Region:Middle East

Author(s):Geetanshi

Product Code:KRAD4096

Pages:83

Published On:December 2025

Market.png)

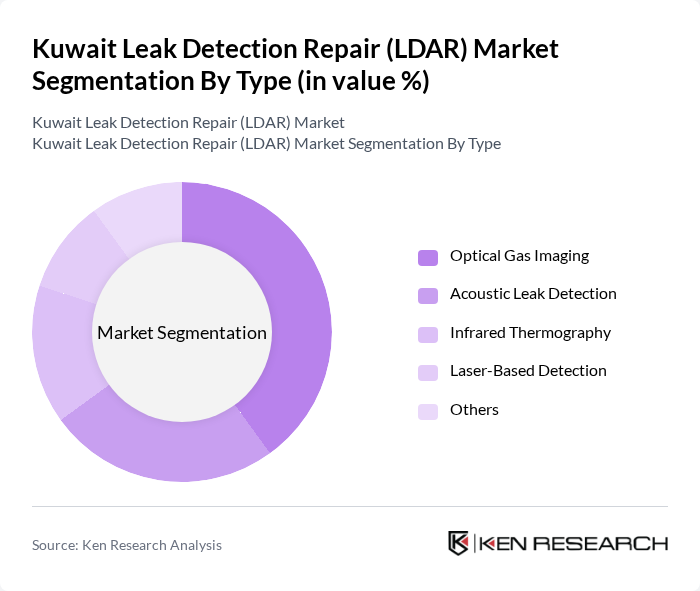

By Type:The market is segmented into various types of leak detection technologies, including Optical Gas Imaging, Acoustic Leak Detection, Infrared Thermography, Laser-Based Detection, and Others. Among these, Optical Gas Imaging is currently the leading sub-segment due to its effectiveness in detecting gas leaks in real-time and its non-invasive nature, which is highly valued in the oil and gas sector. The increasing adoption of advanced technologies and the need for efficient monitoring solutions are driving the growth of this segment.

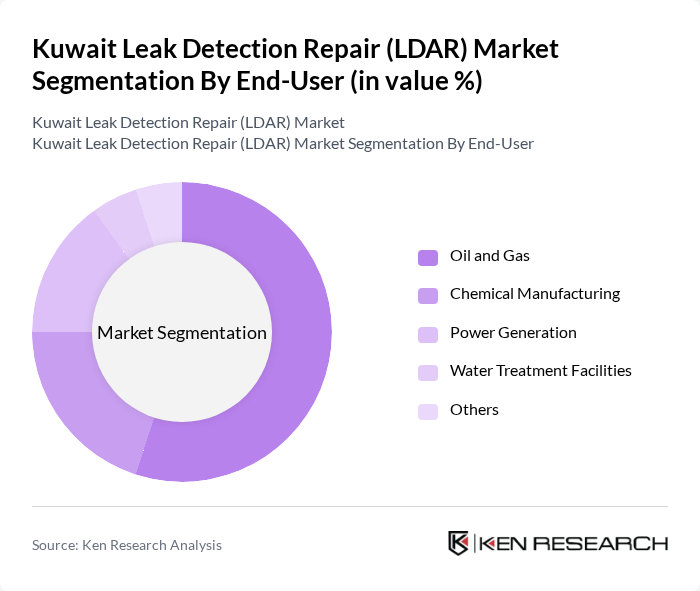

By End-User:The end-user segmentation includes Oil and Gas, Chemical Manufacturing, Power Generation, Water Treatment Facilities, and Others. The Oil and Gas sector is the dominant end-user, accounting for a significant portion of the market share. This is primarily due to the high volume of operations and the critical need for leak detection to prevent environmental hazards and economic losses. The stringent regulations in this sector further enhance the demand for LDAR services.

The Kuwait Leak Detection Repair (LDAR) Market is characterized by a dynamic mix of regional and international players. Leading participants such as KROHNE Group, Emerson Electric Co., FLIR Systems, Inc., Honeywell International Inc., Siemens AG, ABB Ltd., Teledyne Technologies Incorporated, Ametek, Inc., MSA Safety Incorporated, Perma-Pipe International Holdings, Inc., Spectris plc, RMT, Inc., TSI Incorporated, Aegion Corporation, KROHNE Oil & Gas contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Kuwait LDAR market appears promising, driven by increasing investments in sustainable practices and technological innovations. As companies seek to comply with stringent environmental regulations, the demand for automated and IoT-integrated leak detection systems is expected to rise significantly. Furthermore, the expansion of the oil and gas sector will likely create new opportunities for LDAR solutions, fostering a competitive landscape that encourages continuous improvement and collaboration among industry players.

| Segment | Sub-Segments |

|---|---|

| By Type | Optical Gas Imaging Acoustic Leak Detection Infrared Thermography Laser-Based Detection Others |

| By End-User | Oil and Gas Chemical Manufacturing Power Generation Water Treatment Facilities Others |

| By Application | Pipeline Monitoring Storage Tank Inspection Facility Maintenance Emergency Response Others |

| By Technology | Continuous Monitoring Systems Portable Detection Devices Fixed Detection Systems Others |

| By Service Type | Consulting Services Installation Services Maintenance Services Training Services Others |

| By Region | Central Kuwait Northern Kuwait Southern Kuwait Others |

| By Policy Support | Government Subsidies Tax Incentives Regulatory Compliance Support Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Oil & Gas Sector LDAR Implementation | 120 | Environmental Compliance Officers, Operations Managers |

| Petrochemical Industry Leak Detection Practices | 90 | Maintenance Supervisors, Safety Managers |

| Manufacturing Facility Emission Control | 80 | Plant Managers, Environmental Engineers |

| Technology Providers for LDAR Solutions | 70 | Product Managers, Sales Directors |

| Regulatory Compliance and Policy Makers | 60 | Government Officials, Policy Analysts |

The Kuwait Leak Detection Repair (LDAR) Market is valued at approximately USD 150 million, reflecting a five-year historical analysis. This valuation is influenced by regulatory requirements, economic awareness, and advancements in detection technologies, particularly in the oil and gas sector.