Kuwait Recreational Vehicle Market Overview

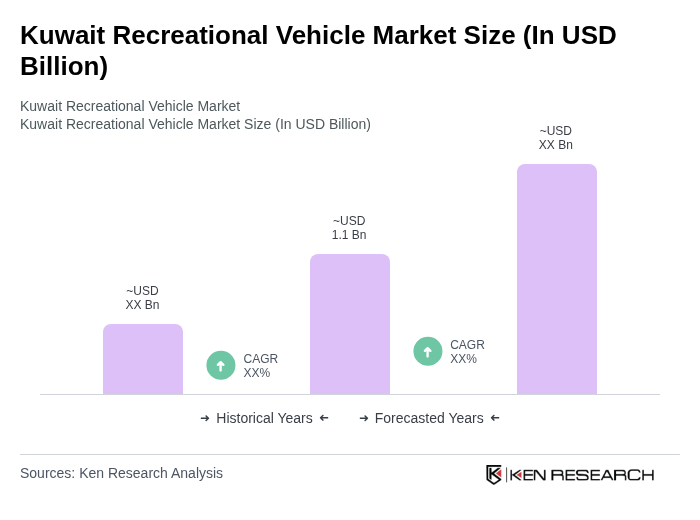

- The Kuwait Recreational Vehicle market is valued at USD 1.1 billion, based on a five-year historical analysis. This growth is primarily driven by increasing disposable income, a growing interest in outdoor activities, and a rise in domestic tourism. The market has seen a surge in demand for recreational vehicles as more families seek leisure travel options within the country and beyond. Recent trends also highlight the influence of digital connectivity, eco-friendly vehicle options, and the integration of advanced amenities as key growth drivers in the region .

- Kuwait City and Al Ahmadi remain the dominant cities in the recreational vehicle market due to their developed infrastructure, accessibility to outdoor recreational areas, and a higher concentration of affluent consumers. The urban population in these areas is increasingly inclined towards leisure activities, contributing to the market's growth .

- The Ministerial Resolution No. 2023/12 issued by the Ministry of Commerce and Industry in 2023 introduced regulations to promote the use of recreational vehicles, including tax incentives for manufacturers and consumers. This initiative requires manufacturers to comply with new safety and environmental standards, and provides tax reductions for locally assembled recreational vehicles, aiming to boost local production and encourage tourism .

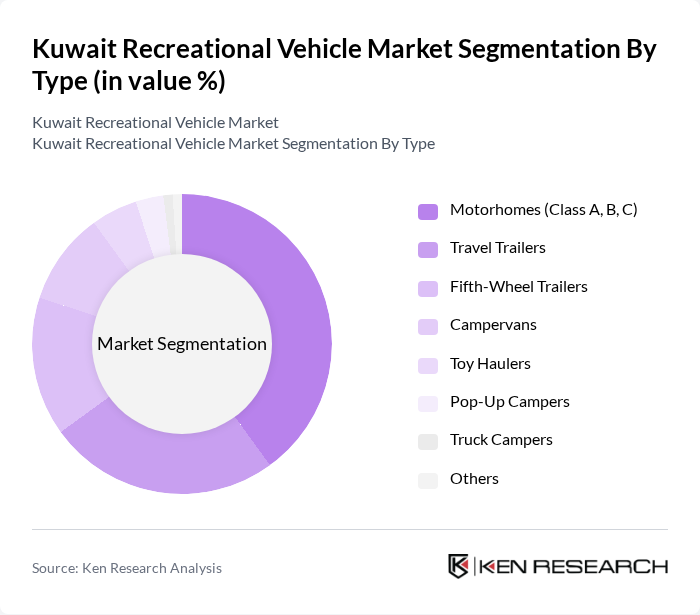

Kuwait Recreational Vehicle Market Segmentation

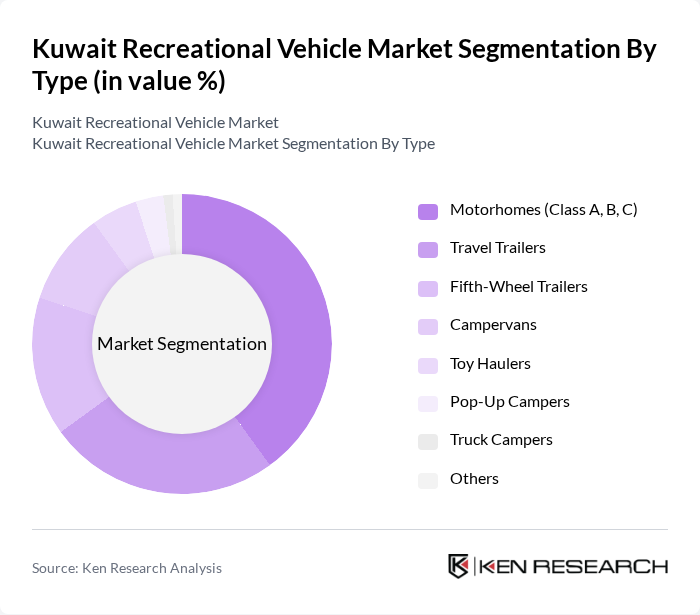

By Type:The recreational vehicle market can be segmented into various types, including Motorhomes (Class A, B, C), Travel Trailers, Fifth-Wheel Trailers, Campervans, Toy Haulers, Pop-Up Campers, Truck Campers, and Others. Among these, Motorhomes are particularly popular due to their all-in-one convenience and comfort, appealing to families and adventure seekers alike. The trend towards road trips and outdoor activities, as well as the introduction of smart home features and eco-friendly models, has further solidified their dominance in the market .

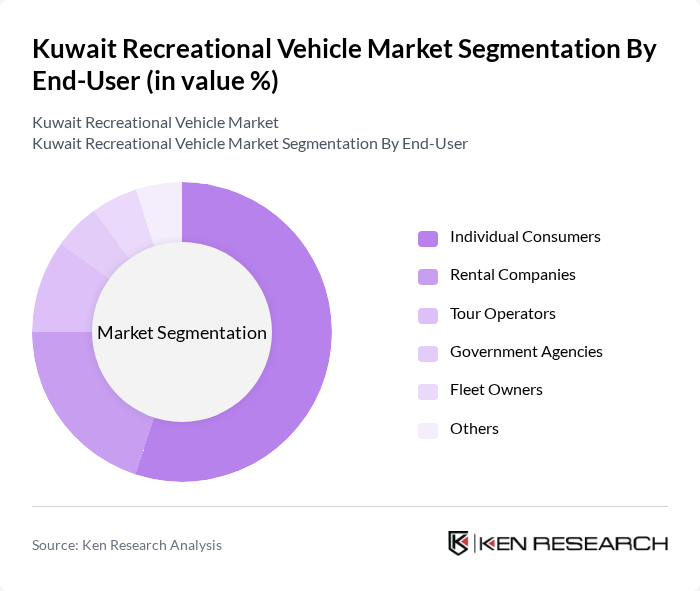

By End-User:The end-user segmentation includes Individual Consumers, Rental Companies, Tour Operators, Government Agencies, Fleet Owners, and Others. Individual Consumers dominate the market as more families and adventure enthusiasts invest in recreational vehicles for personal use. The growing trend of staycations and road trips, along with increased interest in eco-friendly and technologically advanced vehicles, has led to increased purchases among this demographic, driving the market forward .

Kuwait Recreational Vehicle Market Competitive Landscape

The Kuwait Recreational Vehicle Market is characterized by a dynamic mix of regional and international players. Leading participants such as Al Mulla Automobiles Co., Alghanim Automotive, Caravans Kuwait, Caravan World Kuwait, Al Sayer Group (Toyota Kuwait), Al Babtain Group, Al Futtaim Automotive (Gulf region distributor), Swift Group, Hymer AG, Thor Industries, Inc., Winnebago Industries, Inc., Gulf Stream Coach, Inc., Jayco, Inc., Coachmen RV, Forest River, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

Kuwait Recreational Vehicle Market Industry Analysis

Growth Drivers

- Increasing Disposable Income:The disposable income in Kuwait is projected to reach approximately $42,000 per capita in future, reflecting a 5% increase from the previous period. This rise in income enables more families to invest in recreational vehicles, as they seek leisure activities that enhance their quality of life. The growing middle class, which constitutes about 60% of the population, is particularly inclined towards outdoor adventures, driving demand for RVs as a preferred mode of travel and recreation.

- Growing Interest in Outdoor Activities:Kuwait's population has shown a significant shift towards outdoor activities, with participation in camping and adventure sports increasing by 30% over the past three years. This trend is supported by a growing awareness of health and wellness, leading to a surge in demand for recreational vehicles that facilitate outdoor experiences. The government’s promotion of national parks and outdoor events further encourages this interest, making RVs an attractive option for families and adventure seekers alike.

- Expansion of Tourism and Leisure Sectors:The Kuwaiti government aims to increase tourism revenue to $6 billion in future, focusing on leisure and recreational activities. This expansion includes the development of new tourist attractions and events that cater to both local and international visitors. As tourism grows, so does the demand for recreational vehicles, which provide flexible accommodation and travel options for tourists exploring Kuwait’s diverse landscapes and cultural sites.

Market Challenges

- High Initial Investment Costs:The average cost of a new recreational vehicle in Kuwait ranges from $32,000 to $105,000, which can be a significant barrier for potential buyers. This high initial investment limits access to RV ownership, particularly among lower-income families. Additionally, financing options are often limited, making it challenging for many consumers to afford these vehicles, thereby hindering market growth in the short term.

- Limited Infrastructure for RVs:Kuwait currently has only a handful of designated RV parks and campgrounds, with fewer than 12 facilities available nationwide. This lack of infrastructure poses a challenge for RV owners seeking safe and convenient places to park and camp. The absence of adequate facilities can deter potential buyers, as the overall experience of RV ownership is significantly impacted by the availability of supportive infrastructure for recreational activities.

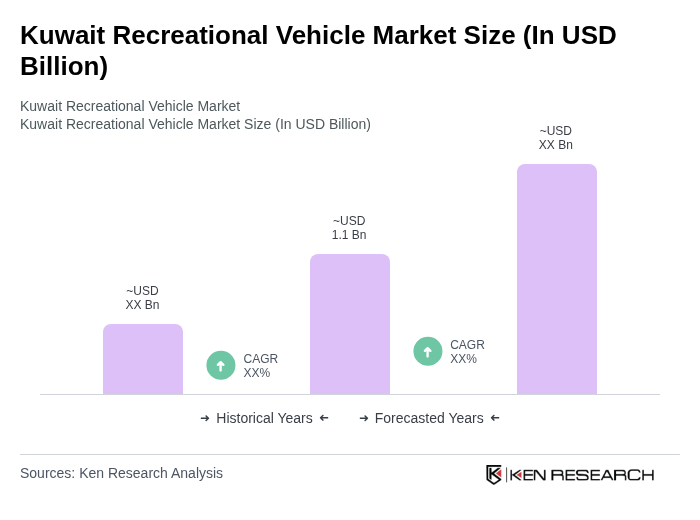

Kuwait Recreational Vehicle Market Future Outlook

The future of the Kuwait recreational vehicle market appears promising, driven by increasing disposable incomes and a growing interest in outdoor activities. As the government continues to invest in tourism and leisure infrastructure, the demand for RVs is expected to rise. Additionally, the integration of smart technology and eco-friendly options in RVs will likely attract environmentally conscious consumers, further enhancing market growth. The collaboration between RV manufacturers and tourism agencies will also play a crucial role in expanding the market landscape.

Market Opportunities

- Development of RV Parks and Campgrounds:There is a significant opportunity for investment in RV parks and campgrounds, with only 10 existing facilities in Kuwait. Expanding this infrastructure could attract more RV owners and tourists, enhancing the overall recreational experience. The government’s focus on tourism development can facilitate partnerships for creating these facilities, which would support the growing RV market.

- Increasing Popularity of RV Rentals:The RV rental market in Kuwait is gaining traction, with a projected growth rate of 18% annually. This trend is driven by younger consumers who prefer renting over purchasing due to lower costs and flexibility. Establishing rental services can cater to both locals and tourists, providing an accessible entry point into the RV lifestyle and stimulating overall market growth.