Region:Middle East

Author(s):Rebecca

Product Code:KRAC9785

Pages:96

Published On:November 2025

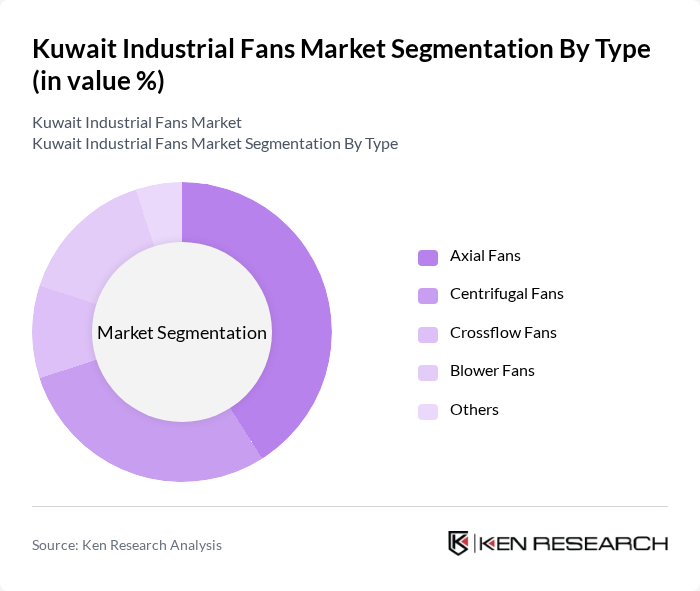

By Type:The industrial fans market can be segmented into various types, including Axial Fans, Centrifugal Fans, Crossflow Fans, Blower Fans, and Others. Among these, Axial Fans are currently leading the market due to their efficiency in moving large volumes of air at low pressure, making them ideal for ventilation applications in industrial settings. The growing focus on energy efficiency and cost-effectiveness has further propelled the demand for Axial Fans, particularly in the HVAC and manufacturing sectors .

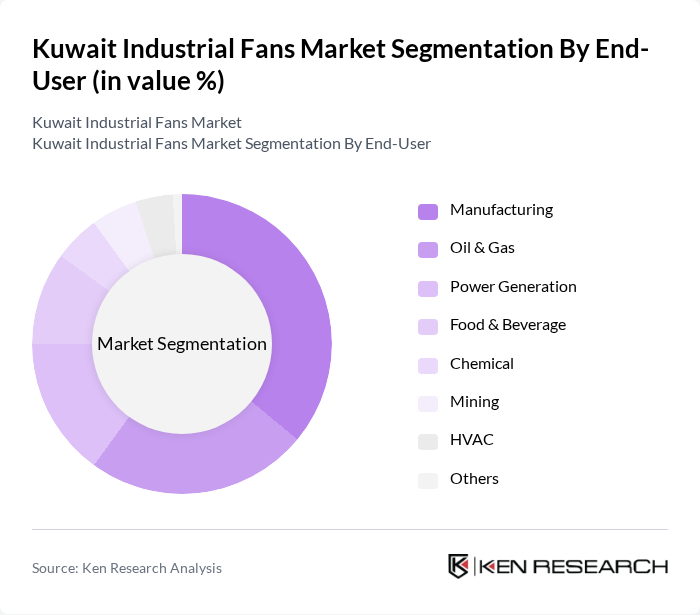

By End-User:The market can also be segmented based on end-users, including Manufacturing, Oil & Gas, Power Generation, Food & Beverage, Chemical, Mining, HVAC, and Others. The Manufacturing sector is the leading end-user, driven by the need for effective ventilation and cooling solutions in production facilities. The increasing industrial activities and the push for automation in manufacturing processes have led to a higher demand for industrial fans, particularly in sectors like automotive and electronics. The Oil & Gas sector also represents a significant share, given Kuwait’s economic reliance on petroleum and the stringent safety and ventilation requirements in refineries and processing plants .

The Kuwait Industrial Fans Market is characterized by a dynamic mix of regional and international players. Leading participants such as Alfanar, Gulf Fans, KSB Pumps and Valves, Systemair AB, Greenheck Fan Corporation, Howden Group, ebm?papst, Soler & Palau Ventilation Group, Vent-Axia, Airmatic Kuwait, TPI Corporation, Air Control Industries, Delta Electronics, Sodeca, Fantech contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Kuwait industrial fans market appears promising, driven by technological advancements and a growing emphasis on sustainability. As industries increasingly adopt smart technologies, the integration of IoT in fan systems is expected to enhance operational efficiency and reduce energy consumption. Furthermore, the rising focus on indoor air quality will likely propel demand for customized fan solutions that cater to specific industrial needs. These trends indicate a dynamic market landscape poised for growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Axial Fans Centrifugal Fans Crossflow Fans Blower Fans Others |

| By End-User | Manufacturing Oil & Gas Power Generation Food & Beverage Chemical Mining HVAC Others |

| By Application | Ventilation Cooling Systems Exhaust Systems Material Handling Dust Collection Air Circulation Others |

| By Material | Metal Plastic Composite Others |

| By Size | Low Flow Capacity (up to 5,000 CFM) Medium Flow Capacity (5,000–50,000 CFM) High Flow Capacity (above 50,000 CFM) Others |

| By Power Source | Electric Solar Hybrid Others |

| By Region | Kuwait City Hawalli Al Ahmadi Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Oil & Gas Sector | 100 | Operations Managers, Maintenance Supervisors |

| Manufacturing Industry | 90 | Production Managers, Facility Engineers |

| HVAC Applications | 60 | HVAC Technicians, Project Managers |

| Food Processing Sector | 50 | Quality Control Managers, Plant Managers |

| Textile Industry | 40 | Production Supervisors, Equipment Managers |

The Kuwait Industrial Fans Market is valued at approximately USD 20 million, driven by increasing demand for efficient ventilation and cooling solutions across various industries, including manufacturing, oil and gas, and HVAC systems.