Region:Middle East

Author(s):Rebecca

Product Code:KRAD7458

Pages:97

Published On:December 2025

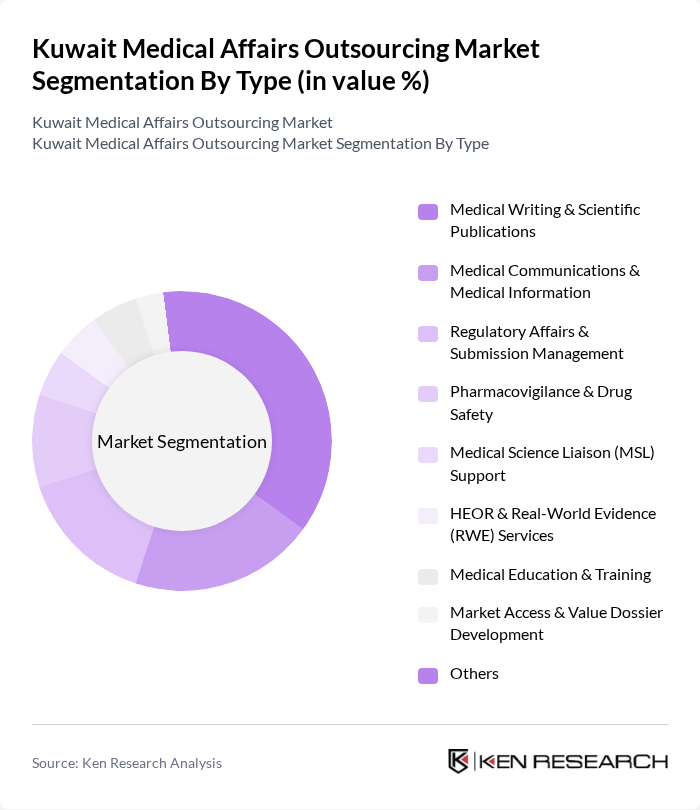

By Type:The market is segmented into various types, including Medical Writing & Scientific Publications, Medical Communications & Medical Information, Regulatory Affairs & Submission Management, Pharmacovigilance & Drug Safety, Medical Science Liaison (MSL) Support, HEOR & Real-World Evidence (RWE) Services, Medical Education & Training, Market Access & Value Dossier Development, and Others. Among these, Medical Writing & Scientific Publications is the leading sub-segment, driven by the increasing need for high-quality documentation and regulatory submissions in the pharmaceutical industry.

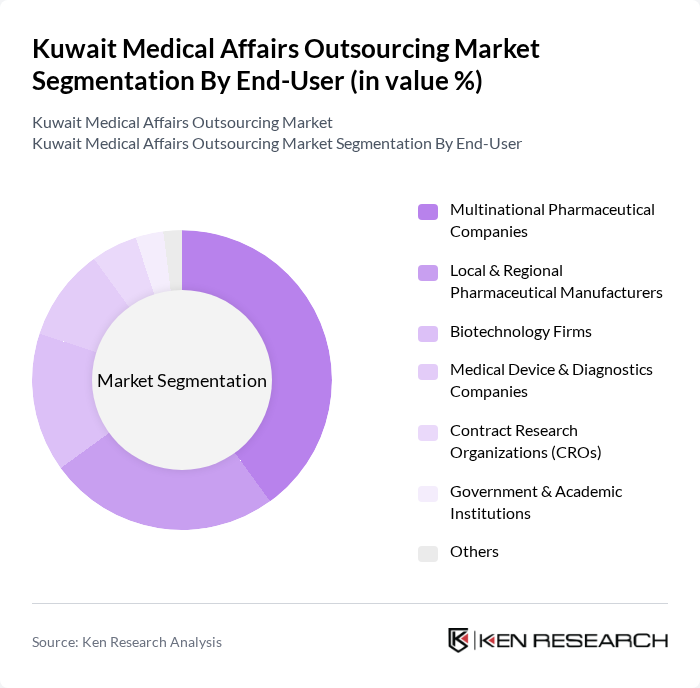

By End-User:The end-user segmentation includes Multinational Pharmaceutical Companies, Local & Regional Pharmaceutical Manufacturers, Biotechnology Firms, Medical Device & Diagnostics Companies, Contract Research Organizations (CROs), Government & Academic Institutions, and Others. Multinational Pharmaceutical Companies dominate this segment due to their extensive resources and established networks, which enable them to leverage outsourcing for efficiency and cost-effectiveness.

The Kuwait Medical Affairs Outsourcing Market is characterized by a dynamic mix of regional and international players. Leading participants such as IQVIA Holdings Inc., ICON plc, Syneos Health Inc., Syngene International Ltd., SGS SA, Indegene Limited, Ashfield Engage (UDG Healthcare), The Medical Affairs Company (TMAC), Pharmaceutical Product Development LLC (Thermo Fisher Scientific), Wipro GE Healthcare Pvt. Ltd. – Healthcare & Life Sciences Services, Kuwait Life Sciences Company (KLSC), Qatar Biotech & CRO Partners active in Kuwait, Kuwait University – Health Sciences Centre & Clinical Research Unit, Ministry of Health, Kuwait – Research & Clinical Trials Department, Local Niche Medical Affairs & Regulatory Consultancies in Kuwait contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Kuwait Medical Affairs Outsourcing Market appears promising, driven by technological advancements and a shift towards patient-centric care. As healthcare providers increasingly adopt digital solutions, the integration of artificial intelligence and advanced analytics will enhance operational efficiency. Furthermore, the growing emphasis on value-based healthcare models will encourage collaboration between local and international firms, fostering innovation and improving service delivery in the medical affairs sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Medical Writing & Scientific Publications Medical Communications & Medical Information Regulatory Affairs & Submission Management Pharmacovigilance & Drug Safety Medical Science Liaison (MSL) Support HEOR & Real-World Evidence (RWE) Services Medical Education & Training Market Access & Value Dossier Development Others |

| By End-User | Multinational Pharmaceutical Companies Local & Regional Pharmaceutical Manufacturers Biotechnology Firms Medical Device & Diagnostics Companies Contract Research Organizations (CROs) Government & Academic Institutions Others |

| By Service Model | Full-Service Outsourcing Functional Service Provider (FSP) Model Project-Based Outsourcing Dedicated Offshore/Shared Service Centers Others |

| By Therapeutic Area | Oncology Cardiometabolic & Cardiovascular Central Nervous System (CNS) & Neurology Infectious Diseases & Vaccines Respiratory & Allergy Rare Diseases & Specialty Care Others |

| By Project Size | Small Projects (? USD 0.25 million) Medium Projects (USD 0.25–1 million) Large Projects (> USD 1 million) Others |

| By Duration | Short-Term Projects (< 12 months) Long-Term Projects (12–36 months) Multi-Year Strategic Partnerships (> 36 months) Others |

| By Geographic Focus of Engagement | Kuwait-Only Assignments GCC/Regional Middle East Mandates Multi-Country / Global Programs Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pharmaceutical Regulatory Affairs | 80 | Regulatory Affairs Managers, Compliance Officers |

| Clinical Trial Management | 60 | Clinical Research Coordinators, Project Managers |

| Medical Communications Services | 50 | Medical Science Liaisons, Communication Specialists |

| Market Access Strategies | 40 | Market Access Managers, Health Economists |

| Healthcare Provider Engagement | 70 | Healthcare Administrators, Outreach Coordinators |

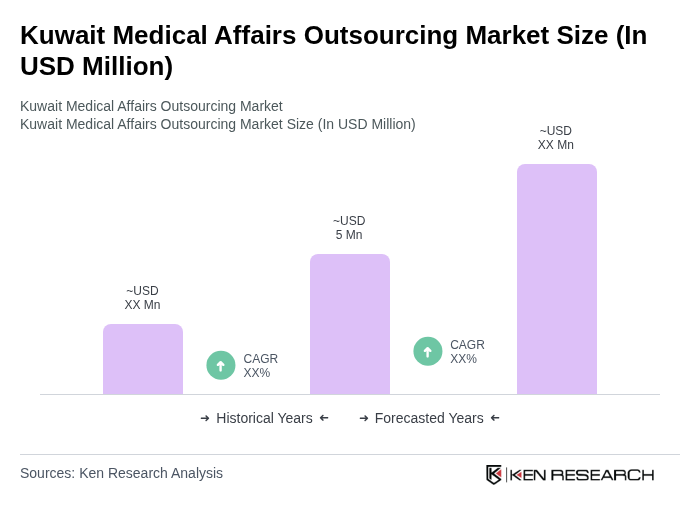

The Kuwait Medical Affairs Outsourcing Market is valued at approximately USD 5 million, reflecting a five-year historical analysis. This growth is driven by increasing demand for specialized medical services and the rise of pharmaceutical and biotechnology activities.