Region:Middle East

Author(s):Rebecca

Product Code:KRAE0945

Pages:93

Published On:December 2025

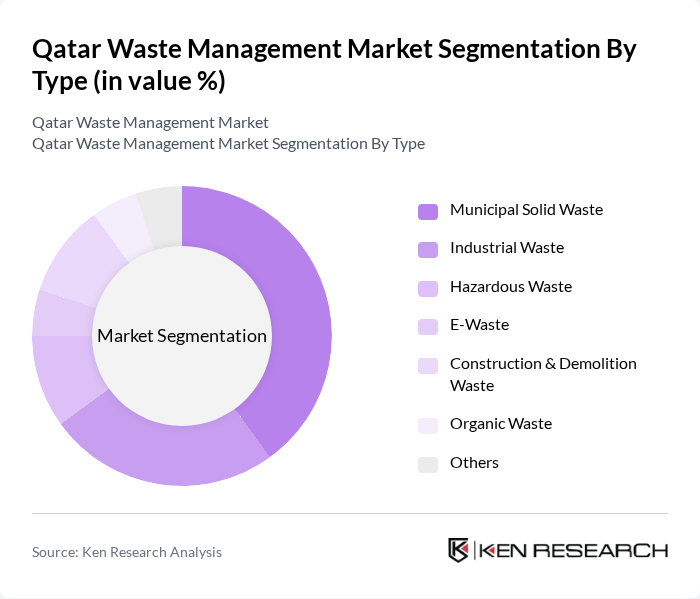

By Type:The waste management market in Qatar is segmented into various types, including Municipal Solid Waste, Industrial Waste, Hazardous Waste, E-Waste, Construction & Demolition Waste, Organic Waste, and Others. Among these, Municipal Solid Waste is the dominant segment due to the increasing urban population and the corresponding rise in household waste generation. The growing awareness of environmental sustainability and the need for efficient waste disposal methods further bolster this segment's growth.

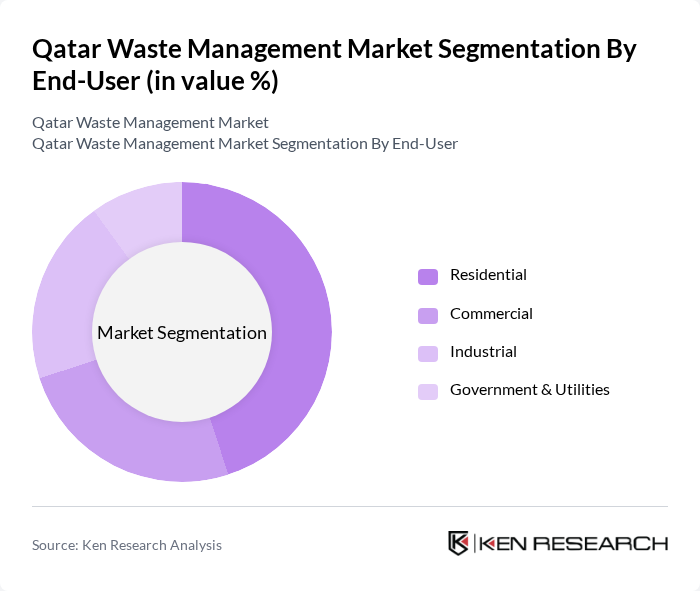

By End-User:The end-user segmentation of the waste management market includes Residential, Commercial, Industrial, and Government & Utilities. The Residential segment is the largest due to the increasing population and urbanization, leading to higher waste generation from households. The growing emphasis on recycling and waste segregation at the household level is also contributing to the expansion of this segment.

The Qatar Waste Management Market is characterized by a dynamic mix of regional and international players. Leading participants such as Veolia Environmental Services, SUEZ Recycling and Recovery, Qatari Diar, Qatar Waste Management Company, Gulf Waste Management, EcoWaste Qatar, Al Jazeera Recycling, Qatar Green Building Council, Doha Waste Management, Qatar Recycling, Mowasalat, Qatari Environmental Services, Qatar National Cement Company, Qatar Petroleum, and Qatar University contribute to innovation, geographic expansion, and service delivery in this space.

The future of Qatar's waste management market appears promising, driven by increasing urbanization and government commitment to sustainability. In the future, the focus will shift towards integrating smart technologies and enhancing recycling capabilities. The anticipated growth in public-private partnerships will facilitate investment in innovative waste management solutions. Additionally, the emphasis on hazardous waste management and e-waste recycling will likely shape the market landscape, ensuring a more sustainable approach to waste management in the region.

| Segment | Sub-Segments |

|---|---|

| By Type (e.g., Municipal Solid Waste, Industrial Waste, Hazardous Waste, E-Waste, Construction & Demolition Waste, Organic Waste, Others) | Municipal Solid Waste Industrial Waste Hazardous Waste E-Waste Construction & Demolition Waste Organic Waste Others |

| By End-User (Residential, Commercial, Industrial, Government & Utilities) | Residential Commercial Industrial Government & Utilities |

| By Collection Method (Door-to-Door, Drop-off Centers, Curbside Collection) | Door-to-Door Drop-off Centers Curbside Collection |

| By Treatment Method (Recycling, Composting, Incineration, Landfilling) | Recycling Composting Incineration Landfilling |

| By Waste Source (Household, Commercial, Industrial, Construction) | Household Commercial Industrial Construction |

| By Geographic Area (Urban, Suburban, Rural) | Urban Suburban Rural |

| By Policy Support (Subsidies, Tax Exemptions, Grants, Others) | Subsidies Tax Exemptions Grants Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Municipal Waste Management | 100 | City Planners, Waste Management Officials |

| Industrial Waste Processing | 80 | Operations Managers, Environmental Compliance Officers |

| Recycling Initiatives | 70 | Recycling Facility Managers, Sustainability Coordinators |

| Hazardous Waste Management | 60 | Health and Safety Officers, Waste Disposal Specialists |

| Waste-to-Energy Projects | 50 | Project Managers, Energy Analysts |

The Qatar Waste Management Market is valued at approximately USD 550 million, driven by rapid urbanization, industrial expansion, and high per-capita waste generation, which creates a strong demand for municipal and industrial waste services.