Region:Middle East

Author(s):Rebecca

Product Code:KRAA9459

Pages:88

Published On:November 2025

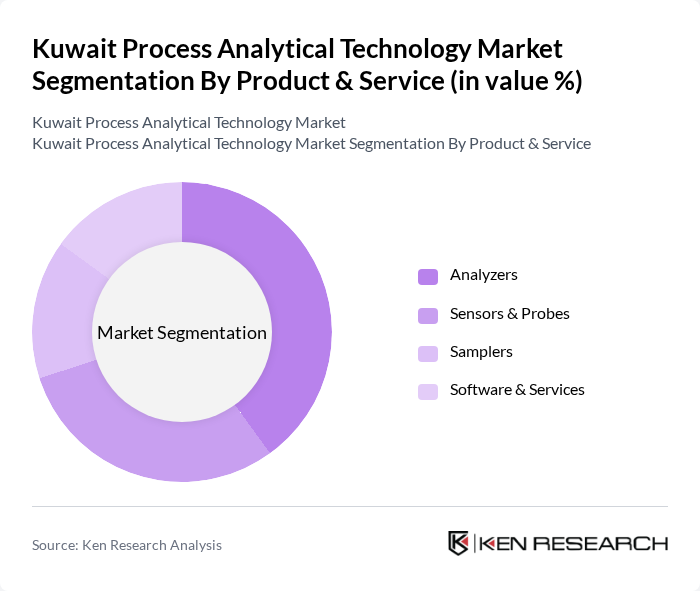

By Product & Service:The product and service segment includes analyzers, sensors & probes, samplers, and software & services. Analyzers are crucial for real-time data collection and quality assurance, while sensors & probes facilitate accurate measurements. Samplers are essential for collecting representative samples, and software & services support data management and analysis .

The analyzers sub-segment is currently dominating the market due to their critical role in ensuring product quality and compliance with regulatory standards. The increasing complexity of industrial processes necessitates advanced analytical solutions that can provide real-time data and insights. As industries strive for higher efficiency and lower operational costs, the demand for sophisticated analyzers continues to rise, making them the leading product in the market .

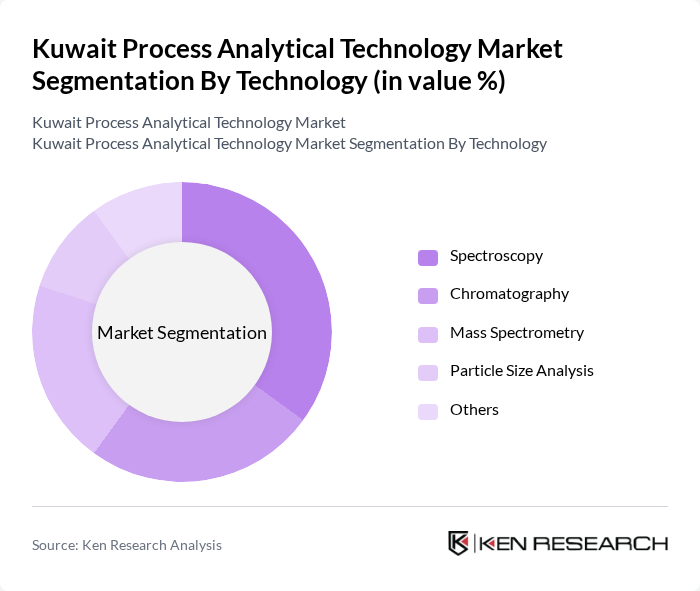

By Technology:The technology segment encompasses spectroscopy, chromatography, mass spectrometry, particle size analysis, and others. Spectroscopy is widely used for its versatility in analyzing various substances, while chromatography is essential for separating mixtures. Mass spectrometry provides detailed molecular information, and particle size analysis is crucial for quality control in many industries .

Spectroscopy leads the technology segment due to its broad applicability across various industries, including pharmaceuticals, food and beverage, and environmental testing. Its ability to provide rapid and accurate results makes it indispensable for quality control and process monitoring. The growing emphasis on safety and compliance in these sectors further drives the demand for spectroscopy solutions .

The Kuwait Process Analytical Technology Market is characterized by a dynamic mix of regional and international players. Leading participants such as ABB Ltd., Siemens AG, Emerson Electric Co., Honeywell International Inc., Yokogawa Electric Corporation, Endress+Hauser AG, Agilent Technologies Inc., PerkinElmer Inc., Thermo Fisher Scientific Inc., KROHNE Group, Mettler-Toledo International Inc., Rockwell Automation Inc., Teledyne Technologies Incorporated, AMETEK Inc., Hach Company contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Kuwait process analytical technology market appears promising, driven by ongoing advancements in automation and digitalization. As industries increasingly adopt Industry 4.0 practices, the integration of AI and machine learning into analytical processes is expected to enhance data analysis capabilities. Furthermore, the growing emphasis on sustainability will likely propel investments in eco-friendly technologies, fostering innovation and efficiency across sectors, particularly in pharmaceuticals and food production.

| Segment | Sub-Segments |

|---|---|

| By Product & Service | Analyzers Sensors & Probes Samplers Software & Services |

| By Technology | Spectroscopy Chromatography Mass Spectrometry Particle Size Analysis Others |

| By Measurement Method | In-line Measurement On-line Measurement At-line Measurement Off-line Measurement Others |

| By Application | Quality Control Process Monitoring Research and Development Environmental Testing Manufacturing Applications Others |

| By End-User | Pharmaceutical Manufacturers Biopharmaceutical Manufacturers Chemical Manufacturing Oil and Gas Food and Beverage Contract Research and Manufacturing Organizations Others |

| By Industry Vertical | Healthcare Manufacturing Energy Water and Wastewater Treatment Others |

| By Region | Central Kuwait Southern Kuwait Northern Kuwait Others |

| By Policy Support | Government Subsidies Tax Incentives Research Grants Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pharmaceutical Manufacturing | 100 | Quality Control Managers, R&D Directors |

| Food & Beverage Processing | 60 | Production Managers, Compliance Officers |

| Petrochemical Industry | 80 | Process Engineers, Safety Managers |

| Environmental Monitoring | 50 | Environmental Scientists, Regulatory Affairs Specialists |

| Research Institutions | 40 | Lab Technicians, Research Scientists |

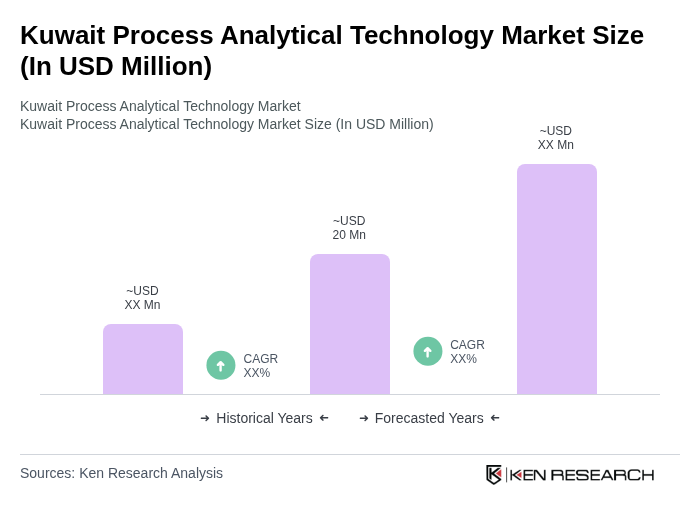

The Kuwait Process Analytical Technology market is valued at approximately USD 20 million, reflecting a five-year historical analysis. This growth is driven by increasing automation demands, real-time monitoring needs, and stringent regulatory requirements across various sectors.