Region:Global

Author(s):Geetanshi

Product Code:KRAE1301

Pages:85

Published On:February 2026

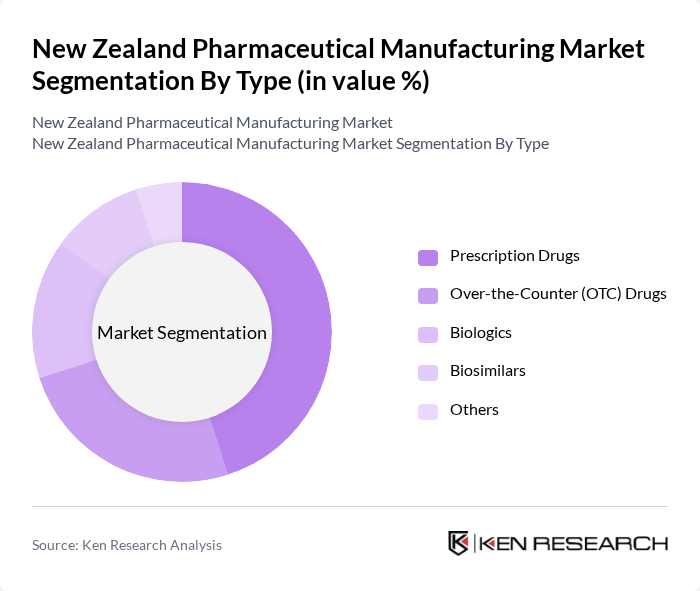

By Type:The pharmaceutical manufacturing market is segmented into various types, including Prescription Drugs, Over-the-Counter (OTC) Drugs, Biologics, Biosimilars, and Others. Prescription drugs dominate the market due to their essential role in treating chronic diseases and the increasing prevalence of conditions such as diabetes and cardiovascular diseases. The demand for OTC drugs is also rising as consumers seek self-medication options for minor ailments, contributing to the overall growth of the market.

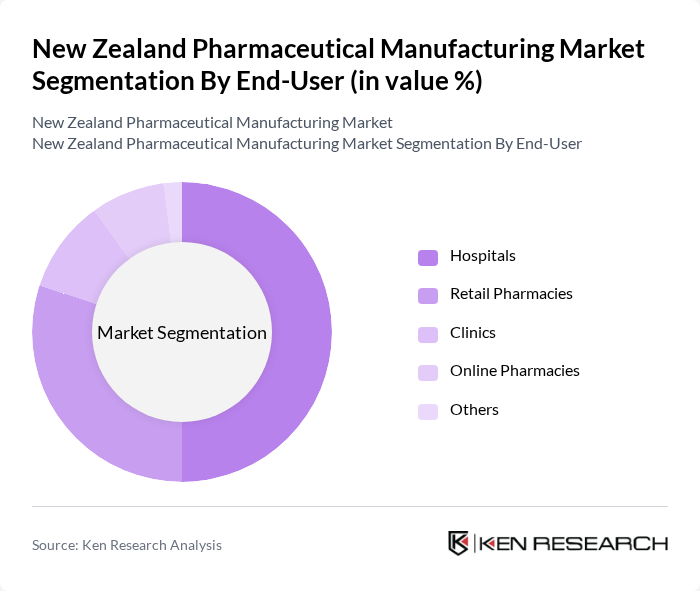

By End-User:The end-user segmentation includes Hospitals, Retail Pharmacies, Clinics, Online Pharmacies, and Others. Hospitals are the leading end-users due to their high demand for prescription medications and specialized treatments. Retail pharmacies are also significant as they provide easy access to both prescription and OTC drugs, catering to the growing trend of self-medication among consumers. Online pharmacies are gaining traction, especially post-pandemic, as consumers prefer the convenience of home delivery.

The New Zealand Pharmaceutical Manufacturing Market is characterized by a dynamic mix of regional and international players. Leading participants such as Fonterra Co-operative Group, Douglas Pharmaceuticals, AFT Pharmaceuticals, Kiwi Pharma, Phebra, Medsafe, PharmaNZ, Helius Therapeutics, Green Cross Health, New Zealand Pharmaceuticals, Apotex, Mylan, Novartis, Pfizer, Roche contribute to innovation, geographic expansion, and service delivery in this space.

The future of the New Zealand pharmaceutical manufacturing market appears promising, driven by technological advancements and a growing focus on personalized medicine. As the industry adapts to evolving healthcare needs, investments in research and development are expected to increase, fostering innovation. Additionally, the expansion into Asia-Pacific markets presents significant growth potential, allowing local manufacturers to leverage their expertise and enhance their global presence while addressing regional healthcare demands.

| Segment | Sub-Segments |

|---|---|

| By Type | Prescription Drugs Over-the-Counter (OTC) Drugs Biologics Biosimilars Others |

| By End-User | Hospitals Retail Pharmacies Clinics Online Pharmacies Others |

| By Distribution Channel | Direct Sales Wholesalers Distributors E-commerce Others |

| By Therapeutic Area | Cardiovascular Oncology Neurology Infectious Diseases Others |

| By Formulation | Tablets Injectables Liquids Topicals Others |

| By Manufacturing Process | Batch Production Continuous Production Contract Manufacturing Others |

| By Market Segment | Generic Pharmaceuticals Branded Pharmaceuticals Specialty Pharmaceuticals Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pharmaceutical Manufacturing Operations | 100 | Production Managers, Quality Assurance Leads |

| Regulatory Compliance and Affairs | 80 | Regulatory Affairs Specialists, Compliance Officers |

| Research and Development Insights | 70 | R&D Directors, Clinical Research Managers |

| Market Access and Pricing Strategies | 60 | Market Access Managers, Pricing Analysts |

| Supply Chain and Distribution Networks | 90 | Supply Chain Managers, Logistics Coordinators |

The New Zealand Pharmaceutical Manufacturing Market is valued at approximately USD 1.5 billion, reflecting a robust growth driven by increasing demand for innovative therapies, an aging population, and government initiatives to enhance local manufacturing capabilities.