Region:Middle East

Author(s):Dev

Product Code:KRAD7603

Pages:81

Published On:December 2025

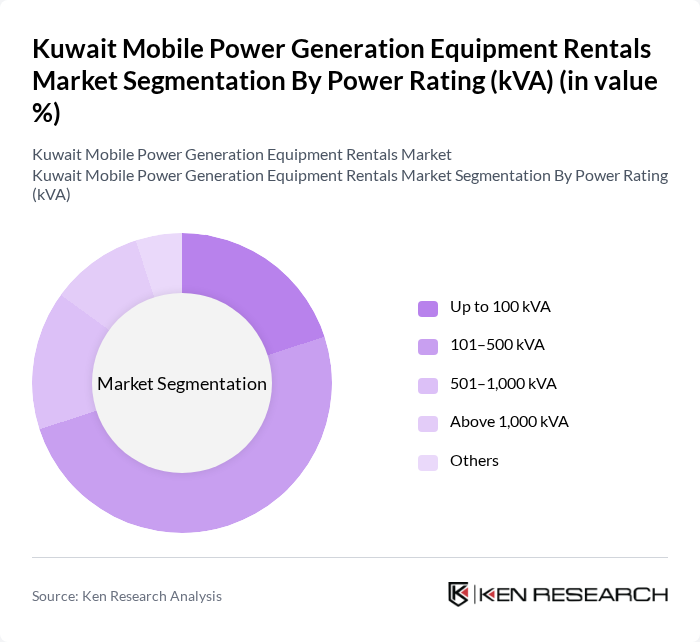

By Power Rating (kVA):

The power rating segmentation includes various subsegments: Up to 100 kVA, 101–500 kVA, 501–1,000 kVA, Above 1,000 kVA, and Others. The 101–500 kVA segment is currently dominating the market due to its versatility and suitability for a wide range of applications, including construction sites, small industrial loads, and temporary power needs for events, which is consistent with typical demand patterns in power rental markets where medium-capacity generators are widely preferred. This segment is favored by customers for its balance between power output and portability, making it ideal for both short-term and medium-term projects. The increasing number of infrastructure and real estate projects in Kuwait, particularly in and around Kuwait City and major industrial zones, has further solidified the demand for generators in this range.

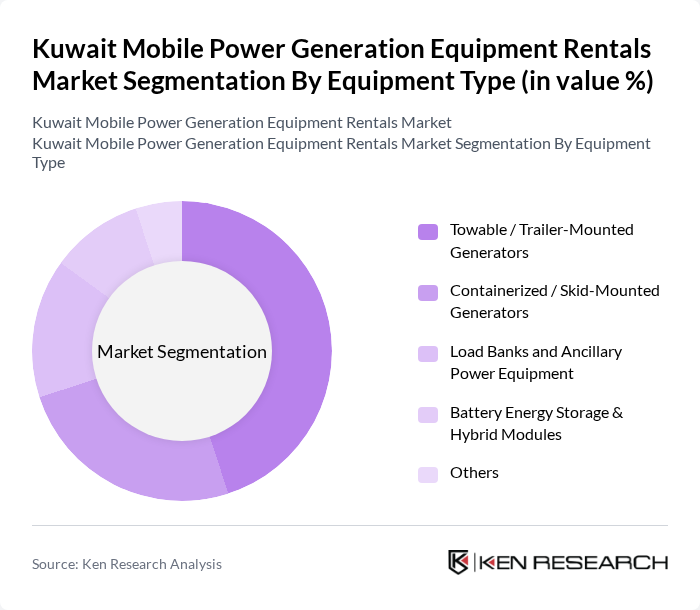

By Equipment Type:

The equipment type segmentation includes Towable / Trailer-Mounted Generators, Containerized / Skid-Mounted Generators, Load Banks and Ancillary Power Equipment, Battery Energy Storage & Hybrid Modules, and Others. The Towable / Trailer-Mounted Generators segment is leading the market due to their ease of transport and quick setup, making them ideal for temporary installations at construction sites, road projects, events, and small industrial applications, in line with global rental market trends favoring mobile diesel generator sets. Their flexibility, ability to be rapidly redeployed between sites, and compatibility with standard towing equipment have made them a preferred choice among contractors and event organizers, driving significant demand in the market. At the same time, there is a gradual increase in interest in containerized sets integrated with battery storage and hybrid modules for longer-duration and higher-capacity projects, reflecting broader Middle Eastern rental power usage patterns.

The Kuwait Mobile Power Generation Equipment Rentals Market is characterized by a dynamic mix of regional and international players. Leading participants such as Aggreko plc, JTC Power Rental (Jassim Transport & Stevedoring Co. K.S.C.P.), Mohamed Abdulrahman Al-Bahar LLC (Cat Rental Power – Kuwait), Al Askafi Trading & Contracting Co. (Power Rental Division), AIPS Power Solutions (Advanced Integrated Power Solutions Co.), Atlas Copco Specialty Rental – Kuwait, Dayim Equipment Rentals (Dayim Rentals – GCC Operations), Kandas Rental Solutions, Altaaqa Global Energy Services, Cummins Inc. (Cummins Power Generation – Rental Partners in Kuwait), Generac Power Systems (through Regional Distributors), Kohler Co. (Kohler-SDMO via Local Rental Partners), Jubaili Bros (Genset Rental & Power Solutions in Kuwait), Byrne Equipment Rental (Regional Power Rental), Aggreko–Kuwait Joint Project Partners & Local Contractors contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Kuwait mobile power generation equipment rentals market appears promising, driven by ongoing infrastructure projects and a shift towards sustainable energy solutions. As the government continues to invest in renewable energy initiatives, the demand for hybrid and eco-friendly power generation solutions is expected to rise. Additionally, advancements in technology, such as IoT integration for power management, will likely enhance operational efficiency and attract new customers seeking reliable and efficient power solutions.

| Segment | Sub-Segments |

|---|---|

| By Power Rating (kVA) | Up to 100 kVA –500 kVA –1,000 kVA Above 1,000 kVA Others |

| By Equipment Type | Towable / Trailer-Mounted Generators Containerized / Skid-Mounted Generators Load Banks and Ancillary Power Equipment Battery Energy Storage & Hybrid Modules Others |

| By Application | Construction & Infrastructure Projects Oil & Gas and Petrochemicals Utilities & Power Projects (Peak Shaving, Grid Support) Events, Commercial & Hospitality Emergency Backup & Disaster Recovery Others |

| By Fuel Type | Diesel Natural Gas Hybrid (Diesel + Solar / Battery) Others |

| By Rental Contract Duration | Short-term (Less than 3 Months) Medium-term (3–12 Months) Long-term (More than 12 Months) Others |

| By Service Offering | Power-Only Rental (Dry Hire) Full Turnkey Solutions (Power Plants, EPC & O&M) Fuel Management & Logistics Monitoring, Maintenance & Remote Operations Others |

| By Customer Type | Government & Utilities Oil & Gas, Petrochemicals & Industrial Construction Contractors Commercial & Services (Retail, Healthcare, Data Centers, Hospitality) Residential & Small Businesses Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Construction Industry Rentals | 100 | Project Managers, Site Supervisors |

| Event Management Power Solutions | 80 | Event Coordinators, Technical Directors |

| Oil & Gas Sector Equipment Usage | 70 | Operations Managers, Safety Officers |

| Renewable Energy Integration | 60 | Energy Consultants, Sustainability Managers |

| Emergency Power Supply Services | 90 | Facility Managers, Emergency Response Coordinators |

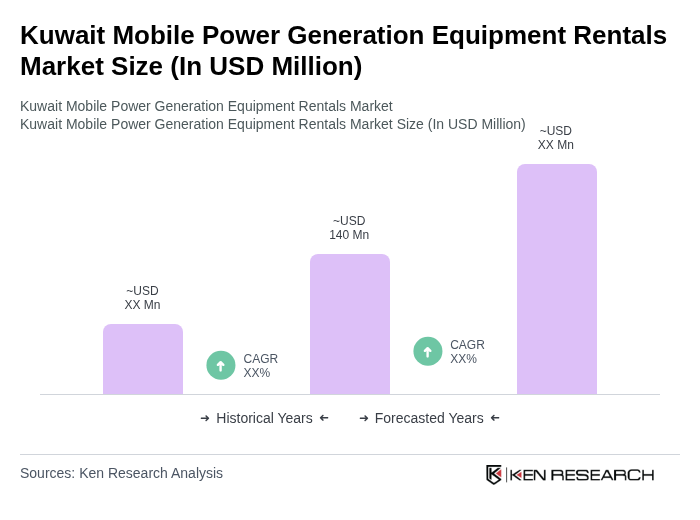

The Kuwait Mobile Power Generation Equipment Rentals Market is valued at approximately USD 140 million, reflecting a robust growth trajectory driven by increasing demand for temporary power solutions across various sectors, including construction and oil and gas.