Region:Middle East

Author(s):Shubham

Product Code:KRAC4252

Pages:86

Published On:October 2025

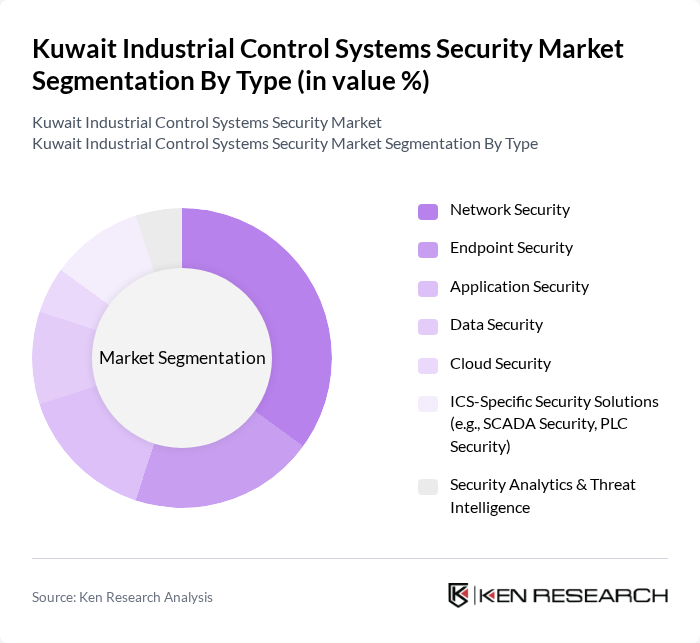

By Type:The market is segmented into a range of security solutions tailored for industrial control systems. Subsegments include Network Security, Endpoint Security, Application Security, Data Security, Cloud Security, ICS-Specific Security Solutions (such as SCADA Security and PLC Security), and Security Analytics & Threat Intelligence. Network Security is the leading subsegment, driven by the increasing frequency of cyberattacks targeting industrial network infrastructures and the need for robust perimeter defense, segmentation, and real-time monitoring .

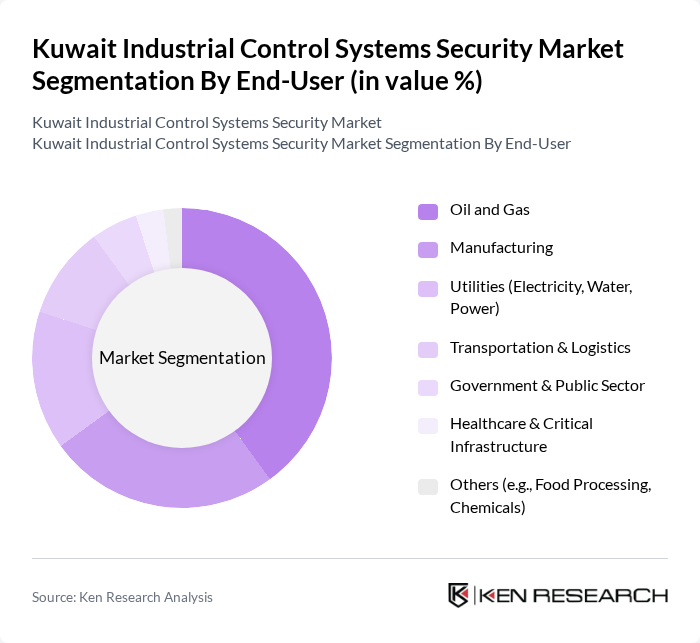

By End-User:The end-user segmentation encompasses industries deploying industrial control systems security solutions. Key segments include Oil and Gas, Manufacturing, Utilities (Electricity, Water, Power), Transportation & Logistics, Government & Public Sector, Healthcare & Critical Infrastructure, and Others (such as Food Processing and Chemicals). The Oil and Gas sector holds the largest share, reflecting the critical nature of its operations, high risk of targeted cyberattacks, and stringent regulatory requirements for ICS security .

The Kuwait Industrial Control Systems Security Market is characterized by a dynamic mix of regional and international players. Leading participants such as Honeywell International Inc., Siemens AG, Schneider Electric SE, ABB Ltd., Rockwell Automation, Inc., Cisco Systems, Inc., Fortinet, Inc., Palo Alto Networks, Inc., Check Point Software Technologies Ltd., Kaspersky Lab, Trend Micro Incorporated, CyberArk Software Ltd., Darktrace Ltd., Claroty Ltd., Dragos, Inc., Nozomi Networks Inc., Belden Inc., Radiflow Ltd., Forescout Technologies, Inc., Trellix (formerly McAfee Enterprise and FireEye) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Kuwait industrial control systems security market appears promising, driven by increasing investments in smart manufacturing and the expansion of cloud-based security solutions. As industries embrace digital transformation, the demand for innovative security measures will rise. Additionally, the growing emphasis on compliance with international standards and data privacy regulations will further propel market growth, encouraging organizations to adopt advanced security frameworks to safeguard their operations against evolving cyber threats.

| Segment | Sub-Segments |

|---|---|

| By Type | Network Security Endpoint Security Application Security Data Security Cloud Security ICS-Specific Security Solutions (e.g., SCADA Security, PLC Security) Security Analytics & Threat Intelligence |

| By End-User | Oil and Gas Manufacturing Utilities (Electricity, Water, Power) Transportation & Logistics Government & Public Sector Healthcare & Critical Infrastructure Others (e.g., Food Processing, Chemicals) |

| By Component | Hardware (Firewalls, Intrusion Detection Systems, Secure Gateways) Software (Security Management Platforms, SIEM, Antivirus) Services (Managed Security, Consulting, Incident Response) |

| By Deployment Mode | On-Premises Cloud-Based Hybrid |

| By Sales Channel | Direct Sales Distributors/Resellers Online Sales |

| By Industry Vertical | Energy and Power Manufacturing Transportation and Logistics Chemicals & Petrochemicals |

| By Policy Support | Government Subsidies Tax Incentives Regulatory Compliance Support |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Oil & Gas Sector Security | 100 | IT Security Managers, Operations Directors |

| Manufacturing Control Systems | 80 | Plant Managers, Cybersecurity Analysts |

| Utility Providers Cybersecurity | 70 | Infrastructure Security Officers, Compliance Managers |

| Telecommunications Network Security | 50 | Network Security Engineers, Risk Management Officers |

| Government Regulatory Bodies | 40 | Policy Makers, Cybersecurity Advisors |

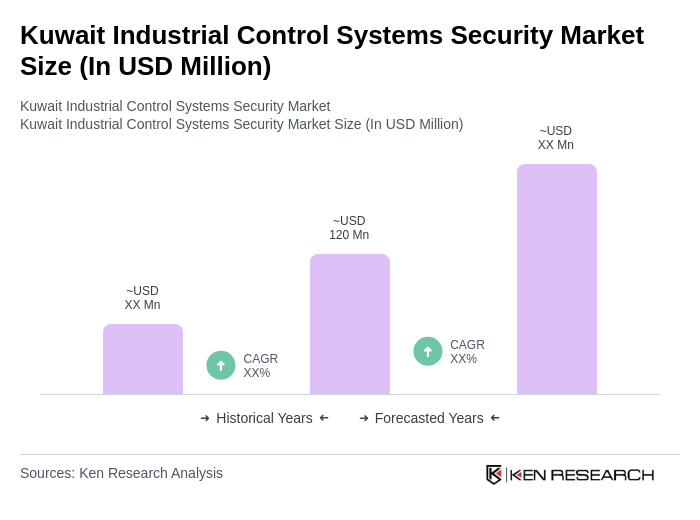

The Kuwait Industrial Control Systems Security Market is valued at approximately USD 120 million, reflecting a five-year historical analysis and normalization from regional cybersecurity and ICS market data, driven by increasing demand for advanced cybersecurity solutions in critical infrastructure sectors.