Region:Middle East

Author(s):Geetanshi

Product Code:KRAC2380

Pages:87

Published On:October 2025

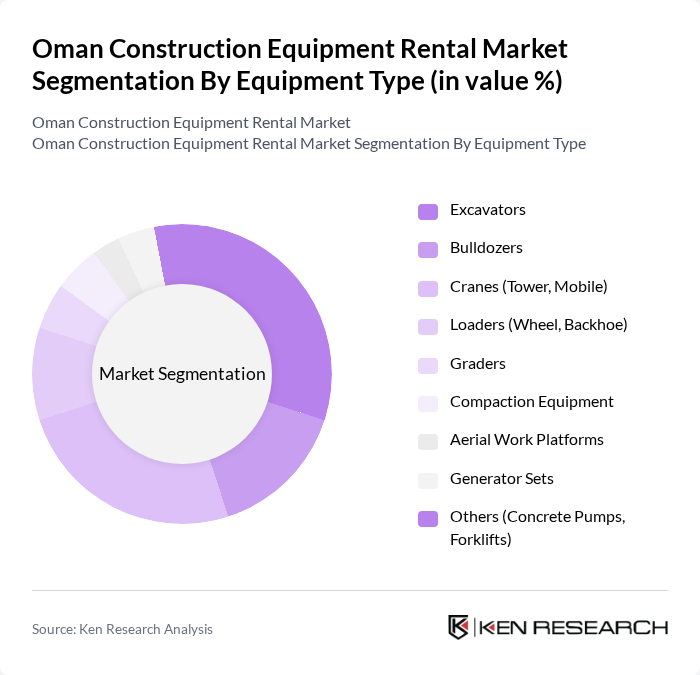

By Equipment Type:The equipment type segmentation includes various categories such as excavators, bulldozers, cranes, loaders, graders, compaction equipment, aerial work platforms, generator sets, and others. Among these, excavators and cranes are the most sought-after due to their versatility and essential role in construction projects. The demand for these equipment types is driven by ongoing infrastructure development and urbanization trends, with earth-moving machinery accounting for the largest share in the rental market .

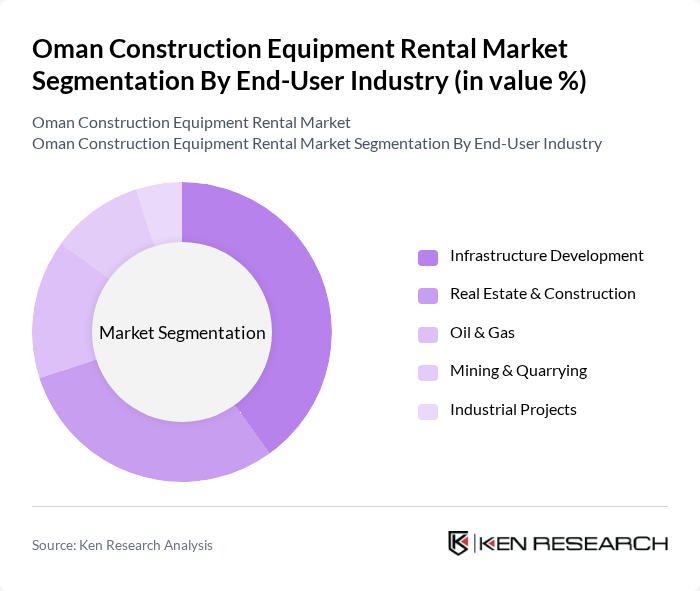

By End-User Industry:The end-user industry segmentation encompasses infrastructure development, real estate & construction, oil & gas, mining & quarrying, and industrial projects. The infrastructure development sector is the leading segment, driven by government initiatives and investments in public works, which require extensive use of rental equipment for efficiency and cost-effectiveness. Oil & gas and mining continue to represent significant demand drivers, especially for specialized heavy equipment .

The Oman Construction Equipment Rental Market is characterized by a dynamic mix of regional and international players. Leading participants such as Al-Bahar (Oman), Al Fairuz Trading & Contracting Co. LLC, Al Hooqani International Group, Al Maha Engineering LLC, Al Rawasi International LLC, Al Tamman Rental, Arabian Machinery & Heavy Equipment Co., Gulf Services & Industrial Supplies Co. LLC, Mohsin Haider Darwish LLC (MHD LLC), Oman Gulf Company SAOC, Sarooj Construction Company, United Equipment Rental LLC, Zawawi Trading Company LLC, Al Ansari Heavy Equipment Rental, Al Sahra Equipment Rental contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Oman construction equipment rental market appears promising, driven by ongoing infrastructure projects and a shift towards rental solutions. As urbanization accelerates, the demand for efficient and cost-effective equipment rentals is expected to rise. Additionally, the integration of advanced technologies, such as IoT and digital platforms, will enhance operational efficiency and safety standards. Companies that adapt to these trends will likely capture a larger market share and improve their competitive positioning in the evolving landscape.

| Segment | Sub-Segments |

|---|---|

| By Equipment Type | Excavators Bulldozers Cranes (Tower, Mobile) Loaders (Wheel, Backhoe) Graders Compaction Equipment Aerial Work Platforms Generator Sets Others (Concrete Pumps, Forklifts) |

| By End-User Industry | Infrastructure Development Real Estate & Construction Oil & Gas Mining & Quarrying Industrial Projects |

| By Application | Residential Construction Commercial Construction Industrial Facilities Government & Public Projects |

| By Rental Period | Short-Term (Daily/Weekly) Medium-Term (Monthly) Long-Term (Annual) |

| By Pricing Model | Fixed Pricing Dynamic/Variable Pricing |

| By Distribution Channel | Direct Rental Online Platforms Third-Party Agents/Distributors |

| By Region | Muscat Salalah Sohar Nizwa Duqm Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Construction Equipment Rental Companies | 60 | Business Owners, Operations Managers |

| General Contractors | 50 | Project Managers, Site Supervisors |

| Infrastructure Development Projects | 40 | Procurement Officers, Financial Analysts |

| Heavy Machinery Manufacturers | 40 | Sales Managers, Product Development Engineers |

| Construction Industry Associations | 40 | Policy Makers, Industry Analysts |

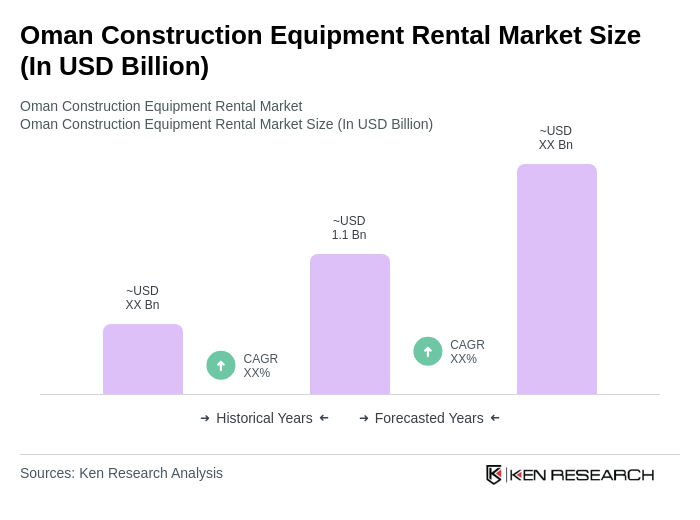

The Oman Construction Equipment Rental Market is valued at approximately USD 1.1 billion, reflecting a significant growth trend driven by increased construction activities, particularly in infrastructure and real estate development.