Region:Middle East

Author(s):Rebecca

Product Code:KRAD1486

Pages:95

Published On:November 2025

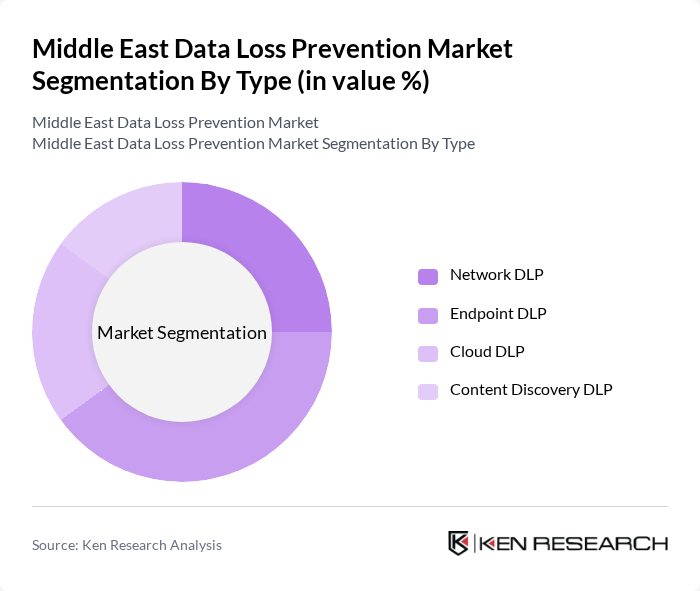

By Type:

The segmentation by type includes Network DLP, Endpoint DLP, Cloud DLP, and Content Discovery DLP. Among these,Endpoint DLPis currently the leading subsegment, driven by the increasing use of mobile devices, remote work arrangements, and the proliferation of BYOD (Bring Your Own Device) policies. Organizations are focusing on protecting sensitive data at endpoints, which are often vulnerable to breaches. The rise in cyber threats and the need for comprehensive data protection strategies are propelling the growth of Endpoint DLP solutions.

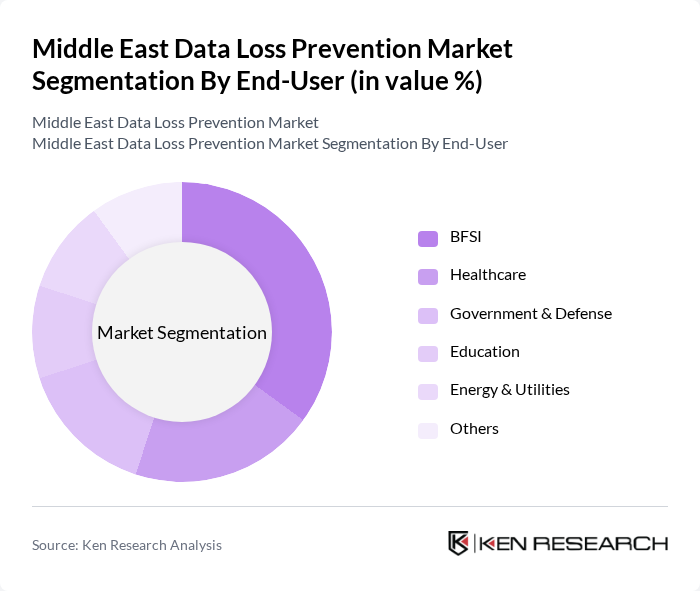

By End-User:

This segmentation includes BFSI, Healthcare, Government & Defense, Education, Energy & Utilities, and Others. TheBFSI sectoris the dominant end-user, primarily due to stringent regulatory requirements and the critical need to protect sensitive financial data. Financial institutions are increasingly adopting DLP solutions to mitigate risks associated with data breaches and ensure compliance with regulations, thus driving the growth of this segment.

The Middle East Data Loss Prevention Market is characterized by a dynamic mix of regional and international players. Leading participants such as McAfee, Broadcom (Symantec Enterprise Division), Digital Guardian, Forcepoint, Trend Micro, Check Point Software Technologies, Palo Alto Networks, IBM Security, Microsoft, RSA Security, Proofpoint, Varonis Systems, Zscaler, Cisco Systems, Trellix, GTB Technologies, InfoWatch, HelpSystems (Fortra), Safetica, Digital Guardian contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Middle East Data Loss Prevention market appears promising, driven by the increasing integration of advanced technologies and a growing emphasis on data security. As organizations continue to adapt to remote work environments, the demand for effective DLP solutions is expected to rise. Additionally, the expansion of IoT devices will necessitate enhanced data protection measures, further propelling market growth. Companies are likely to invest in innovative solutions to address evolving threats and regulatory requirements.

| Segment | Sub-Segments |

|---|---|

| By Type | Network DLP Endpoint DLP Cloud DLP Content Discovery DLP |

| By End-User | BFSI Healthcare Government & Defense Education Energy & Utilities Others |

| By Deployment Mode | On-Premises Cloud-Based Hybrid |

| By Industry Vertical | Retail Manufacturing Telecommunications & IT Oil & Gas Others |

| By Region | GCC Countries (Saudi Arabia, UAE, Qatar, Kuwait, Oman, Bahrain) Levant Region (Jordan, Lebanon, Iraq, Syria, Palestine) North Africa (Egypt, Morocco, Algeria, Tunisia, Libya) Rest of Middle East |

| By Compliance Requirement | GDPR Compliance HIPAA Compliance PCI DSS Compliance National Data Protection Laws (e.g., UAE PDPL, Saudi PDPL) Others |

| By Service Type | Consulting Services Implementation Services Managed Services Training & Support Services Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Financial Services DLP Implementation | 100 | IT Security Managers, Compliance Officers |

| Healthcare Data Protection Strategies | 60 | Data Protection Officers, IT Administrators |

| Telecommunications DLP Solutions | 50 | Network Security Engineers, Risk Management Executives |

| Government Sector Data Loss Prevention | 40 | Cybersecurity Analysts, Policy Makers |

| Retail Industry DLP Practices | 70 | IT Managers, Operations Directors |

The Middle East Data Loss Prevention Market is valued at approximately USD 330 million, reflecting a significant increase driven by the rising frequency of data breaches and the need for organizations to comply with regulatory requirements and protect sensitive information.