Region:Middle East

Author(s):Geetanshi

Product Code:KRAC8207

Pages:97

Published On:November 2025

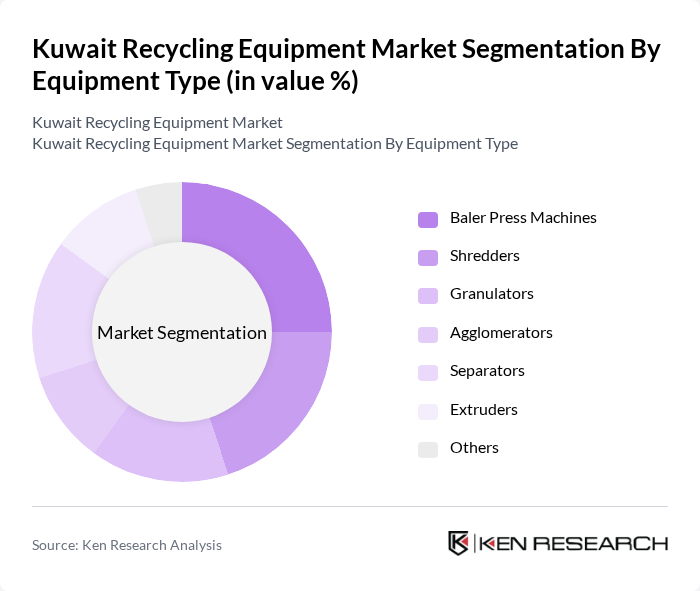

By Equipment Type:The equipment type segmentation includes various machinery essential for recycling processes. The key subsegments are Baler Press Machines, Shredders, Granulators, Agglomerators, Separators, Extruders, and Others. Each of these plays a crucial role in the recycling process, catering to different materials and operational needs.

The Baler Press Machines segment is currently dominating the market due to their essential role in compacting recyclable materials for easier transportation and storage. The increasing volume of waste generated, particularly in urban areas, has led to a higher demand for balers, which are crucial for efficient waste management. Additionally, advancements in technology have improved the efficiency and effectiveness of balers, making them a preferred choice among recycling facilities .

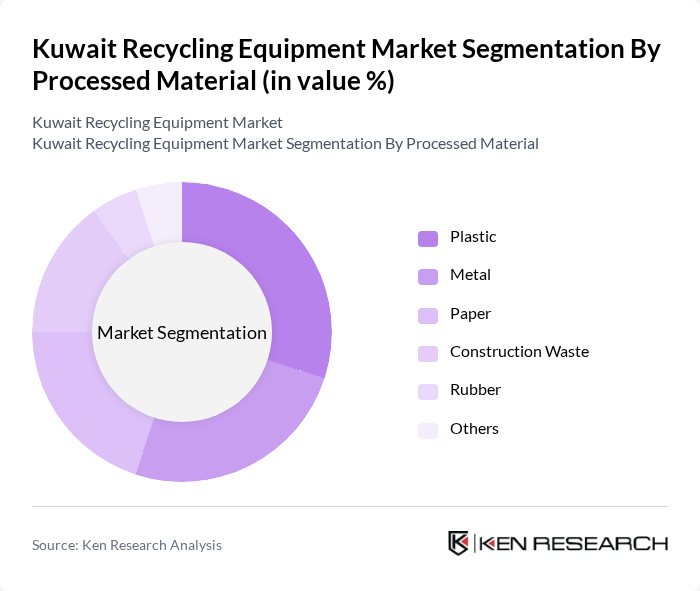

By Processed Material:This segmentation focuses on the types of materials processed by recycling equipment. The key subsegments include Plastic, Metal, Paper, Construction Waste, Rubber, and Others. Each material type requires specific processing techniques and equipment to ensure effective recycling.

The Plastic segment leads the market due to the high volume of plastic waste generated in Kuwait, driven by consumer behavior and the prevalence of single-use plastics. The growing awareness of environmental issues has prompted both consumers and businesses to seek effective recycling solutions for plastics. Additionally, advancements in recycling technologies have made it easier to process various types of plastics, further boosting this segment's growth .

The Kuwait Recycling Equipment Market is characterized by a dynamic mix of regional and international players. Leading participants such as Al Kifah Holding Company, Alghanim Industries, Kuwait Waste Management Company, Gulf Recycling and Waste Management, Al-Mansour Holding Company, Al-Bahar Group, Al-Futtaim Group, Al-Sayer Group, KGL Holding Company, United Waste Management Company, Al-Muhalab Group, Al-Qatami Global for General Trading & Contracting, Al-Shaheen Group, Al-Mansour International Group, Al-Majed Group contribute to innovation, geographic expansion, and service delivery in this space.

The future of the recycling equipment market in Kuwait appears promising, driven by a combination of government support and increasing public awareness. As the nation moves towards a circular economy, investments in recycling infrastructure and technology are expected to rise significantly. By future, the government aims to achieve a recycling rate of 15%, which will necessitate the adoption of innovative recycling solutions. This trend will likely attract both local and international players to the market, fostering competition and technological advancements.

| Segment | Sub-Segments |

|---|---|

| By Equipment Type | Baler Press Machines Shredders Granulators Agglomerators Separators Extruders Others |

| By Processed Material | Plastic Metal Paper Construction Waste Rubber Others |

| By Technology | Mechanical Recycling Chemical Recycling Biological Recycling Artificial Intelligence & Smart Systems Others |

| By End-Use Industry | Municipal Solid Waste (MSW) Recycling Industrial Waste Recycling Construction & Demolition (C&D) Waste Automotive Scrap Recycling Electronics Waste (WEEE) Recycling |

| By Investment Source | Domestic Investment Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Government Grants Others |

| By Enterprise Size | Large Enterprises Small and Medium Enterprises (SMEs) Startups |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Municipal Recycling Programs | 120 | City Managers, Waste Management Coordinators |

| Industrial Recycling Facilities | 110 | Facility Managers, Operations Directors |

| Construction and Demolition Waste Management | 100 | Project Managers, Environmental Compliance Officers |

| Commercial Recycling Initiatives | 130 | Business Owners, Sustainability Managers |

| Recycling Equipment Suppliers | 140 | Sales Managers, Product Development Engineers |

The Kuwait Recycling Equipment Market is valued at approximately USD 150 million, reflecting a significant growth trend driven by increased environmental awareness, government initiatives, and rising waste generation in urban areas.