Region:Middle East

Author(s):Shubham

Product Code:KRAD4588

Pages:92

Published On:December 2025

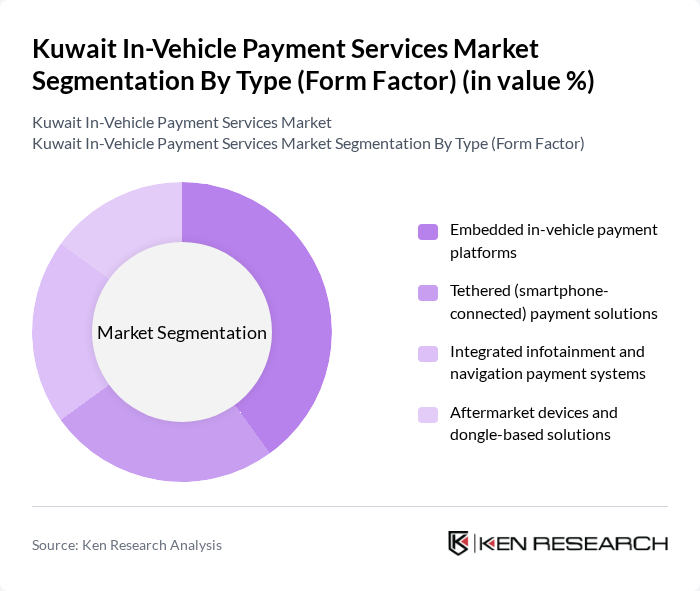

By Type (Form Factor):The market is segmented into four key types: Embedded in-vehicle payment platforms, Tethered (smartphone-connected) payment solutions, Integrated infotainment and navigation payment systems, and Aftermarket devices and dongle-based solutions. Among these, embedded in-vehicle payment platforms are leading due to their seamless integration into vehicles, providing users with a convenient and efficient payment experience. The trend towards smart vehicles and connected technologies is driving the adoption of these platforms.

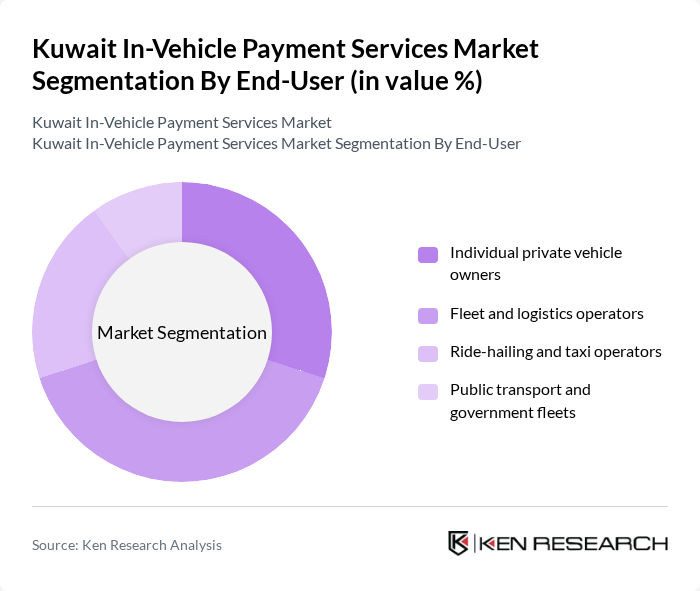

By End-User:The end-user segmentation includes Individual private vehicle owners, Fleet and logistics operators, Ride-hailing and taxi operators, and Public transport and government fleets. Fleet and logistics operators are currently the dominant segment, driven by the need for efficient payment solutions to manage fuel and toll expenses. The increasing trend of digitization in fleet management is further propelling this segment's growth.

The Kuwait In-Vehicle Payment Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as Shared Electronic Banking Services Company (KNET), National Bank of Kuwait (NBK), Kuwait Finance House (KFH), Boubyan Bank, Gulf Bank, Al Ahli Bank of Kuwait (ABK), Zain Kuwait (Zain Pay and digital wallet services), Ooredoo Kuwait (Ooredoo digital payment services), stc Kuwait (stc Pay and digital wallet services), Visa Inc., Mastercard Incorporated, TAP Payments, One Global (PayIt and OG Money), Kuwait Oil Company & fuel station operators (fuel and EV charging payment integration), Leading parking and smart mobility operators in Kuwait contribute to innovation, geographic expansion, and service delivery in this space.

The future of the in-vehicle payment services market in Kuwait appears promising, driven by technological advancements and increasing consumer acceptance. As the government continues to invest in smart transportation initiatives, the integration of IoT and AI technologies is expected to enhance payment security and user experience. Furthermore, the growing trend of subscription-based services will likely reshape consumer payment preferences, making in-vehicle payment systems more appealing and accessible to a broader audience in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type (Form Factor) | Embedded in-vehicle payment platforms Tethered (smartphone-connected) payment solutions Integrated infotainment and navigation payment systems Aftermarket devices and dongle-based solutions |

| By End-User | Individual private vehicle owners Fleet and logistics operators Ride-hailing and taxi operators Public transport and government fleets |

| By Vehicle Type | Passenger cars Light commercial vehicles (LCVs) Heavy commercial vehicles (HCVs) and buses Electric vehicles and plug-in hybrids |

| By Payment Method | KNET and card-based payments (credit/debit) Mobile wallets and telco wallets QR code and RFID / tag-based payments OEM / in-app tokenized payments |

| By Region | Kuwait City and Capital Governorate Hawalli and Farwaniya Ahmadi (including oil and industrial corridors) Jahra and emerging development corridors |

| By Technology | NFC-enabled in-vehicle payments RFID / DSRC tag-based tolling and access control Cloud-based and API-integrated payment platforms Biometric and tokenization-based authentication |

| By Application | Toll and road usage payments On-street and off-street parking payments Fuel and EV charging payments Drive?through, food & retail and other in-car commerce |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Adoption of In-Vehicle Payment Systems | 150 | Vehicle Owners, Tech-Savvy Consumers |

| Automotive Industry Stakeholders | 100 | Automakers, Payment Solution Providers |

| Regulatory Bodies and Policy Makers | 50 | Government Officials, Regulatory Analysts |

| Market Analysts and Consultants | 80 | Industry Analysts, Market Researchers |

| Retailers and Service Providers | 70 | Retail Managers, Service Station Owners |

The Kuwait In-Vehicle Payment Services Market is valued at approximately USD 150 million, driven by the increasing adoption of digital payment solutions and the rise in vehicle ownership, reflecting a growing demand for seamless payment experiences in transportation.