Region:Middle East

Author(s):Shubham

Product Code:KRAD6764

Pages:83

Published On:December 2025

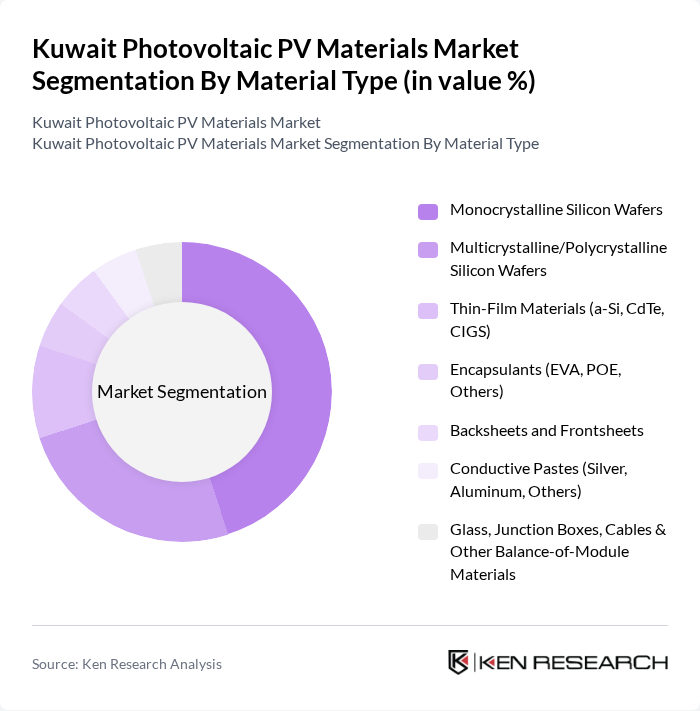

By Material Type:The material type segmentation includes various components essential for photovoltaic systems. The subsegments are Monocrystalline Silicon Wafers, Multicrystalline/Polycrystalline Silicon Wafers, Thin-Film Materials (a-Si, CdTe, CIGS), Encapsulants (EVA, POE, Others), Backsheets and Frontsheets, Conductive Pastes (Silver, Aluminum, Others), and Glass, Junction Boxes, Cables & Other Balance-of-Module Materials. Among these, Monocrystalline Silicon Wafers dominate the market due to their high efficiency and performance in converting sunlight into electricity, which is consistent with global PV technology trends where mono-PERC and similar high-efficiency mono products account for the majority of new module shipments. The increasing preference for high-efficiency solar panels in both residential and commercial applications, combined with falling module prices and improved performance in high-temperature environments typical of Kuwait, drives the demand for this subsegment.

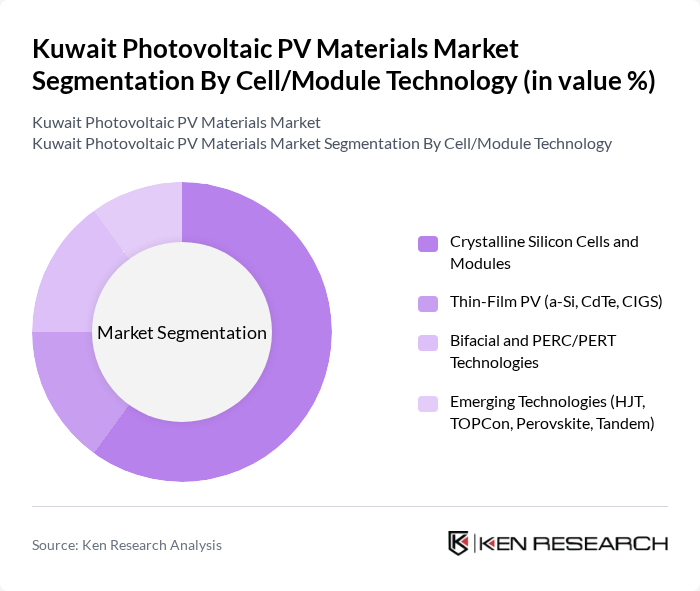

By Cell/Module Technology:This segmentation includes Crystalline Silicon Cells and Modules, Thin-Film PV (a-Si, CdTe, CIGS), Bifacial and PERC/PERT Technologies, and Emerging Technologies (HJT, TOPCon, Perovskite, Tandem). Crystalline Silicon Cells and Modules are the leading technology in the market, primarily due to their established efficiency, bankability, and reliability in utility-scale and rooftop applications across the GCC. The growing trend towards bifacial technology and advanced PERC/TOPCon architectures, which allow for higher energy yields and better performance under Kuwait’s high-irradiance, high-temperature, and dusty conditions, is also gaining traction, further enhancing the market's dynamics and materials demand for high-spec glass, encapsulants, and backsheets.

The Kuwait Photovoltaic PV Materials Market is characterized by a dynamic mix of regional and international players. Leading participants such as Kuwait Institute for Scientific Research (KISR), Shagaya Renewable Energy Park Project Developers (e.g., Kuwait Authority for Partnership Projects and Consortia), Kuwait National Petroleum Company (KNPC), Ministry of Electricity, Water and Renewable Energy (MEWRE) – Renewable Projects Unit, Al Ghanim International General Trading & Contracting Co., Kharafi National, Al Mulla Engineering Group, Gulf Energy Environment Protection Co. (GEEP), Enviromena Power Systems, ACWA Power, JinkoSolar Holding Co., Ltd., Trina Solar Co., Ltd., LONGi Green Energy Technology Co., Ltd., Canadian Solar Inc., JA Solar Technology Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Kuwait photovoltaic materials market appears promising, driven by increasing government support and technological advancements. As the country aims to diversify its energy sources, the integration of smart technologies and energy storage solutions will likely enhance the efficiency and reliability of solar energy systems. Furthermore, the growing trend towards decentralized energy production will empower consumers, fostering a more sustainable energy landscape in Kuwait.

| Segment | Sub-Segments |

|---|---|

| By Material Type | Monocrystalline Silicon Wafers Multicrystalline/Polycrystalline Silicon Wafers Thin-Film Materials (a-Si, CdTe, CIGS) Encapsulants (EVA, POE, Others) Backsheets and Frontsheets Conductive Pastes (Silver, Aluminum, Others) Glass, Junction Boxes, Cables & Other Balance-of-Module Materials |

| By Cell/Module Technology | Crystalline Silicon Cells and Modules Thin-Film PV (a-Si, CdTe, CIGS) Bifacial and PERC/PERT Technologies Emerging Technologies (HJT, TOPCon, Perovskite, Tandem) |

| By Application | Utility-Scale PV Projects Commercial & Industrial (C&I) Rooftop Residential Rooftop Building-Integrated Photovoltaics (BIPV) Off-Grid and Portable Power Solutions |

| By End-User / Procurement Segment | EPC Contractors and Project Developers Module and Cell Manufacturers Government & Utilities (MEW/Authority-Led Projects) Commercial & Industrial End-Users Residential Installers and System Integrators |

| By Import Origin | China Other Asia-Pacific (Japan, South Korea, others) Europe North America Rest of World |

| By Project Type | Government-Tendered & Public Sector Projects Public-Private Partnership (PPP) Projects Private Utility-Scale Projects Distributed Rooftop Programs |

| By Investment Source | Domestic Capital Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Multilateral and Development Finance Government Schemes and Sovereign Funds |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Photovoltaic Material Suppliers | 60 | Sales Managers, Product Development Heads |

| Solar Project Developers | 60 | Project Managers, Technical Directors |

| Regulatory Authorities | 40 | Policy Makers, Energy Analysts |

| Installation Companies | 70 | Operations Managers, Installation Supervisors |

| Research Institutions | 40 | Research Scientists, Academic Professors |

The Kuwait Photovoltaic PV Materials Market is valued at approximately USD 130 million, reflecting a significant growth driven by increasing demand for renewable energy and government initiatives aimed at promoting solar energy in the region.