Region:Middle East

Author(s):Rebecca

Product Code:KRAD4324

Pages:85

Published On:December 2025

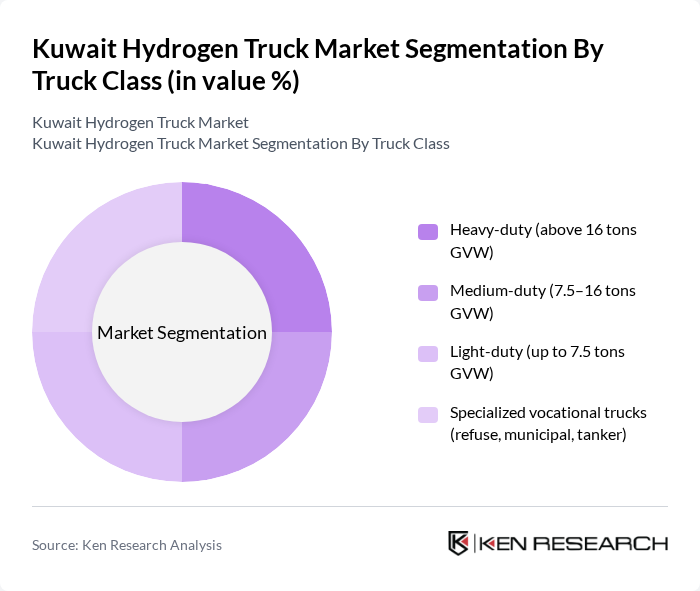

By Truck Class:The truck class segmentation includes various categories based on the weight and purpose of the trucks. The subsegments are Heavy-duty (above 16 tons GVW), Medium-duty (7.5–16 tons GVW), Light-duty (up to 7.5 tons GVW), and Specialized vocational trucks (refuse, municipal, tanker). Heavy-duty trucks dominate the market due to their extensive use in logistics and freight transport, which is essential for the economy, and this pattern is consistent with Kuwait’s overall heavy-duty truck market where long-haul, construction, and industrial logistics make up the majority of ton?kilometers moved. Globally, hydrogen truck adoption is strongest first in heavy-duty segments because of their high daily mileage, large fuel consumption, and the operational value of quick refueling and longer range versus battery?electric solutions, so projecting heavy?duty hydrogen trucks as the leading class in Kuwait follows the general global trend even though specific Kuwait class?wise hydrogen shares are not available from public data.

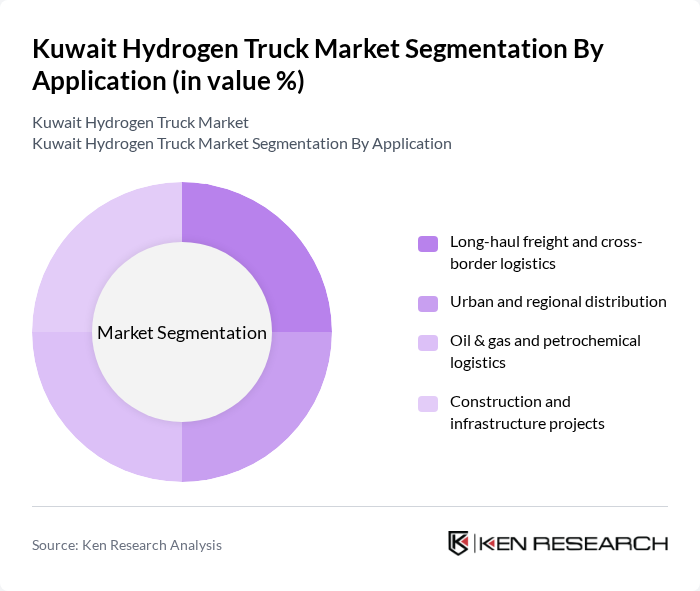

By Application:The application segmentation encompasses various uses of hydrogen trucks, including Long-haul freight and cross-border logistics, Urban and regional distribution, Oil & gas and petrochemical logistics, and Construction and infrastructure projects. Long-haul freight is the leading application due to the significant distance covered and the need for sustainable solutions in heavy transport, which aligns with global hydrogen truck deployment patterns where early fleets target long?distance corridors and high?utilization routes to maximize fuel?cost and emissions benefits. In Kuwait, heavy commercial vehicles already support large volumes of cross?border and port?linked traffic, as well as oil, gas, and petrochemical supply chains, so these segments are natural early candidates for hydrogen pilots, even though no Kuwait?specific hydrogen truck application breakdowns have been formally published.

The Kuwait Hydrogen Truck Market is characterized by a dynamic mix of regional and international players. Leading participants such as Hyundai Motor Company, Daimler Truck AG, Volvo Group, PACCAR Inc (DAF, Kenworth, Peterbilt), Toyota Motor Corporation, Hino Motors, Ltd., Nikola Corporation, Iveco Group N.V., FAW Group (including FAW Jiefang), BYD Company Limited, Ballard Power Systems Inc., Plug Power Inc., Cummins Inc. (including Accelera by Cummins), Kuwait National Petroleum Company (KNPC), Kuwait Oil Company (KOC) contribute to innovation, geographic expansion, and service delivery in this space, although public information does not yet document significant commercial-scale hydrogen truck fleets or binding orders in Kuwait tied to these companies. Most of these OEMs and fuel?cell suppliers are active in hydrogen truck pilots or commercialization programs in other regions such as Europe, North America, and East Asia, and they are logical candidates to supply future hydrogen trucks, fuel?cell systems, or hydrogen production and refueling solutions to Kuwait once local pilot projects, blue?hydrogen capacity, and refueling corridors are secured.

The future of the hydrogen truck market in Kuwait appears promising, driven by increasing government support and a growing emphasis on sustainable logistics. As infrastructure develops, including the planned expansion of hydrogen refueling stations, the adoption of hydrogen trucks is expected to accelerate. Furthermore, partnerships between public and private sectors will likely foster innovation and investment, enhancing the overall market landscape. The shift towards zero-emission vehicles will continue to shape the industry, aligning with global sustainability goals.

| Segment | Sub-Segments |

|---|---|

| By Truck Class | Heavy-duty (above 16 tons GVW) Medium-duty (7.5–16 tons GVW) Light-duty (up to 7.5 tons GVW) Specialized vocational trucks (refuse, municipal, tanker) |

| By Application | Long-haul freight and cross-border logistics Urban and regional distribution Oil & gas and petrochemical logistics Construction and infrastructure projects |

| By Payload Capacity | Up to 10 tons to 25 tons Above 25 tons Oversized / special transport |

| By Powertrain / Technology | Fuel cell electric trucks (FCEV) Hydrogen internal combustion engine trucks (H2-ICE) Hybrid hydrogen–battery trucks Other emerging hydrogen drivetrains |

| By Ownership Model | Fleet-owned (private logistics and transport fleets) Leasing and rental (including pay-per-use) OEM / energy-company operated demo fleets Public sector and municipal fleets |

| By Deployment Geography | Kuwait City and urban corridors Key logistics and industrial hubs (Shuaiba, Shuwaikh, Mina Al Ahmadi) Cross-border freight routes (Saudi Arabia, UAE, Iraq) Other regions |

| By Policy / Project Framework | National hydrogen and decarbonization programs Public–private partnership (PPP) pilots Multilateral and climate-financed projects Corporate net-zero and ESG-driven initiatives |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Logistics and Freight Operators | 100 | Fleet Managers, Operations Directors |

| Government Regulatory Bodies | 50 | Policy Makers, Energy Sector Analysts |

| Hydrogen Technology Providers | 70 | Product Managers, R&D Engineers |

| Public Transport Authorities | 60 | Transport Planners, Sustainability Officers |

| Environmental NGOs and Advocacy Groups | 40 | Research Analysts, Program Directors |

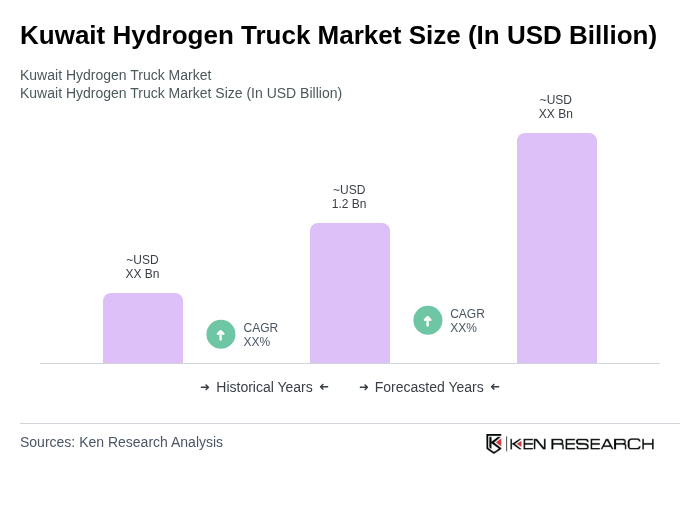

The Kuwait Hydrogen Truck Market is valued at approximately USD 1.2 billion, based on historical analysis. This figure reflects the emerging nature of hydrogen trucks within the broader heavy-duty truck market, which is estimated at around USD 1.5 billion.