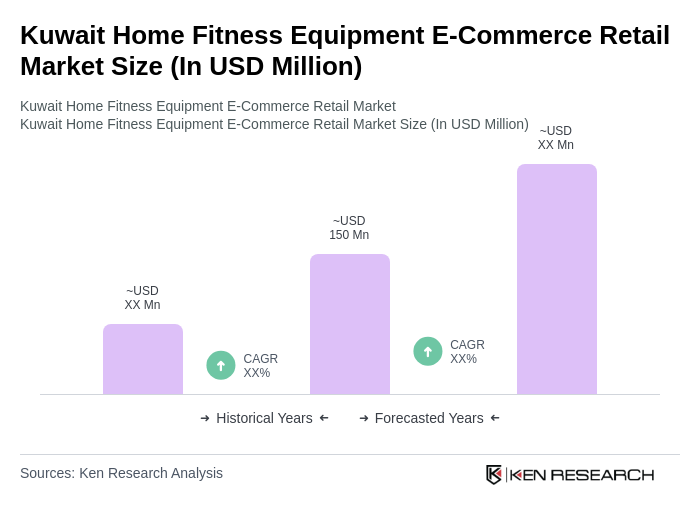

The Kuwait Home Fitness Equipment E-Commerce Retail Market is valued at approximately USD 150 million, reflecting a significant growth trend driven by increased health consciousness and the convenience of home workouts.