Region:Middle East

Author(s):Geetanshi

Product Code:KRAD7926

Pages:95

Published On:December 2025

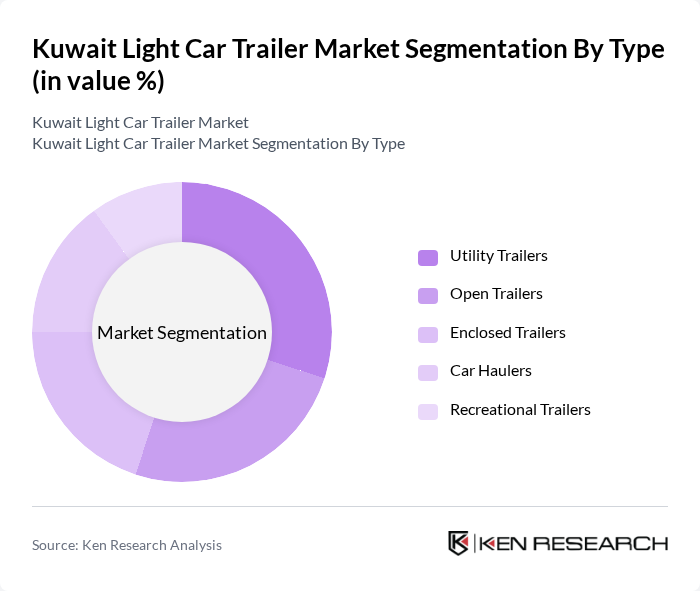

By Type:The market is segmented into various types of trailers, including Utility Trailers, Open Trailers, Enclosed Trailers, Car Haulers, and Recreational Trailers. Each type serves distinct purposes, catering to different consumer needs and preferences. Utility Trailers are popular for their versatility, while Enclosed Trailers are favored for transporting valuable goods securely. The Recreational Trailers segment has seen a surge in demand due to the growing interest in outdoor activities. Open trailers currently dominate the market segment due to their adaptability and spacious design, which is ideal for moving heavier equipment and recreational gear, meeting both individual and commercial transportation demands.

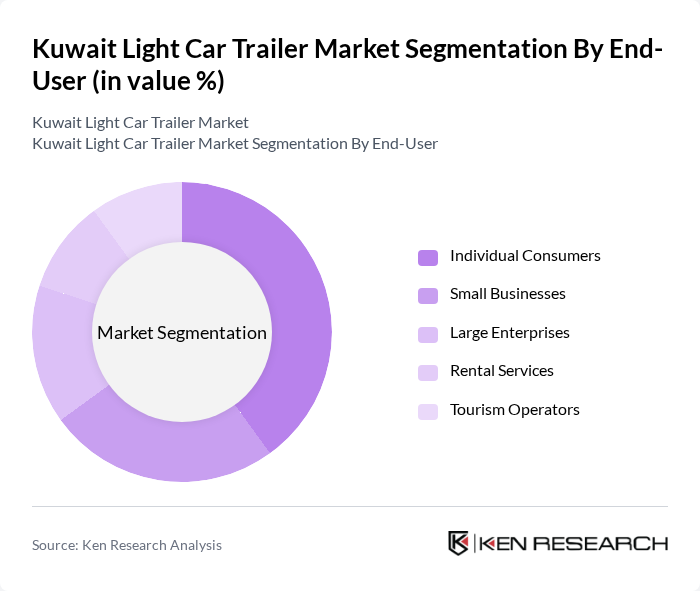

By End-User:The end-user segmentation includes Individual Consumers, Small Businesses, Large Enterprises, Rental Services, and Tourism Operators. Individual Consumers dominate the market due to the increasing trend of personal vehicle ownership and the need for transporting goods. Small Businesses and Rental Services also contribute significantly, as they require trailers for logistics and transportation purposes.

The Kuwait Light Car Trailer Market is characterized by a dynamic mix of regional and international players. Leading participants such as Al-Futtaim Group, Al-Mansour Automotive, Al-Sayer Group, Al-Khaldiya Group, Al-Muhalab Group, Al-Hamra Group, Al-Masoud Group, Al-Qabas Group, Al-Muhaidib Group, Al-Bahar Group contribute to innovation, geographic expansion, and service delivery in this space.

The Kuwait light car trailer market is poised for significant transformation, driven by technological advancements and changing consumer preferences. The integration of smart technologies in trailers is expected to enhance safety and efficiency, appealing to a tech-savvy consumer base. Additionally, the growing interest in sustainable transportation solutions, including electric trailers, will likely shape future developments. As the market adapts to these trends, opportunities for innovation and collaboration with logistics companies will emerge, fostering a more dynamic industry landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Utility Trailers Open Trailers Enclosed Trailers Car Haulers Recreational Trailers |

| By End-User | Individual Consumers Small Businesses Large Enterprises Rental Services Tourism Operators |

| By Application | Transportation of Goods and Equipment Recreational Use (Camping, Boating, Off-roading) Commercial Logistics Tourism Support Services |

| By Material | Steel Trailers Aluminum Trailers Lightweight Composite Materials |

| By Size | Small Trailers (for sedans and compact SUVs) Medium Trailers Large Trailers |

| By Distribution Channel | Online Retail (including Askar platform) Offline Retail Direct Sales |

| By Price Range | Budget Trailers Mid-Range Trailers Premium Trailers with Advanced Features |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Commercial Trailer Users | 120 | Fleet Managers, Logistics Coordinators |

| Private Trailer Owners | 100 | Individual Consumers, Car Enthusiasts |

| Trailer Manufacturers | 40 | Production Managers, Sales Directors |

| Dealerships and Distributors | 110 | Sales Representatives, Inventory Managers |

| Regulatory Bodies | 50 | Policy Makers, Compliance Officers |

The Kuwait Light Car Trailer Market is valued at approximately USD 165 million, reflecting growth driven by increased demand for transportation solutions in logistics and recreational sectors, particularly due to the rise in e-commerce and outdoor activities.