Region:Middle East

Author(s):Shubham

Product Code:KRAB7606

Pages:99

Published On:October 2025

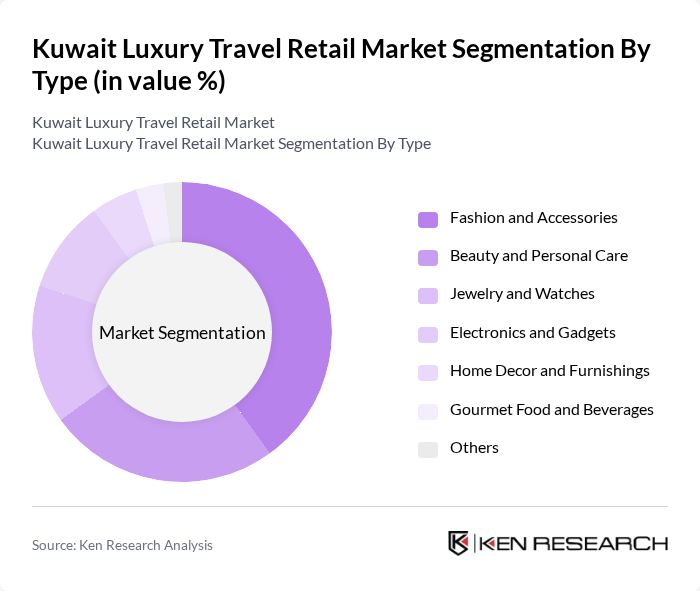

By Type:The luxury travel retail market can be segmented into various types, including Fashion and Accessories, Beauty and Personal Care, Jewelry and Watches, Electronics and Gadgets, Home Decor and Furnishings, Gourmet Food and Beverages, and Others. Among these, Fashion and Accessories dominate the market due to the high demand for luxury apparel and accessories from both local consumers and international travelers. The trend of personal branding and social media influence has further propelled the growth of this segment, as consumers seek to showcase their status through luxury fashion items.

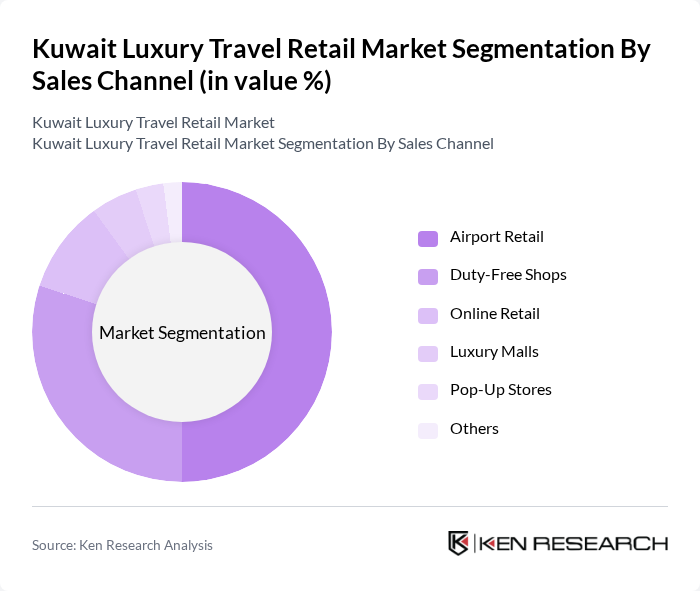

By Sales Channel:The sales channels for luxury travel retail include Airport Retail, Duty-Free Shops, Online Retail, Luxury Malls, Pop-Up Stores, and Others. Airport Retail is the leading channel, as it provides travelers with convenient access to luxury goods while they await their flights. The unique shopping experience offered at airports, combined with the allure of duty-free pricing, makes this channel particularly attractive to consumers looking to purchase luxury items before departing or upon arrival.

The Kuwait Luxury Travel Retail Market is characterized by a dynamic mix of regional and international players. Leading participants such as Al Haramain Perfumes, Alshaya Group, Chalhoub Group, Dufry AG, Estée Lauder Companies Inc., LVMH Moët Hennessy Louis Vuitton, Richemont Group, Gucci Group, Burberry Group plc, Dior SE, Chanel S.A., Hermès International S.A., Prada S.p.A., Tiffany & Co., Rolex SA contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Kuwait luxury travel retail market appears promising, driven by increasing disposable incomes and a growing influx of international tourists. As luxury brands continue to expand their presence, the market is likely to witness enhanced shopping experiences. Additionally, the integration of technology in retail environments will cater to evolving consumer preferences, making shopping more engaging. However, retailers must navigate economic fluctuations and regional competition to capitalize on these opportunities effectively.

| Segment | Sub-Segments |

|---|---|

| By Type | Fashion and Accessories Beauty and Personal Care Jewelry and Watches Electronics and Gadgets Home Decor and Furnishings Gourmet Food and Beverages Others |

| By Sales Channel | Airport Retail Duty-Free Shops Online Retail Luxury Malls Pop-Up Stores Others |

| By Consumer Demographics | Age Group (Millennials, Gen X, Baby Boomers) Gender (Male, Female) Income Level (High, Middle) Nationality (Local, Expatriate) |

| By Occasion | Travel Gifts Personal Indulgence Special Events (Weddings, Anniversaries) Corporate Gifting |

| By Brand Positioning | Premium Brands Luxury Brands Designer Brands Emerging Luxury Brands |

| By Product Origin | Local Brands International Brands Regional Brands |

| By Price Range | High-End Luxury Mid-Range Luxury Affordable Luxury Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Luxury Fashion Retail | 100 | Store Managers, Brand Executives |

| High-End Cosmetics and Fragrances | 80 | Beauty Advisors, Marketing Managers |

| Luxury Watches and Jewelry | 70 | Sales Directors, Product Managers |

| Luxury Travel Services | 90 | Travel Agents, Concierge Service Managers |

| Affluent Consumer Insights | 120 | High-Net-Worth Individuals, Luxury Lifestyle Influencers |

The Kuwait Luxury Travel Retail Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by increased international tourism, rising disposable incomes, and a growing preference for luxury goods among consumers.