Region:Middle East

Author(s):Shubham

Product Code:KRAD6719

Pages:87

Published On:December 2025

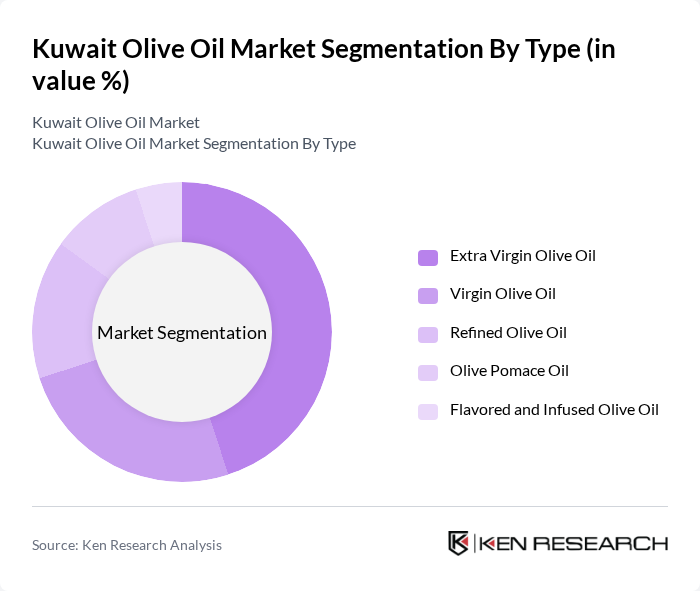

By Type:The olive oil market can be segmented into various types, including Extra Virgin Olive Oil, Virgin Olive Oil, Refined Olive Oil, Olive Pomace Oil, and Flavored and Infused Olive Oil. Each type caters to different consumer preferences and culinary uses, with Extra Virgin Olive Oil being the most sought after due to its superior quality and health benefits.

The Extra Virgin Olive Oil segment dominates the market due to its high nutritional value and flavor profile, making it a preferred choice among health-conscious consumers and culinary enthusiasts. The increasing trend towards organic and natural food products has further propelled the demand for Extra Virgin Olive Oil, as it is often perceived as a premium product. Virgin Olive Oil also holds a significant share, appealing to consumers looking for quality at a more affordable price point.

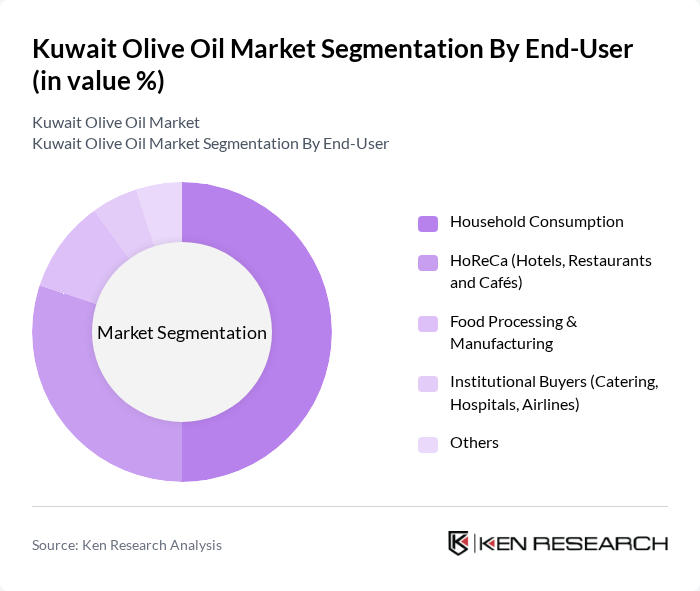

By End-User:The market can be segmented based on end-users, including Household Consumption, HoReCa (Hotels, Restaurants, and Cafés), Food Processing & Manufacturing, Institutional Buyers (Catering, Hospitals, Airlines), and Others. Each segment reflects different consumption patterns and purchasing behaviors.

Household Consumption is the leading segment, driven by the increasing use of olive oil in everyday cooking and its perceived health benefits. The HoReCa segment follows closely, as restaurants and cafes increasingly incorporate olive oil into their menus, catering to the growing demand for Mediterranean cuisine. The Food Processing & Manufacturing segment is also significant, as olive oil is used as an ingredient in various food products.

The Kuwait Olive Oil Market is characterized by a dynamic mix of regional and international players. Leading participants such as Al Wazzan Foodstuff Industries Group Co., Mezzan Holding Company (Kuwait Saudi Pharmaceutical Industries & Foodstuff – KSPICO / Food Division), Kuwait Agro Company, Sultan Center Food Products Co. (TSC), Lulu Hypermarket Kuwait (Emke Group – Private Label Olive Oil), Carrefour Kuwait (Majid Al Futtaim – Private Label Olive Oil), City Centre Kuwait (Gulfmart / Retail Private Labels), Union Trading Company (UTC), Al Shaya Group – Retail & Foodservice Concepts (e.g., Dean & Deluca, Starbucks, etc.), Areej Vegetable Oils & Derivatives Co. (AVOD), Borges International Group (Borges Olive Oil – Imported Brand), Deoleo S.A. (Bertolli, Carapelli – Imported Brands Active in GCC), Minerva S.A. Edible Oils & Food Enterprises (Minerva Olive Oil – Regional Presence), Filippo Berio (Salov Group) – Premium Imported Olive Oil Brand, Al Rifai Roastery & Mediterranean Foods (Olive Oil & Levant Food Products in Kuwait) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Kuwait olive oil market appears promising, driven by increasing health awareness and a growing preference for organic products. As consumers continue to embrace healthier lifestyles, the demand for high-quality olive oil is expected to rise. Additionally, the expansion of retail channels, particularly e-commerce, will enhance product accessibility. Innovations in product offerings and sustainable practices will likely attract a broader consumer base, positioning the market for significant growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Extra Virgin Olive Oil Virgin Olive Oil Refined Olive Oil Olive Pomace Oil Flavored and Infused Olive Oil |

| By End-User | Household Consumption HoReCa (Hotels, Restaurants and Cafés) Food Processing & Manufacturing Institutional Buyers (Catering, Hospitals, Airlines) Others |

| By Packaging Type | Glass Bottles Plastic Bottles (PET/HDPE) Tetra Packs/Cartons Metal Cans/Tins Bulk Containers (Drums, IBCs) |

| By Distribution Channel | Supermarkets/Hypermarkets Convenience Stores & Groceries Specialty & Gourmet Stores Online Retail (E-commerce Platforms) HoReCa & Foodservice Distributors |

| By Origin | Imported – Mediterranean (Spain, Italy, Greece) Imported – Levant & North Africa (Jordan, Palestine, Tunisia, Morocco) Repacked/Private Label in Kuwait |

| By Price Range | Premium & Organic Standard/Mid-range Value/Economy |

| By Consumer Demographics | Kuwaiti Nationals Expatriates from Mediterranean/Levant Countries Other Expatriate Segments Health-conscious & Lifestyle-driven Consumers |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Preferences for Olive Oil | 120 | Health-conscious Consumers, Culinary Enthusiasts |

| Retail Distribution Insights | 100 | Retail Managers, Category Buyers |

| Import and Export Dynamics | 80 | Importers, Exporters, Trade Analysts |

| Market Trends and Innovations | 70 | Food Industry Experts, Product Developers |

| Health Benefits Awareness | 90 | Nutritionists, Health Coaches, Dietitians |

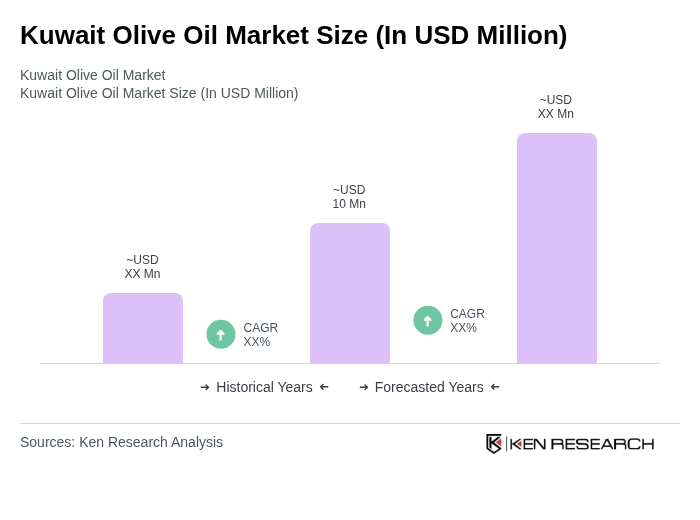

The Kuwait Olive Oil Market is valued at approximately USD 10 million, reflecting a five-year historical analysis. This growth is driven by increasing health consciousness, demand for organic products, and the popularity of Mediterranean diets.