Region:Middle East

Author(s):Dev

Product Code:KRAD5234

Pages:98

Published On:December 2025

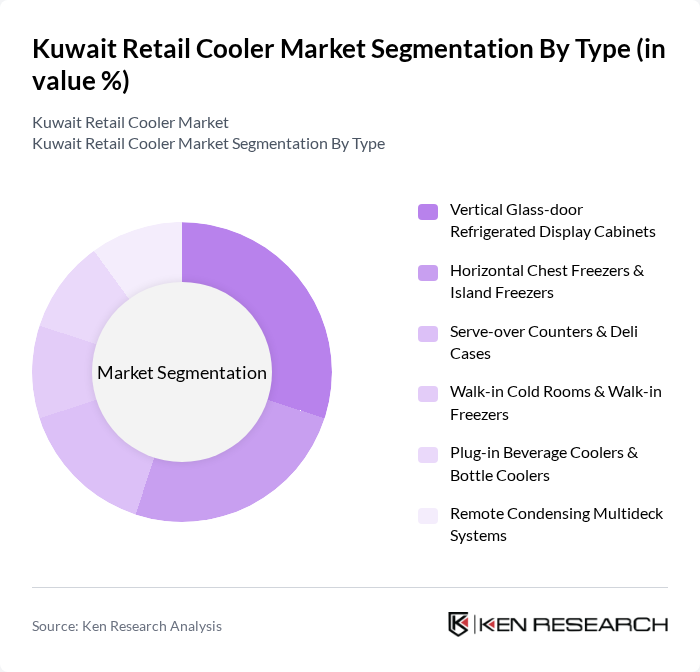

By Type:The market is segmented into various types of retail coolers, including Vertical Glass-door Refrigerated Display Cabinets, Horizontal Chest Freezers & Island Freezers, Serve-over Counters & Deli Cases, Walk-in Cold Rooms & Walk-in Freezers, Plug-in Beverage Coolers & Bottle Coolers, and Remote Condensing Multideck Systems. Each type serves specific retail needs, with varying levels of energy efficiency, load profile, and storage/display capacity, and is increasingly being specified with features such as high-efficiency compressors, LED lighting, electronic expansion valves, and low?GWP refrigerants to align with Kuwait’s energy?saving and sustainability goals in commercial refrigeration.

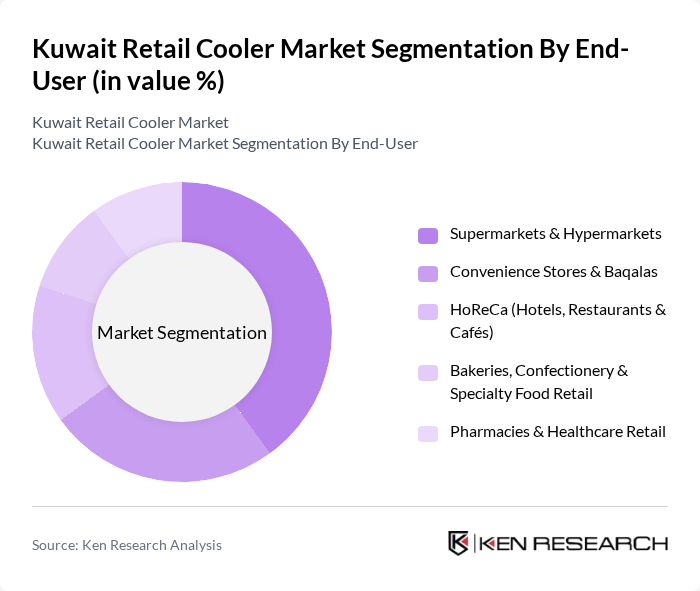

By End-User:The end-user segmentation includes Supermarkets & Hypermarkets, Convenience Stores & Baqalas, HoReCa (Hotels, Restaurants & Cafés), Bakeries, Confectionery & Specialty Food Retail, and Pharmacies & Healthcare Retail. Each segment has unique requirements for refrigeration solutions – from high?capacity multideck cabinets and island freezers in modern grocery formats, to compact plug?in coolers in convenience stores, temperature?critical storage for pharmaceuticals, and display?oriented units for bakeries and cafés – which influences the mix of plug?in versus remote systems, temperature classes, and cabinet configurations adopted in Kuwait.

The Kuwait Retail Cooler Market is characterized by a dynamic mix of regional and international players. Leading participants such as Hussmann Corporation (Panasonic), Carrier Commercial Refrigeration (Carrier Global), Daikin Industries Ltd. (Commercial Refrigeration Division), Haier Smart Solutions (Haier Commercial Refrigeration), Whirlpool Corporation (Commercial & Display Refrigeration), Electrolux Professional AB, Epta Group, Arneg Group, Frigoglass S.A.I.C., AHT Cooling Systems GmbH, SKM Air Conditioning LLC (Commercial Refrigeration & Cold Rooms), Petra Engineering Industries Co., Al Mulla Engineering Group (Refrigeration & HVAC Division), United Engineering Projects Co. (Kuwait), Kharafi National – Refrigeration & Cold Storage Solutions contribute to innovation, geographic expansion, and service delivery in this space, with offerings ranging from plug?in display cabinets and beverage coolers to large remote systems and walk?in cold rooms for supermarkets, foodservice, and convenience retail.

The future of the Kuwait retail cooler market appears promising, driven by technological advancements and a growing emphasis on sustainability. As retailers increasingly adopt smart technology, such as IoT-enabled coolers, operational efficiency is expected to improve significantly. Additionally, the expansion of e-commerce is likely to create new demand for innovative cooling solutions tailored for online grocery delivery. These trends will shape the market landscape, fostering a competitive environment that prioritizes energy efficiency and product quality in future.

| Segment | Sub-Segments |

|---|---|

| By Type | Vertical Glass-door Refrigerated Display Cabinets Horizontal Chest Freezers & Island Freezers Serve-over Counters & Deli Cases Walk-in Cold Rooms & Walk-in Freezers Plug-in Beverage Coolers & Bottle Coolers Remote Condensing Multideck Systems |

| By End-User | Supermarkets & Hypermarkets Convenience Stores & Baqalas HoReCa (Hotels, Restaurants & Cafés) Bakeries, Confectionery & Specialty Food Retail Pharmacies & Healthcare Retail |

| By Region | Capital Governorate (Kuwait City) Hawalli Governorate Al Ahmadi Governorate Farwaniya Governorate Al Jahra & Mubarak Al-Kabeer Governorates |

| By Application | Food and Beverage Merchandising Frozen & Chilled Food Storage Pharmaceutical & Vaccine Storage Impulse & Promotional Display |

| By Investment Source | Domestic Private Investment Foreign Direct Investment (FDI) Franchise & International Retail Chains Government-backed Development Projects Others |

| By Policy Support | Incentives for High-Efficiency Refrigeration Systems Customs & Duty Exemptions on Certified Green Equipment Regulations on Low-GWP Refrigerants Others |

| By Distribution Channel | Direct OEM Sales to Key Accounts HVACR & Refrigeration Equipment Distributors Kitchen & Cold-room Contractors Online & B2B E-commerce Platforms Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Store Managers | 120 | Store Managers, Retail Operations Heads |

| Consumer Preferences | 150 | General Consumers, Household Decision Makers |

| Wholesalers and Distributors | 80 | Wholesale Managers, Distribution Coordinators |

| Industry Experts | 50 | Market Analysts, Retail Consultants |

| Product Manufacturers | 70 | Product Development Managers, Sales Directors |

The Kuwait Retail Cooler Market is valued at approximately USD 140 million, reflecting the demand for commercial refrigeration solutions driven by the growth of supermarkets, hypermarkets, and convenience stores in the region.