Region:Middle East

Author(s):Rebecca

Product Code:KRAD5067

Pages:88

Published On:December 2025

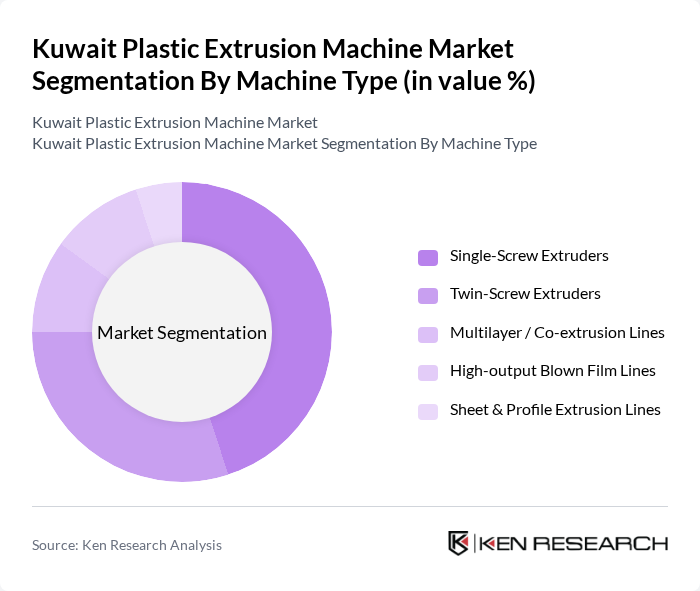

By Machine Type:The machine type segmentation includes various categories such as Single-Screw Extruders, Twin-Screw Extruders, Multilayer / Co-extrusion Lines, High-output Blown Film Lines, and Sheet & Profile Extrusion Lines. This structure is consistent with how global and regional plastic extrusion machinery markets are commonly segmented by technology and process (single-screw, twin-screw, multilayer, blown film, and sheet/film/profile lines). Among these, Single-Screw Extruders dominate the market due to their versatility, relatively lower investment cost, and suitability for high-volume production of pipes, profiles, and films, which reflects global patterns where single-screw machines hold the largest share of plastic extrusion equipment. The demand for Twin-Screw Extruders is also significant and increasing, particularly in applications requiring high mixing, compounding, and processing of complex or recycled materials, in line with the growing role of twin-screw technology in packaging, automotive, and construction applications in Kuwait.

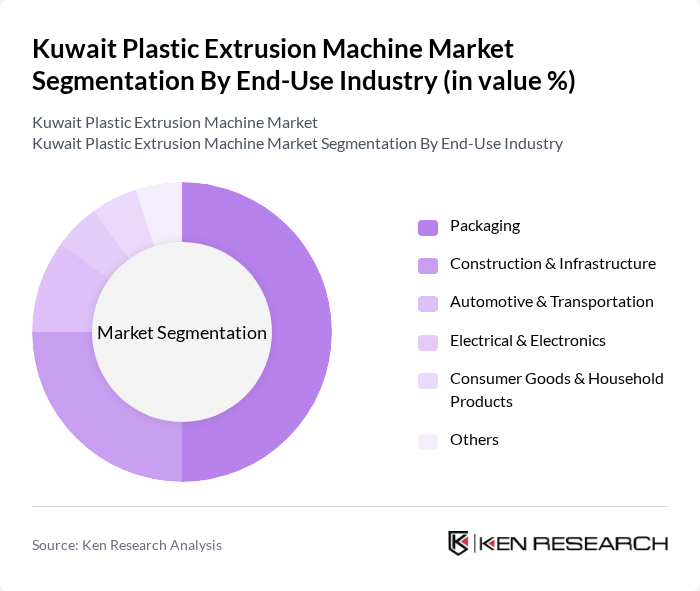

By End-Use Industry:The end-use industry segmentation encompasses Packaging, Construction & Infrastructure, Automotive & Transportation, Electrical & Electronics, Consumer Goods & Household Products, and Others, which is consistent with the main demand sectors identified for extrusion machinery and extruded plastics in Kuwait and the wider Middle East. The Packaging sector leads the market, driven by the increasing demand for flexible films, rigid containers, and industrial packaging, supported by growth in food, retail, and consumer goods, mirroring global extrusion machinery trends where packaging accounts for the largest end-use share. The Construction & Infrastructure segment is also significant, as the need for pressure and non-pressure pipes, conduits, cable ducts, and window/door profiles continues to rise with ongoing utilities expansion, housing, and infrastructure projects across Kuwait.

The Kuwait Plastic Extrusion Machine Market is characterized by a dynamic mix of regional and international players. Leading participants such as KraussMaffei Group GmbH, Reifenhäuser GmbH & Co. KG Maschinenfabrik, Davis-Standard, LLC, BATtenfeld-Cincinnati Austria GmbH, Cincinnati Milacron LLC, Shibaura Machine Co., Ltd. (formerly Toshiba Machine), Costruzioni Meccaniche Luigi Bandera SpA, Amut SpA, Windmöller & Hölscher KG, Jwell Machinery Co., Ltd., KraussMaffei Berstorff (extrusion systems division), Al Sulaiman Group (regional distributor & service provider, Kuwait/GCC), Gulf Extrusions LLC (regional extrusion technology supplier), Krah Middle East Co. Ltd. (large-diameter pipe extrusion systems in GCC), Future Plastic Industries Co. W.L.L. (Kuwait – major plastic converter & machinery buyer) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Kuwait plastic extrusion machine market appears promising, driven by increasing demand for sustainable and innovative plastic solutions. As manufacturers adopt automation and Industry 4.0 practices, operational efficiencies are expected to improve significantly. Additionally, the focus on eco-friendly technologies will likely lead to the development of biodegradable plastics, aligning with global sustainability trends. This evolving landscape presents opportunities for growth and innovation, positioning Kuwait as a competitive player in the regional plastic manufacturing sector.

| Segment | Sub-Segments |

|---|---|

| By Machine Type | Single-Screw Extruders Twin-Screw Extruders Multilayer / Co-extrusion Lines High-output Blown Film Lines Sheet & Profile Extrusion Lines |

| By End-Use Industry | Packaging Construction & Infrastructure (pipes, profiles, cables) Automotive & Transportation Electrical & Electronics Consumer Goods & Household Products Others (medical, agriculture, industrial) |

| By Polymer Processed | Polyethylene (LDPE, LLDPE, HDPE) Polypropylene (PP) Polyvinyl Chloride (PVC) Engineering & Specialty Plastics (ABS, PET, PA, etc.) |

| By Application | Film & Flexible Packaging Pipe, Conduit & Profile Extrusion Sheet, Board & Panel Extrusion Cable Coating & Jacketing Others (compounding, pellets, laminates) |

| By Technology / Automation Level | Manual & Semi-automatic Lines Fully Automatic PLC-controlled Lines Industry 4.0-enabled / Smart Extrusion Systems |

| By Throughput Capacity | Low Capacity (up to 100 kg/h) Medium Capacity (100–500 kg/h) High Capacity (above 500 kg/h) |

| By Buyer Type | Large Plastic Converters & Integrated Groups Small and Medium-sized Processors Trade, Rental & Contract Extrusion Service Providers |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Plastic Packaging Manufacturers | 100 | Production Managers, Quality Control Supervisors |

| Automotive Component Producers | 80 | Operations Directors, Engineering Managers |

| Construction Material Suppliers | 70 | Procurement Managers, Project Engineers |

| Consumer Goods Manufacturers | 90 | Product Development Managers, Supply Chain Analysts |

| Research and Development Firms | 60 | R&D Directors, Innovation Managers |

The Kuwait Plastic Extrusion Machine market is valued at approximately USD 140 million, reflecting a historical analysis and alignment with regional benchmarks in the Middle East. This valuation is driven by increasing demand across various industries, including packaging and construction.