Region:Middle East

Author(s):Shubham

Product Code:KRAD5534

Pages:92

Published On:December 2025

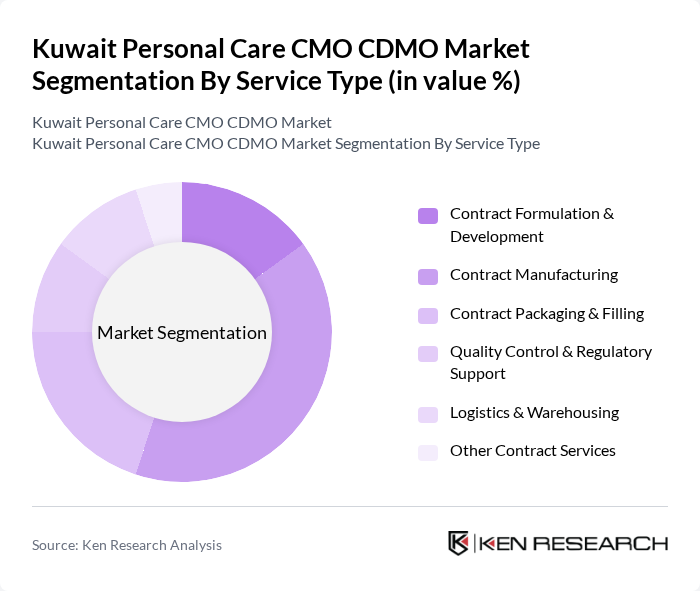

By Service Type:The service type segmentation includes various offerings that cater to the needs of personal care brands. The primary subsegments are Contract Formulation & Development, Contract Manufacturing, Contract Packaging & Filling, Quality Control & Regulatory Support, Logistics & Warehousing, and Other Contract Services. Among these, Contract Manufacturing is the leading subsegment, driven by the increasing trend of brands outsourcing production to focus on core competencies such as marketing and product development, consistent with global personal care contract manufacturing patterns where manufacturing services hold the largest share. This shift is largely influenced by the need for cost efficiency, scalability, and access to advanced manufacturing technologies, including automated filling, flexible batch sizes, and specialized capabilities for natural, dermocosmetic, and sensitive?skin formulations.

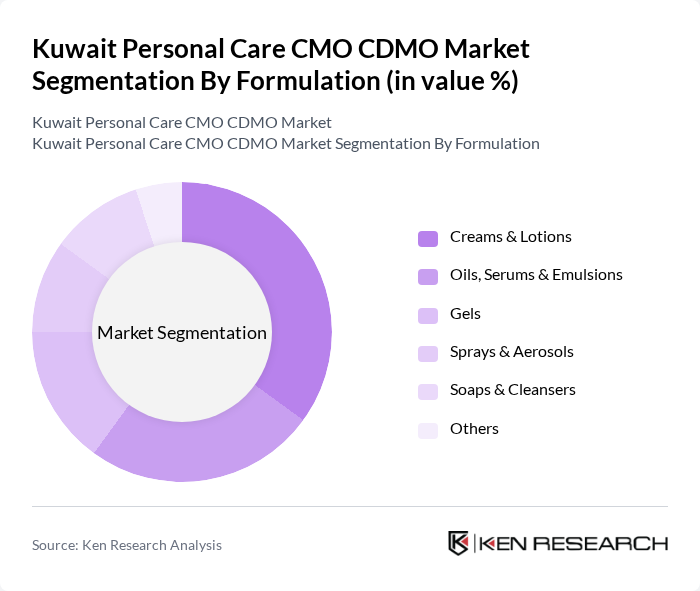

By Formulation:The formulation segmentation encompasses various types of personal care products, including Creams & Lotions, Oils, Serums & Emulsions, Gels, Sprays & Aerosols, Soaps & Cleansers, and Others. Creams & Lotions dominate this segment, driven by their versatility and widespread consumer acceptance across facial care, body care, and dermocosmetic applications, mirroring the global emphasis on skincare within personal care portfolios. The growing trend towards skincare, moisturization, anti?aging, and functional dermatology products, alongside increased demand for hydrating, barrier?repair, and sensitive?skin formulations, has further propelled the demand for creams and lotions, making them a staple in personal care routines and a priority category for CMO/CDMO partners.

The Kuwait Personal Care CMO CDMO Market is characterized by a dynamic mix of regional and international players. Leading participants such as Kuwait Saudi Pharmaceutical Industries Company (KSPICO) – Personal Care & Cosmetics Contract Manufacturing Division, Al Mufid Pharmaceuticals & Cosmetics Manufacturing Co., Kuwait Indo Trading & Contracting Co. – Personal Care Private Label Unit, Al Jothen General Trading & Contracting Co. – Professional Beauty & Salon Products, Al Dorra Cosmetics & Personal Care Manufacturing Co., Al Yasra Fashion & Beauty – Private Label Personal Care, Future Pharma Industries – Personal Care & Derma Contract Manufacturing (Kuwait Operations), Julphar Gulf Pharmaceutical Industries – Personal Care & OTC Contract Manufacturing (GCC Supply into Kuwait), VVF Limited – Personal Care Contract Manufacturing (GCC/Kuwait Supply), Fareva Group – Personal Care CMO/CDMO (Regional Supply into Kuwait), McBride plc – Household & Personal Care Contract Manufacturing (Middle East/Kuwait Distribution), KIK Consumer Products Inc. – Personal & Home Care Contract Manufacturing (Exports to Kuwait), Voyant Beauty Holdings LLC – Beauty & Personal Care CMO (Brand Support in Kuwait via Regional Hubs), Tropical Products Inc. – Private Label Personal Care Manufacturer (Exports via Distributors to Kuwait), Local Pharmacy & Retailer Private Labels (e.g., Boots, Sultan Center, LuLu, Carrefour Kuwait – Contracted Manufacturing Partners) contribute to innovation, geographic expansion, and service delivery in this space.

The Kuwait personal care market is poised for significant growth, driven by evolving consumer preferences and technological advancements. As sustainability becomes a core value, brands are expected to innovate with eco-friendly products. Additionally, the rise of digital marketing will enhance brand visibility and consumer engagement. The male grooming segment is anticipated to expand, reflecting changing societal norms. Overall, the market is likely to witness a dynamic transformation, fostering opportunities for both established and emerging players.

| Segment | Sub-Segments |

|---|---|

| By Service Type | Contract Formulation & Development Contract Manufacturing Contract Packaging & Filling Quality Control & Regulatory Support Logistics & Warehousing Other Contract Services |

| By Formulation | Creams & Lotions Oils, Serums & Emulsions Gels Sprays & Aerosols Soaps & Cleansers Others |

| By Personal Care Category | Skin Care Hair Care Oral Care Fragrances & Deodorants Bath & Shower Products Men’s Grooming Baby & Child Care Others |

| By Client Type | Multinational Personal Care Brands Regional GCC Brands Local Kuwaiti Brands Retailer & Pharmacy Private Labels E?commerce / D2C Brands Others |

| By Ingredient Positioning | Conventional/Synthetic Natural & Herbal Organic & Clean-Label Halal?Certified Dermatologist?Tested / Cosmeceutical Others |

| By Packaging Format | Bottles & Dispensers Tubes Jars Sachets & Single?Dose Packs Aerosol Cans Sustainable / Recyclable Packaging Others |

| By Customer Geography (Client Origin) | Kuwait?Based Clients GCC & Wider Middle East Clients Europe?Based Clients Asia?Pacific?Based Clients Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Personal Care Product Manufacturers | 100 | Product Development Managers, Quality Assurance Leads |

| Contract Manufacturing Organizations (CMOs) | 80 | Operations Managers, Business Development Executives |

| Contract Development and Manufacturing Organizations (CDMOs) | 70 | Regulatory Affairs Specialists, Project Managers |

| Raw Material Suppliers | 60 | Sales Managers, Supply Chain Coordinators |

| Retailers of Personal Care Products | 90 | Category Managers, Procurement Officers |

The Kuwait Personal Care CMO CDMO Market is valued at approximately USD 50 million, reflecting a five-year historical analysis. This growth is driven by increasing consumer demand for personal care products and a trend towards outsourcing manufacturing processes.