Region:Asia

Author(s):Rebecca

Product Code:KRAC8473

Pages:98

Published On:November 2025

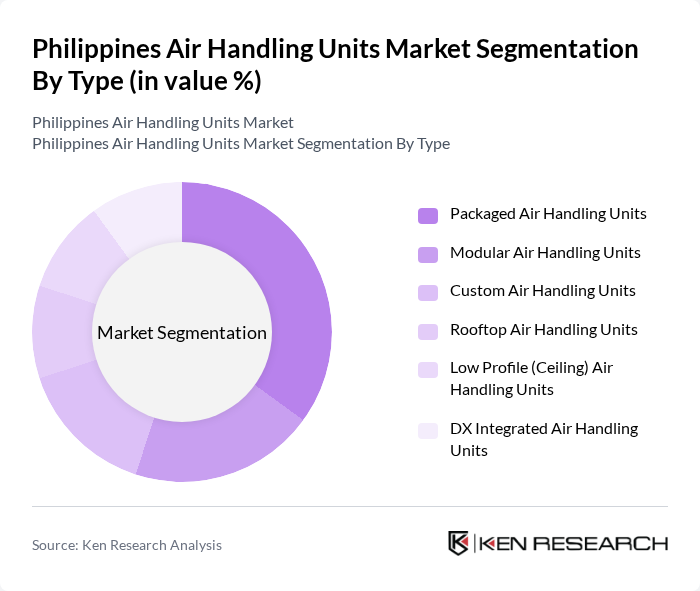

By Type:The market is segmented into various types of air handling units, including Packaged Air Handling Units, Modular Air Handling Units, Custom Air Handling Units, Rooftop Air Handling Units, Low Profile (Ceiling) Air Handling Units, and DX Integrated Air Handling Units. Among these, Packaged Air Handling Units lead the market due to their compact design, ease of installation, and suitability for both residential and commercial applications. Modular and custom units are gaining traction in large-scale commercial and industrial projects, while rooftop and low-profile units are preferred in space-constrained environments .

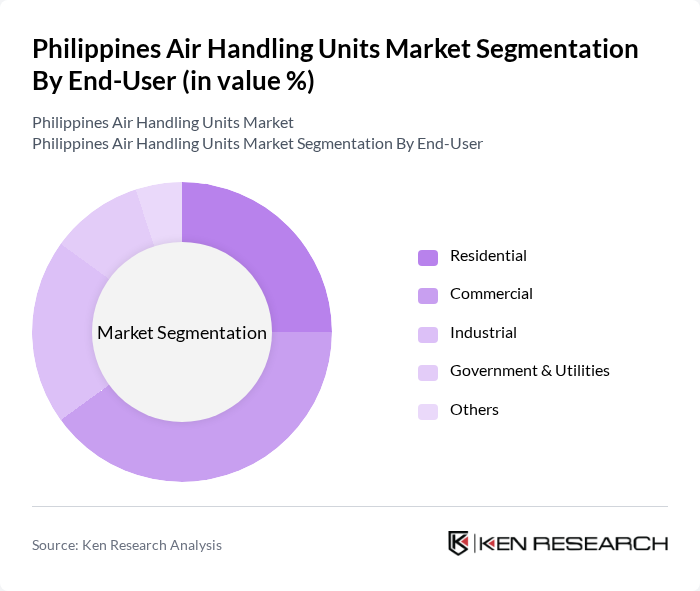

By End-User:The end-user segmentation includes Residential, Commercial, Industrial, Government & Utilities, and Others. The Commercial segment dominates the market, driven by the proliferation of office buildings, shopping malls, hotels, hospitals, and data centers, all requiring efficient air handling solutions for optimal indoor air quality and regulatory compliance. The industrial segment is also expanding, supported by manufacturing growth and stricter workplace safety standards .

The Philippines Air Handling Units Market is characterized by a dynamic mix of regional and international players. Leading participants such as Daikin Philippines, Inc., Mitsubishi Electric Philippines, Johnson Controls International Philippines, Trane Philippines, Carrier Philippines, LG Electronics Philippines, Fujitsu General Philippines, Panasonic Manufacturing Philippines, York International Corporation Philippines, Gree Electric Appliances, Inc. Philippines, Samsung Electronics Philippines, Hitachi Air Conditioning Philippines, Swegon Philippines, Systemair Philippines, and Aermec Philippines contribute to innovation, geographic expansion, and service delivery in this space.

The future of the air handling units market in the Philippines appears promising, driven by increasing urbanization and a strong focus on energy efficiency. As the government implements stricter regulations and incentives for green technologies, businesses are likely to invest in modern HVAC systems. Additionally, the integration of smart technologies and IoT in air handling units will enhance operational efficiency and indoor air quality, aligning with the growing consumer demand for healthier living environments. This trend will likely shape the market landscape in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Packaged Air Handling Units Modular Air Handling Units Custom Air Handling Units Rooftop Air Handling Units Low Profile (Ceiling) Air Handling Units DX Integrated Air Handling Units |

| By End-User | Residential Commercial Industrial Government & Utilities Others |

| By Application | HVAC Systems Cleanroom Applications Process Cooling Others |

| By Material | Metal Plastic Composite Others |

| By Size | Small (?5,000 m³/h) Medium (5,001–15,000 m³/h) Large (?15,001 m³/h) Others |

| By Energy Source | Electric Solar Hybrid Others |

| By Region | Luzon Visayas Mindanao |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Commercial Building HVAC Systems | 100 | Facility Managers, Building Owners |

| Residential Air Handling Units | 60 | Homeowners, HVAC Contractors |

| Industrial HVAC Applications | 50 | Plant Managers, Operations Managers |

| Energy Efficiency Initiatives | 40 | Sustainability Officers, Energy Consultants |

| Regulatory Compliance in HVAC | 40 | Building Inspectors, Compliance Officers |

The Philippines Air Handling Units market is valued at approximately USD 170 million, reflecting a significant growth trend driven by the demand for energy-efficient HVAC systems and urbanization in key cities like Metro Manila, Cebu, and Davao.