Region:Middle East

Author(s):Geetanshi

Product Code:KRAA9072

Pages:92

Published On:November 2025

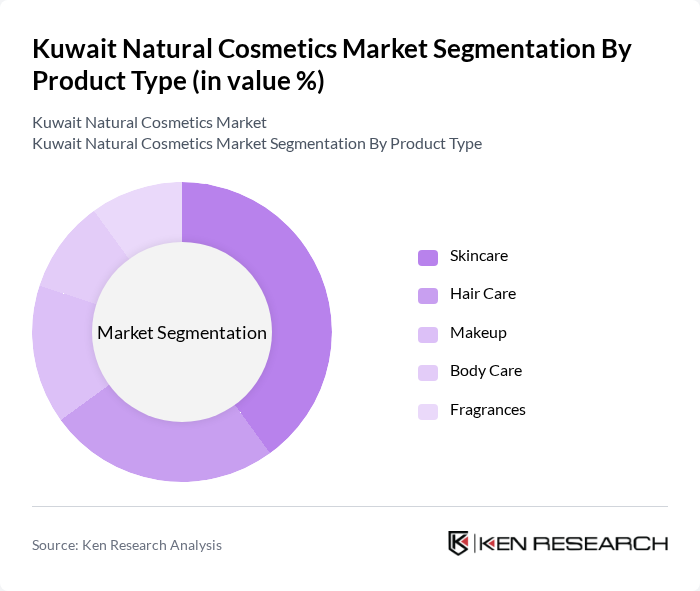

By Product Type:The product type segmentation includes skincare, hair care, makeup, body care, and fragrances. Skincare products dominate the market, reflecting the increasing focus on personal grooming, skin health, and the preference for natural and organic ingredients. Consumers are increasingly seeking products that offer natural benefits, leading to a rise in demand for organic and herbal skincare solutions. Hair care products also show significant growth, driven by rising awareness of hair health and the use of natural ingredients .

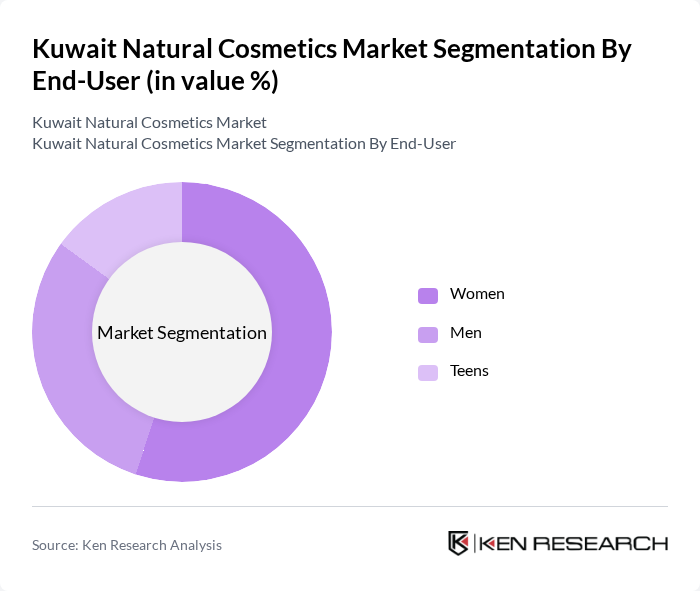

By End-User:The end-user segmentation includes women, men, and teens. Women represent the largest segment, driven by higher spending on beauty and personal care products and a strong trend of self-care and beauty consciousness. Men are also a growing segment, as they increasingly seek grooming products that are natural and effective. The teen segment is influenced by social media trends and the desire for safe, non-toxic products .

The Kuwait Natural Cosmetics Market is characterized by a dynamic mix of regional and international players. Leading participants such as Al Haramain Perfumes, Al Jazeera Perfumes, Souffle Beauty, The Body Shop, Lush Fresh Handmade Cosmetics, Herbal Essentials, Oriflame Cosmetics S.A., Amway Corporation, Neutrogena (Johnson & Johnson), Yves Rocher, Tarte Cosmetics, Burt's Bees, Weleda, Dr. Hauschka, L'Oréal Middle East contribute to innovation, geographic expansion, and service delivery in this space.

The future of the natural cosmetics market in Kuwait appears promising, driven by increasing consumer demand for sustainable and ethically produced products. As awareness of the benefits of natural ingredients continues to rise, brands that prioritize transparency and eco-friendliness are likely to thrive. Additionally, the integration of technology in product development and marketing strategies will enhance consumer engagement, paving the way for innovative product offerings that cater to evolving preferences and lifestyles.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Skincare Hair Care Makeup Body Care Fragrances |

| By End-User | Women Men Teens |

| By Distribution Channel | Online Retail Department Stores Specialty Stores Pharmacies Direct Sales |

| By Ingredient Type | Natural Ingredients Organic Ingredients Synthetic-Free |

| By Packaging Type | Bottles Tubes Jars |

| By Price Range | Premium Mid-Range Budget |

| By Brand Type | International Brands Local Brands |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Sector Insights | 100 | Store Managers, Beauty Advisors |

| Consumer Preferences Survey | 120 | Natural Cosmetics Users, Potential Buyers |

| Industry Expert Interviews | 40 | Cosmetic Chemists, Brand Managers |

| Distribution Channel Analysis | 60 | Distributors, Wholesalers |

| Market Trend Focus Groups | 40 | Beauty Influencers, Dermatologists |

The Kuwait Natural Cosmetics Market is valued at approximately USD 35 million, reflecting a growing trend towards natural and organic products driven by consumer awareness and demand for eco-friendly options.