Region:Asia

Author(s):Rebecca

Product Code:KRAD5060

Pages:97

Published On:December 2025

By Product Type:The product type segmentation includes various categories of sports nutrition products that cater to different consumer needs. The market is primarily driven by the demand for protein powders and ready-to-drink (RTD) protein drinks, which are favored for their convenience and effectiveness in muscle recovery, satiety, and lean mass support among gym-goers and active consumers. Sports drinks and electrolyte beverages also hold a significant share, appealing to athletes and fitness enthusiasts looking to replenish fluids and minerals during workouts and outdoor activities in a humid climate. Energy and protein bars, along with pre-workout and intra-workout supplements, are gaining traction as consumers seek quick, portable, and targeted energy sources that fit busy urban lifestyles. Recovery and post-workout supplements, including amino acid blends and protein-based formulations, are increasingly used to support muscle repair, while meal replacement shakes cater to those looking for convenient, calorie-controlled nutrition options, particularly among weight?management users. Other sports supplements, such as BCAAs, creatine, and performance-oriented formulas, are also popular among serious athletes and bodybuilders. Overall, the protein powders and RTD protein drinks segment leads the market due to their widespread acceptance, alignment with high-protein dietary trends, and broad distribution through modern trade and e?commerce.

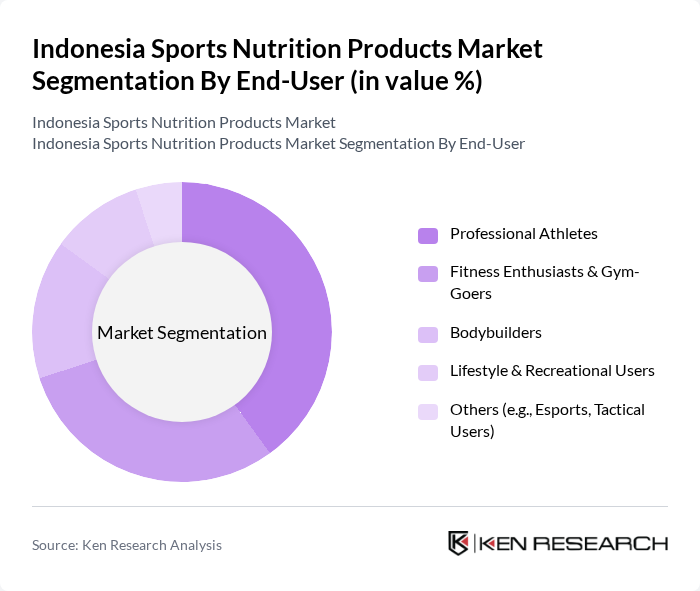

By End-User:The end-user segmentation highlights the diverse consumer base for sports nutrition products. Professional athletes represent a significant portion of the performance-focused market, as they require specialized nutrition to enhance endurance, strength, and recovery, often guided by coaches and sports nutritionists. Fitness enthusiasts and gym-goers are also a major segment, driven by the increasing popularity of fitness culture, membership growth in commercial gyms, and the desire for improved physique and functional performance. Bodybuilders, who focus on muscle gain, definition, and recovery, form a niche but dedicated market segment, with higher per-capita consumption of protein powders, amino acids, and creatine-based products. Lifestyle and recreational users are emerging as a rapidly growing demographic, using protein-enriched drinks, bars, and active-nutrition products to support general wellness, weight management, and daily energy needs beyond organized sport. Additionally, others, including esports and tactical users, are beginning to explore sports nutrition products such as energy drinks, focus-enhancing formulations, and sustained-energy snacks to enhance cognitive and physical performance. The fitness enthusiasts and gym-goers segment is increasingly prominent in volume terms, while professional athletes remain a high-value segment due to their demand for premium, scientifically supported nutrition solutions.

The Indonesia Sports Nutrition Products Market is characterized by a dynamic mix of regional and international players. Leading participants such as PT Nutrifood Indonesia (L-Men, WRP Active), PT Kalbe Farma Tbk (Kalbe Nutritionals, Hydro Coco, Fatigon), PT Indofood CBP Sukses Makmur Tbk (Indomilk, etc.), PT Cisarua Mountain Dairy Tbk (Cimory Protein Products), PT Sanghiang Perkasa (KALBE Nutritionals – Entrasol, etc.), PT Nutra Prima Sejahtera (local sports supplements), PT Anugerah Pharmindo Lestari (import & distribution of nutrition brands), PT Guardian Pharmatama / Guardian Indonesia (retail channel for sports nutrition), PT Gojek Tokopedia Tbk (Tokopedia – key online marketplace channel), PT Shopee International Indonesia (Shopee – key online marketplace channel), PT Lazada Indonesia (Lazada – key online marketplace channel), PT Watsons Personal Care Indonesia (Watsons – specialty retail), PT Sumber Alfaria Trijaya Tbk (Alfamart – convenience & mass channel), PT Indomarco Prismatama (Indomaret – convenience & mass channel), and key imported brands present in Indonesia (e.g., Optimum Nutrition, MyProtein, MuscleTech, BSN) contribute to innovation, geographic expansion, and service delivery in this space by focusing on high-protein formulations, clean-label positioning, and omnichannel distribution strategies.

The future of the sports nutrition market in Indonesia appears promising, driven by evolving consumer preferences and technological advancements. As health consciousness continues to rise, brands are likely to innovate with new product formulations that cater to specific dietary needs. Additionally, the integration of technology in fitness and nutrition, such as mobile apps for personalized nutrition plans, will enhance consumer engagement and drive sales, creating a dynamic market environment.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Protein Powders & RTD Protein Drinks Sports Drinks & Electrolyte Beverages Energy & Protein Bars Pre-Workout & Intra-Workout Supplements Recovery & Post-Workout Supplements Meal Replacement Shakes Other Sports Supplements (e.g., BCAAs, Creatine) |

| By End-User | Professional Athletes Fitness Enthusiasts & Gym-Goers Bodybuilders Lifestyle & Recreational Users Others (e.g., Esports, Tactical Users) |

| By Distribution Channel | Supermarkets/Hypermarkets Specialty Nutrition & Supplement Stores Pharmacies & Drugstores Gyms, Fitness Centers & Sports Clubs Online Stores & Marketplaces Convenience Stores & Others |

| By Packaging Type | Tubs & Canisters Bottles Pouches & Bags Sachets & Single-Serve Packs Others |

| By Ingredient Source | Animal-Based (e.g., Whey, Casein) Plant-Based (e.g., Soy, Pea, Rice) Mixed/Blended Sources Others (e.g., Synthetic, Novel Ingredients) |

| By Price Range | Mass/Budget Mid-Range Premium/Imported Super-Premium |

| By Region | Java (including Greater Jakarta) Sumatra Bali & Nusa Tenggara Kalimantan Sulawesi & Eastern Indonesia Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Sales of Sports Nutrition Products | 150 | Store Managers, Sales Representatives |

| Consumer Preferences in Sports Nutrition | 140 | Athletes, Fitness Enthusiasts |

| Health and Fitness Professionals Insights | 100 | Nutritionists, Personal Trainers |

| Market Trends in Online Sales | 120 | E-commerce Managers, Digital Marketers |

| Product Development Feedback | 80 | Product Managers, R&D Specialists |

The Indonesia Sports Nutrition Products Market is valued at approximately USD 1.3 billion, reflecting significant growth driven by increasing health consciousness, fitness activities, and the popularity of sports among the youth in urban areas.