Kuwait Identity Verification Market Overview

- The Kuwait Identity Verification Market is valued at USD 120 million, based on a five-year historical analysis and normalization from regional GCC market data. This growth is primarily driven by the increasing demand for secure and efficient identity verification solutions across banking, healthcare, and e-commerce sectors. Key drivers include the rise in digital transactions, advancements in biometric and AI-based technologies, and the need for compliance with evolving regulatory standards. The market is further propelled by government initiatives to enhance digital security and the widespread adoption of mobile banking and e-commerce platforms.

- Kuwait City remains the dominant hub for the identity verification market due to its role as the capital and largest city, hosting major financial institutions, government agencies, and a concentration of technology-driven enterprises. The city's tech-savvy population and growing startup ecosystem in digital identity contribute significantly to market growth. Additional regions such as Hawalli and Al Ahmadi are also experiencing increased investments in identity verification technologies, driven by expanding commercial activities and digital transformation initiatives.

- In 2023, the Kuwaiti government enacted the “Central Bank of Kuwait Anti-Money Laundering and Combating the Financing of Terrorism Instructions, 2023,” issued by the Central Bank of Kuwait. This regulation mandates biometric verification for all financial transactions exceeding specified thresholds, requiring financial institutions to implement biometric authentication (such as fingerprint or facial recognition) for customer onboarding and high-value transfers. The regulation aims to strengthen security, ensure compliance with global standards, and prevent financial fraud, thereby accelerating the adoption of advanced identity verification solutions in the financial sector.

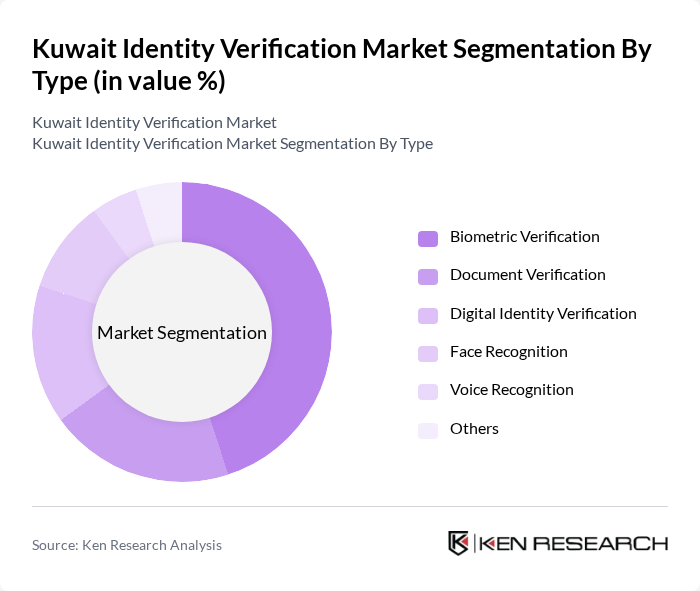

Kuwait Identity Verification Market Segmentation

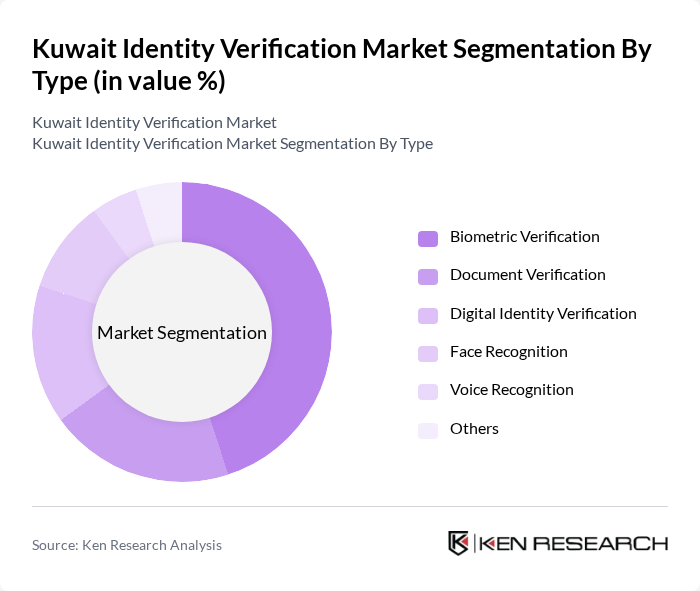

By Type:The identity verification market is segmented into Biometric Verification, Document Verification, Digital Identity Verification, Face Recognition, Voice Recognition, and Others. Biometric Verification leads the market due to its superior accuracy, security, and user convenience. Organizations, especially in banking and government, are increasingly deploying biometric systems—such as fingerprint, facial, and iris recognition—to enhance security, streamline onboarding, and comply with regulatory requirements. The adoption of biometric solutions is further driven by the proliferation of mobile devices and the need for frictionless digital experiences.

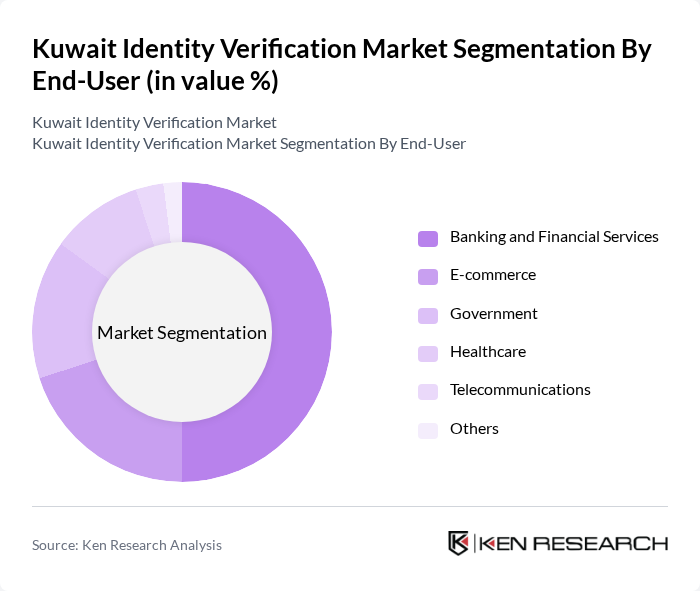

By End-User:The market is categorized by end-users: Banking and Financial Services, E-commerce, Government, Healthcare, Telecommunications, and Others. Banking and Financial Services is the dominant segment, driven by stringent KYC (Know Your Customer) and AML (Anti-Money Laundering) regulations, the need for robust fraud prevention, and the rapid digitalization of financial services. E-commerce and government sectors are also significant adopters, leveraging identity verification to secure online transactions and public services. Healthcare and telecommunications are increasingly integrating identity verification to protect sensitive data and ensure regulatory compliance.

Kuwait Identity Verification Market Competitive Landscape

The Kuwait Identity Verification Market is characterized by a dynamic mix of regional and international players. Leading participants such as Veriff, Jumio, IDnow, Onfido, Trulioo, Yoti, Authenteq, Socure, Mitek Systems, FaceTec, Zighra, Cognitec, Aware, Inc., Kuwait National Bank (KNB) – Digital Identity Solutions, Gulf Bank – Identity Verification Services, Zain Kuwait – Biometric Authentication, Ooredoo Kuwait – Identity Management, Ministry of Interior – Civil ID & Biometric Systems, Ministry of Health – Digital Health Identity, Kuwait Central Bank – Regulatory Compliance & KYC Solutions contribute to innovation, geographic expansion, and service delivery in this space.

Kuwait Identity Verification Market Industry Analysis

Growth Drivers

- Increasing Demand for Secure Online Transactions:The surge in e-commerce activities in Kuwait, with online sales reaching approximately $3 billion in future, has heightened the need for secure identity verification solutions. As consumers increasingly prefer digital transactions, businesses are compelled to implement robust verification systems to mitigate risks associated with fraud. This trend is further supported by a projected 20% annual growth in online retail, emphasizing the critical role of secure identity verification in maintaining consumer trust and safety.

- Government Initiatives for Digital Identity Solutions:The Kuwaiti government has allocated around $200 million for the development of digital identity frameworks as part of its e-Government strategy. This initiative aims to streamline public services and enhance security measures. By future, the government plans to integrate biometric identification systems across various sectors, which will significantly drive the demand for identity verification solutions, ensuring compliance with national security standards and improving service delivery efficiency.

- Rise in Identity Theft and Fraud Cases:Reports indicate that identity theft cases in Kuwait increased by 25% from the previous year, prompting urgent action from both consumers and businesses. The financial losses attributed to fraud reached approximately $250 million in future, highlighting the critical need for effective identity verification solutions. This alarming trend is driving organizations to invest in advanced verification technologies to protect sensitive information and maintain customer confidence in their services.

Market Challenges

- High Implementation Costs:The initial costs associated with deploying advanced identity verification systems can be prohibitive for many businesses in Kuwait. Estimates suggest that implementing a comprehensive identity verification solution can range from $75,000 to $250,000, depending on the technology and scale. This financial barrier can deter small and medium-sized enterprises from adopting necessary security measures, potentially leaving them vulnerable to fraud and identity theft.

- Regulatory Compliance Complexities:Navigating the regulatory landscape in Kuwait poses significant challenges for identity verification providers. Compliance with the Data Protection Law, which mandates strict data handling and privacy protocols, requires substantial investment in legal and operational adjustments. Non-compliance can result in penalties exceeding $150,000, creating a daunting environment for businesses attempting to implement effective identity verification solutions while adhering to regulatory requirements.

Kuwait Identity Verification Market Future Outlook

The future of the Kuwait identity verification market appears promising, driven by technological advancements and increasing digitalization. The integration of artificial intelligence and machine learning in verification processes is expected to enhance accuracy and efficiency. Additionally, the growing trend towards decentralized identity solutions will likely reshape the landscape, offering consumers more control over their personal data. As businesses and government entities prioritize security, the demand for innovative verification solutions will continue to rise, fostering a more secure digital environment.

Market Opportunities

- Expansion of E-Commerce Platforms:The rapid growth of e-commerce in Kuwait, projected to reach $4 billion in future, presents significant opportunities for identity verification providers. As online retailers seek to enhance security measures, partnerships with verification solution providers can lead to innovative offerings that cater to the evolving needs of consumers, ultimately driving market growth.

- Development of Mobile Identity Verification Solutions:With mobile penetration in Kuwait exceeding 95%, there is a substantial opportunity for mobile-based identity verification solutions. These solutions can streamline user experiences and enhance security for mobile transactions, appealing to a tech-savvy consumer base. As businesses increasingly adopt mobile platforms, the demand for effective mobile verification solutions will likely surge, creating a lucrative market segment.