Region:Middle East

Author(s):Geetanshi

Product Code:KRAE0666

Pages:80

Published On:December 2025

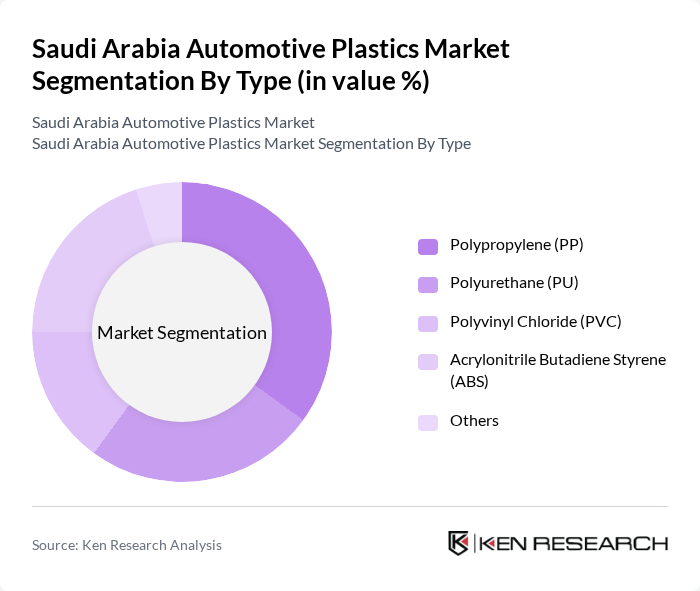

By Type:The automotive plastics market in Saudi Arabia is segmented into various types, including Polypropylene (PP), Polyurethane (PU), Polyvinyl Chloride (PVC), Acrylonitrile Butadiene Styrene (ABS), and others. Among these, Polypropylene (PP) is the leading sub-segment due to its lightweight properties, cost-effectiveness, and versatility in automotive applications. The increasing focus on fuel efficiency and sustainability drives the demand for PP in vehicle manufacturing.

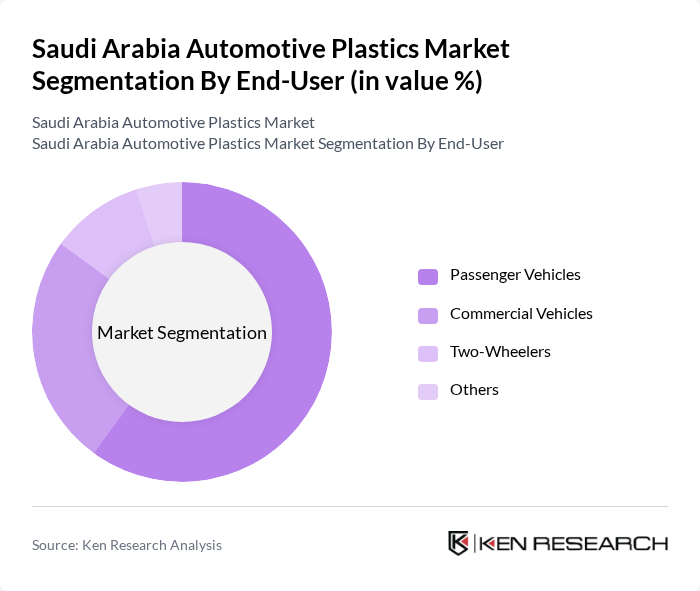

By End-User:The end-user segmentation of the automotive plastics market includes Passenger Vehicles, Commercial Vehicles, Two-Wheelers, and others. Passenger Vehicles dominate the market due to the rising consumer preference for lightweight and fuel-efficient cars. The increasing production of electric vehicles also contributes to the growth of this segment, as manufacturers seek to reduce weight and enhance performance.

The Saudi Arabia Automotive Plastics Market is characterized by a dynamic mix of regional and international players. Leading participants such as SABIC, Advanced Petrochemical Company, Saudi Plastic Factory, Al-Jomaih and Shell Lubricating Oil Company, National Industrialization Company (Tasnee), Saudi Arabian Oil Company (Saudi Aramco), Al-Watania Plastics, Saudi International Petrochemical Company (Sipchem), Gulf Plastic Industries, Al-Falak Electronic Equipment & Supplies, Al-Muhaidib Group, Al-Hokair Group, Al-Suwaidi Industrial Services, Al-Babtain Group, Al-Mansour Automotive contribute to innovation, geographic expansion, and service delivery in this space.

The future of the automotive plastics market in Saudi Arabia appears promising, driven by technological advancements and a shift towards sustainability. As the electric vehicle market expands, the demand for lightweight and recyclable materials is expected to grow significantly. Additionally, the integration of smart technologies in vehicles will create new opportunities for innovative plastic applications. Manufacturers are likely to focus on enhancing product performance while adhering to environmental regulations, positioning themselves competitively in a rapidly evolving market landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Polypropylene (PP) Polyurethane (PU) Polyvinyl Chloride (PVC) Acrylonitrile Butadiene Styrene (ABS) Others |

| By End-User | Passenger Vehicles Commercial Vehicles Two-Wheelers Others |

| By Application | Interior Components Exterior Components Under-the-Hood Components Others |

| By Region | Central Region Eastern Region Western Region Southern Region |

| By Manufacturing Process | Injection Molding Blow Molding Thermoforming Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Product Form | Sheets Films Molded Parts Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Manufacturers | 100 | Production Managers, R&D Directors |

| Plastic Suppliers | 80 | Sales Managers, Product Development Engineers |

| Automotive Design Firms | 60 | Design Engineers, Material Specialists |

| Regulatory Bodies | 50 | Policy Makers, Compliance Officers |

| Industry Consultants | 40 | Market Analysts, Strategic Advisors |

The Saudi Arabia Automotive Plastics Market is valued at approximately USD 445 million, driven by the increasing demand for lightweight automotive components that enhance fuel efficiency and reduce emissions.