Region:Middle East

Author(s):Shubham

Product Code:KRAC4237

Pages:80

Published On:October 2025

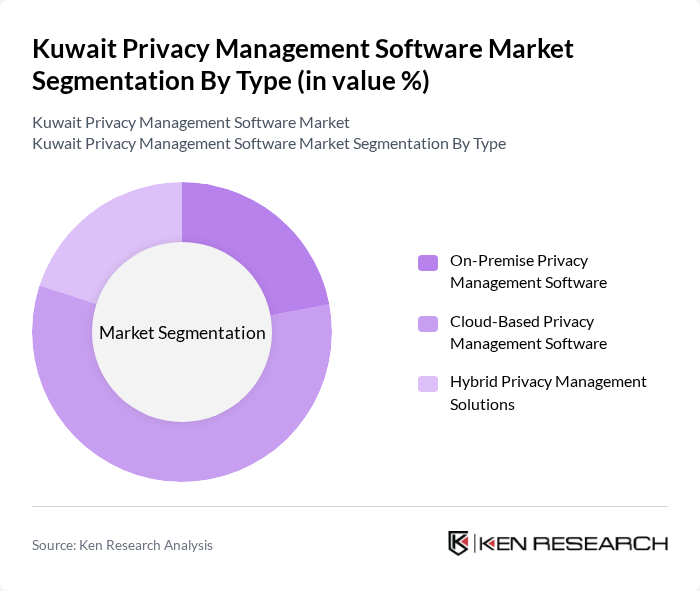

By Type:

The Kuwait Privacy Management Software Market is segmented into On-Premise Privacy Management Software, Cloud-Based Privacy Management Software, and Hybrid Privacy Management Solutions. Cloud-Based Privacy Management Software is the leading sub-segment, driven by the preference for scalable, remotely accessible solutions. Organizations increasingly favor cloud-based models for their cost-effectiveness, rapid deployment, and ability to support remote work and digital transformation initiatives. Hybrid solutions are gaining traction among enterprises seeking flexibility, while on-premise deployments remain relevant for organizations with strict data residency requirements.

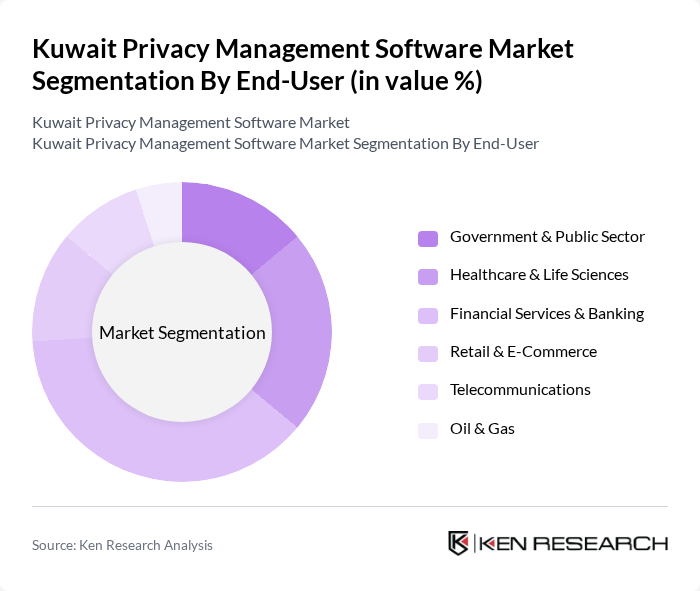

By End-User:

The market is further segmented by end-user into Government & Public Sector, Healthcare & Life Sciences, Financial Services & Banking, Retail & E-Commerce, Telecommunications, and Oil & Gas. Financial Services & Banking is the leading sub-segment, propelled by stringent compliance obligations and the necessity for robust data protection. Healthcare & Life Sciences is also a major adopter, reflecting the sector’s need to comply with health data privacy regulations and manage sensitive patient information. Retail & E-Commerce and Telecommunications are expanding segments due to increasing online transactions and data-driven services, while Oil & Gas and Government remain steady contributors.

The Kuwait Privacy Management Software Market is characterized by a dynamic mix of regional and international players. Leading participants such as IBM Corporation, Microsoft Corporation, Oracle Corporation, SAP SE, TrustArc Inc., OneTrust LLC, RSA Security LLC, Varonis Systems Inc., Proofpoint Inc., BigID Inc., Securiti.ai, Collibra NV, Symantec (Broadcom Inc.), Informatica LLC, Exterro Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Kuwait privacy management software market appears promising, driven by increasing regulatory pressures and consumer expectations for data protection. As organizations prioritize compliance and data security, the adoption of automated compliance solutions is expected to rise significantly. Furthermore, the integration of advanced technologies such as artificial intelligence and machine learning will enhance the capabilities of privacy management software, making it more efficient and user-friendly. This evolution will likely lead to a more robust market landscape in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | On-Premise Privacy Management Software Cloud-Based Privacy Management Software Hybrid Privacy Management Solutions |

| By End-User | Government & Public Sector Healthcare & Life Sciences Financial Services & Banking Retail & E-Commerce Telecommunications Oil & Gas |

| By Industry Vertical | Telecommunications Education Manufacturing Energy & Utilities Gaming & Media |

| By Deployment Mode | Public Cloud Private Cloud Hybrid Cloud |

| By Compliance Standard | Kuwait Data Privacy Protection Regulation GDPR ISO 27001 CCPA |

| By Company Size | Small Enterprises Medium Enterprises Large Enterprises |

| By Region | Capital Governorate (Kuwait City) Hawalli Governorate Farwaniya Governorate Ahmadi Governorate Jahra Governorate Mubarak Al-Kabeer Governorate |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Financial Services Privacy Management | 100 | Compliance Officers, IT Security Managers |

| Healthcare Data Protection Solutions | 60 | Data Protection Officers, IT Administrators |

| Retail Sector Privacy Compliance | 50 | Marketing Managers, IT Managers |

| Telecommunications Data Privacy | 40 | Network Security Managers, Compliance Analysts |

| Government Sector Privacy Initiatives | 40 | Policy Makers, IT Governance Officers |

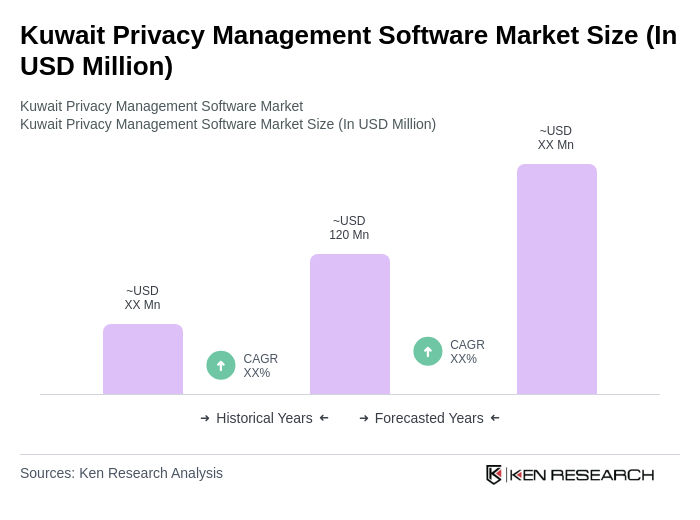

The Kuwait Privacy Management Software Market is valued at approximately USD 120 million, driven by increasing regulatory requirements for data protection, consumer awareness, and digital transformation across various sectors.